No country for coal gen - Below 2°C and regulatory risk for US coal power owners

Coal’s market share in the US power mix is being diminished at an unprecedented rate due to fierce competition from cheap gas and renewables. Around 30 GW of coal capacity has been retired over the last three years, with coal generation declining by 13% over the same period. The economics of US coal power could not be starker: new coal capacity is not remotely competitive, while in the next few years it will be the exception rather than the rule for the operating cost of existing coal to be lower than the levelized cost of new gas and renewables.

Our modelling approach

Our net present value (NPV) model values units based on their regulatory status.Regulated units are valued based on the revenue requirement approved by regulators, while merchant units are valued based on their cost relative to a new combined cycle gas turbine (CCGT). Our NPV model values every operating unit in the US to generate two separate scenarios:

• Below 2°C scenario for all units. Stranded value under the below 2°C scenario is defined as the difference between the IEA “Beyond 2°C Scenario” (B2DS) – which phases-out all unabated coal power by 2035 – and business as usual (BaU) based on company reporting. A 2°C Scenario (2DS) is also included for comparison. Every existing coal unit (both regulated and merchant) is forecasted and ranked to develop a retirement schedule based on its operating cost and system value. The impact on unit valuation from the retirement schedule is aggregated up to the listed coal owner, to provide a tool for investors to comply with the Paris Agreement in way that is economically rational.

• Regulatory risk scenario for regulated units. Regulatory risk under this scenario is defined as the difference between regulatory and market valuation of all regulated units. Regulated units are valued based on the revenue requirement approved by regulators, while market valuation assumes the unit has no value if the operating cost is greater than the cost of a new CCGT. The impact on unit valuation from comparing assets with the most competitive dispatchable power technologies is aggregated to highlight the extent uncompetitive coal power is being subsidized by an out of date regulatory framework.

Below 2°C scenario – $104 billion of stranded value for all listed coal owners

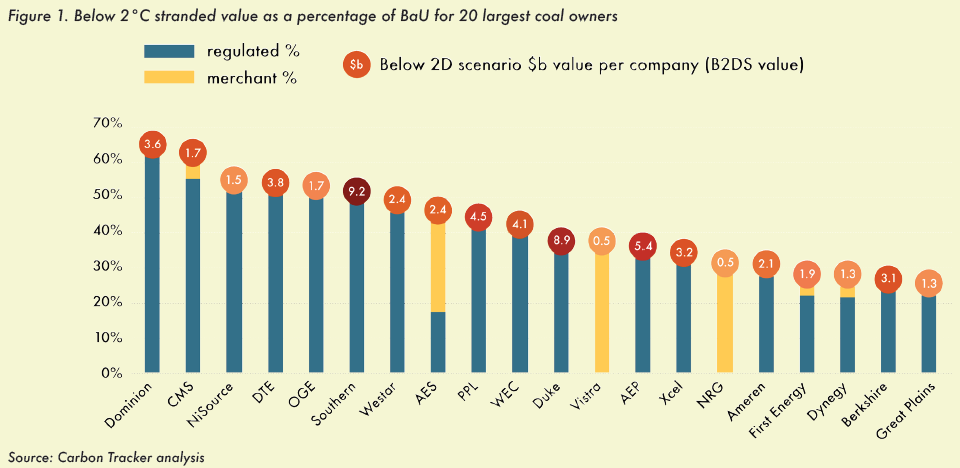

We estimate the total stranded value for coal owners in the B2DS for the period to 2035 to be $104 billion. Out of the 20 largest listed coal owners, Dominion has the highest proportion of value at risk under a B2DS scenario with more than 60% of stranded value compared to the BaU scenario. CMS, NiSource and DTE are also at risk with 59%, 52% and 51% of stranded value against the BaU scenario, respectively. Stranded value as a percentage of the BaU scenario is dependent on the regulatory status and operating cost of the unit.

To download the full text, please click here.