Sustainable Investment Market Report 2017

Sustainable Investment in Switzerland - Excerpt from the Sustainable Investment Market Report 2017

Introduction

This publication contains the chapter on Switzerland from the Sustainable Investment Market Report 2017 – Germany, Austria and Switzerland (Marktbericht Nachhaltige Geldanlagen 2017 – Deutschland, Österreich und die Schweiz). This publication was produced jointly by Forum Nachhaltige Geldanlagen (FNG) and Swiss Sustainable Finance (SSF). The Sustainable Investment Market Report 2017 – Germany, Austria and Switzerland focusses on the issue of human rights, with an analysis and case studies from all three countries. This version contains the Swiss case study. The data on which this publication is based relates to sustainable investments managed in Switzerland.

The following asset classes were considered:

• Equities

• Money market / Bank deposits

• Hedge funds

• Property / Land

• Municipal or local bonds

• Commodities

• Government bonds

• Supranational bonds

• Corporate bonds

• Venture capital / Direct investments

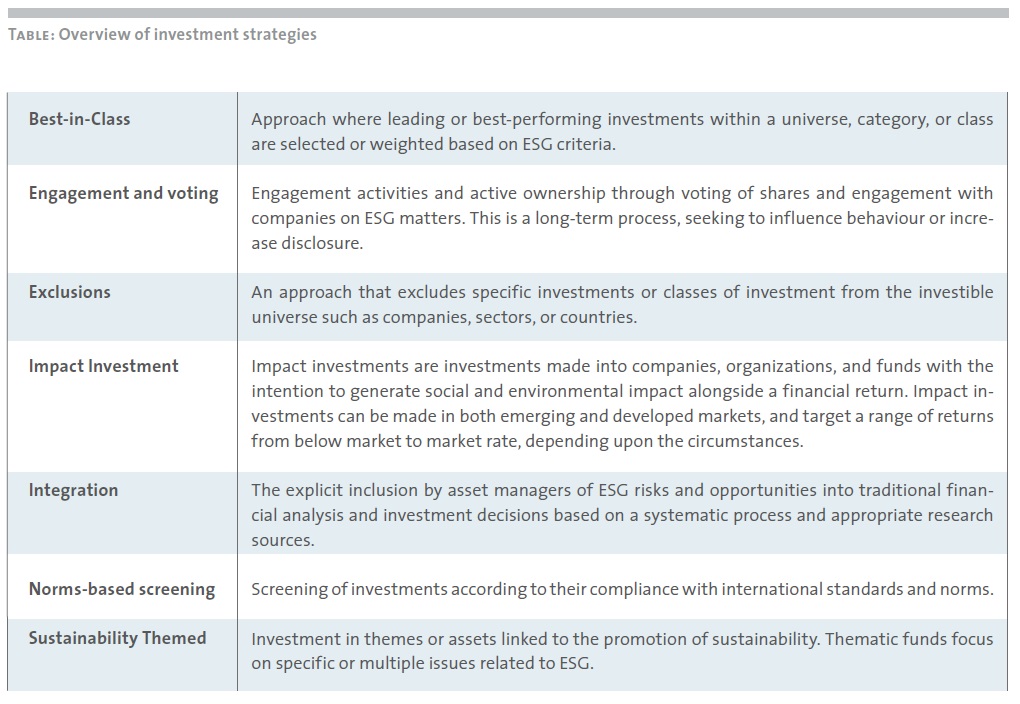

The following sustainable investment strategies were covered:

• Exclusions

• Best-in-Class

• Engagement

• ESG integration

• Impact investment

• Sustainability Themed

• Norms-based screening

• Voting

The definitions of the different investment strategies can be found in the following table:

The study examines all eight sustainable investment strategies on a product specific level and considers the following four strategies product-independently, as asset overlays:

• Exclusions

• Engagement

• Integration

• Voting

There are thus two sets of data for each of these four investment strategies – one product-specific and one product-independent (asset overlay). The latter results in much higher figures in most cases.

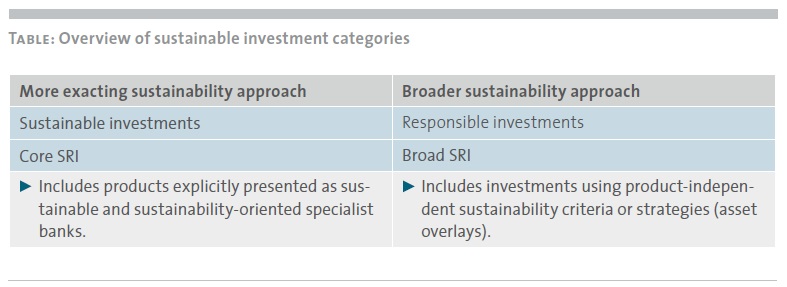

There is a fundamental difference in sustainability quality between specifically sustainable investment products and mainstream investments to which sustainability criteria or strategies have been applied as overlays. For example, in the case of overlays involving exclusion criteria, generally only one or at most two exclusion criteria, such as a ban on anti-personnel mines, are applied. FNG takes this quality difference into account when aggregating and presenting the data, which it subdivides into the following two categories:

The sustainable investment market in Switzerland

In addition to the funds and mandates, which have been recorded since 2005, assets managed by asset owners were, for the second year in a row, recorded for this study. Factors examined in greater detail here include sustainable investment strategies, allocation to asset classes and investors. Also included is a section devoted to the investment strategies recorded product-independently as asset overlays and their development since 2014. This is followed by a short overview of sustainability-oriented specialist banks in Switzerland, and the report concludes with an evaluation of qualitative questions relating to human rights, climate change, key drivers and trends.

Download the fullSustainable Investment Market Report 2017 (German)

Download the excerpt Sustainable Investment in Switzerland - Excerpt from the Sustainable Investment Market Report 2017 (English)