Carrots & Sticks: Global trends in sustainability reporting regulation and policy

EXECUTIVE SUMMARY

• There has been a surge in the number of reporting instruments identified since the last report in 2013. Our 2016 research identified almost 400 sustainability reporting instruments in 64 countries versus 180 instruments identified in 44 countries in our 2013 report. The growth of reporting instruments in Europe, Asia Pacific and Latin America has been particularly strong

• Government regulation accounts for the largest proportion of sustainability reporting instruments worldwide with governments in over 80 percent of the countries studied in this research introducing some form of regulatory sustainability reporting instrument

• Mandatory instruments dominate but growth in voluntary instruments is also strong. Around two thirds of the instruments we identified are mandatory and around one third voluntary. Around one in ten instruments adopts a ‘comply or explain’ approach

• The level of activity of stock exchanges and financial market regulators is noteworthy in the 2016 edition of this report, with these two groups together responsible for almost one third of all sustainability reporting instruments identified

• Almost one third of reporting instruments apply exclusively to large listed companies and of these around three quarters have been introduced by financial market regulators and stock exchanges. The remaining two thirds apply either to all companies or to other types of companies such as state-owned

• While most reporting instruments cover all sectors (crosssectoral scope), those that target specific sectors address the finance and heavy industry sectors in particular. The number of reporting instruments for companies in the financial services sector has more than doubled from 2013 to 2016 and they now account for almost 40 percent of sector specific instruments

• Governments and regulators increasingly require or encourage companies to disclose sustainability information in their annual reports

• There has been a large increase in instruments driving reporting of social information. The number of instruments we identified that focus on reporting of social information has almost doubled since 2013, growing faster than instruments that focus on the reporting of environmental information

• Regulation on tax disclosure has increased as companiescome under increasing pressure to demonstrate they pay their fair share of taxes in all countries in which they operate.

Reporting instruments surge over the last 3 years

Over the last three years, the total number of instruments that require or encourage organizations to report information about their sustainability performance has grown rapidly and significantly worldwide.

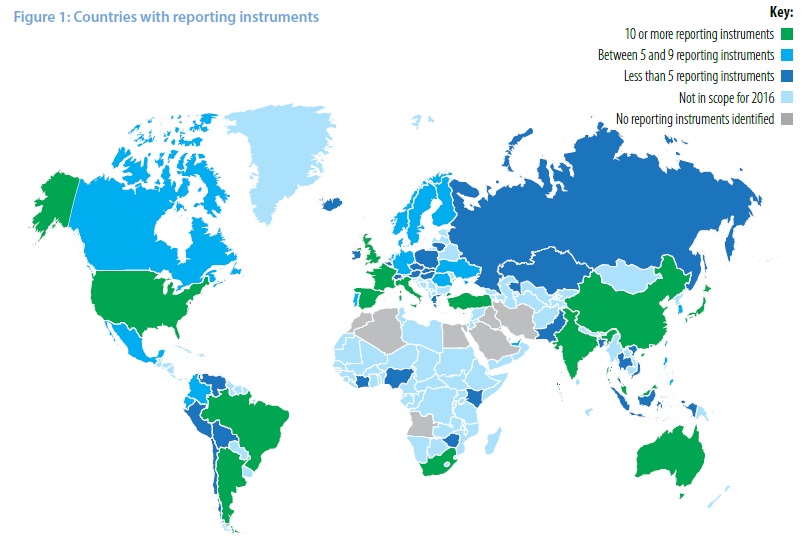

Our research found that sustainability reporting instruments are now in place in most of the world’s biggest economies: 64 of the 71 countries researched in 2016 have some kind of sustainability reporting instrument in place. Our 2016 research identified almost 400 (383) sustainability reporting instruments in 64 countries versus 180 instruments identified in 44 countries in our 2013 report.

There is a clear underlying trend of an increasing volume of reporting instruments: an average of 6.0 instruments per country studied in 2016 versus 4.1 per country in 2013. This upward trend is supported by the fact that most (around 70 percent) of the new instruments identified in our 2016

research are in countries that were also covered in 2013. This suggests that more complex and modernizing markets increasingly expect businesses to report information not only on their financial performance but also on material aspects of their non-financial performance.

The key drivers behind this growth include regulatory growth particularly in Europe, Asia Pacific and Latin America, the rise of ‘comply or explain’ reporting approaches and increasing activity by financial market regulators and stock exchanges. These trends are discussed in more detail in the subsequent sections.

Strong growth in Europe, Asia Pacific and Latin America

Europe continues to have a clear lead among the regions in terms of the overall number of instruments in place. This is to be expected given the high number of countries within the region and given that sustainability reporting and associated instruments are more mature in Europe than in many other regions.

The number of reporting instruments in European countries has continued to grow significantly since 2013. Our research identified 155 instruments in 2016 compared with 80 in 2013. Some of these new instruments relate to the transposition of the EU Non-Financial Reporting Directive as EU member states put in place or prepare for national implementation measures. The directive requires large companies to disclose information on policies, risks and outcomes related to environmental matters, social and employee-related aspects, respect for human rights, anti-corruption and bribery issues, as well as diversity.

New EU reporting instruments have also been introduced that focus on climate change mitigation (e.g. energy efficiency and greenhouse gas (GHG) emissions trading) as well as new initiatives related to business and the protection of human rights in global supply chains.

Reporting instruments in Latin America also grew quickly with the number of instruments issued by governments and financial regulators more than doubling between 2013 and 2016. Our researchers identified new instruments in Argentina and Brazil, among others.

Asia Pacific has also shown strong growth with the number of identified sustainability reporting instruments increasing by about 75 percent since 2013. Many of these instruments (31 out of 108) are new reporting rules introduced by financial market regulators. In fact, in Asia Pacific, stock exchanges and financial or industry regulators are now responsible for a greater number of reporting instruments than governments – they account for 50 percent of instruments compared to 45 percent of instruments from governments. In 2013 the reverse was true and the majority of instruments (58 percent) were issued by governments.

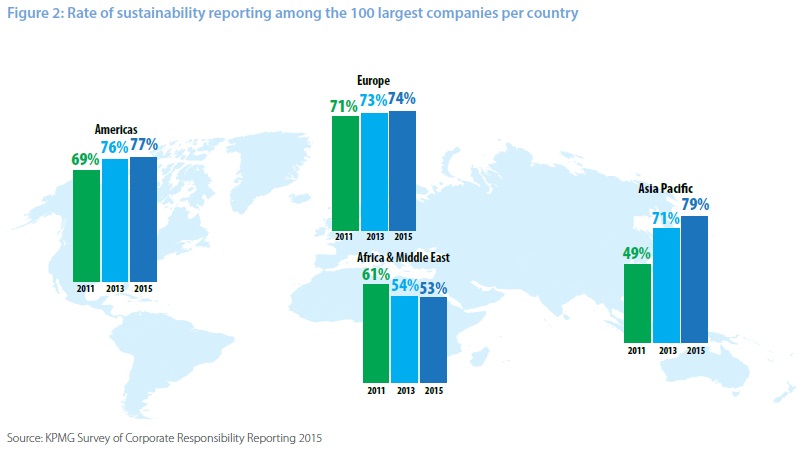

The growth trend in Asia Pacific echoes the findings of KPMG’s 2015 Survey of Corporate Responsibility Reporting which reported that many Asia Pacific countries have high rates of sustainability reporting driven by regulation. These countries include India, Indonesia, Malaysia and South Korea.

To download the full report, please click here.