Topic of the month September 2016: Fossil Fuel Divestment

MSCI ESG Research View

There are numerous paths available to address carbon risks in investment portfolios. While some high profile institutional investors such as the California State Teachers' Retirement System and the Swedish government pension fund AP4 have committed funds to a low carbon approach or focused on engagement, others are increasingly being urged, if not required, to explicitly divest from fossil fuel holdings. Organizations like Divest Invest and 350.org have played key roles in mobilizing support for divestment, especially on college campuses.

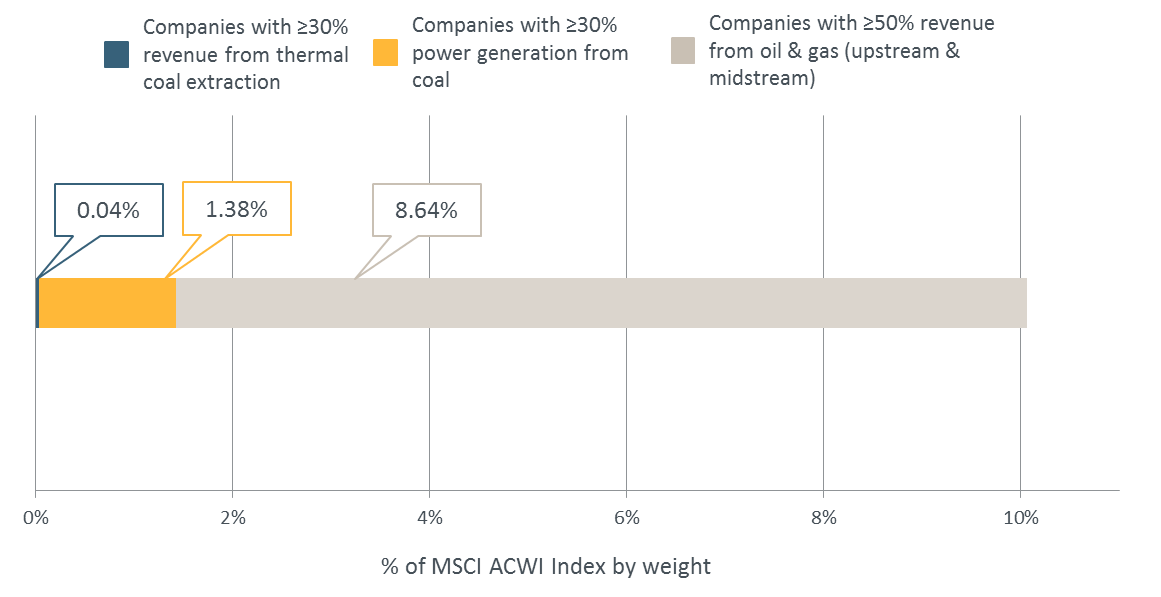

While the divestment movement once focused solely on fossil fuel reserves, we’ve more recently seen a number of institutional investors consider additional business models, revenue, and/or power generation when establishing divestment criteria. Goals and constraints vary, and actual divestments may range from a handful of issuers to hundreds. Those divesting must likely decide which fuel(s) to focus on, whether to zero in on reserves or look at other parts of the fossil fuel value chain, and where to set a threshold for divestment; in other words, how restrictive to make their divestment policy.

These decisions may affect the scale of the impact on the investable universe, alterations to portfolio risk, return, and performance profiles, and size of portfolio carbon footprint.

Figure 1, Summary of Fossil Fuel Divestment Options & Scope Decisions

Impact on investable universe

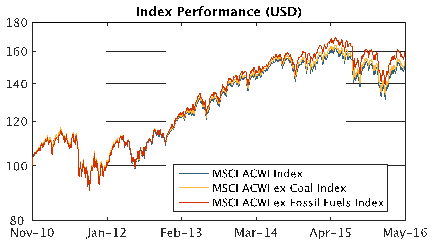

Within the MSCI ACWI Index, a policy benchmark index including large and mid cap issuers across 23 Developed Markets and 23 Emerging Markets countries, reserves-based exclusion removed between 1.7% by weight (thermal coal only) to 7.7% (all fossil fuel reserves owners) of securities based on an analysis conducted by MSCI ESG Research. A revenue-and-generation approach excluded 0.4% of the MSCI ACWI Index by weight (thermal coal only, at a 50% threshold) to 10.1% (thermal coal at 30% plus oil & gas at 50%) or more (with lower thresholds).

Figure 2, Sample illustration of potential divestment impacts on investable universe (Source: MSCI ESG Research. Data as of May 1, 2016)

Impact on performance

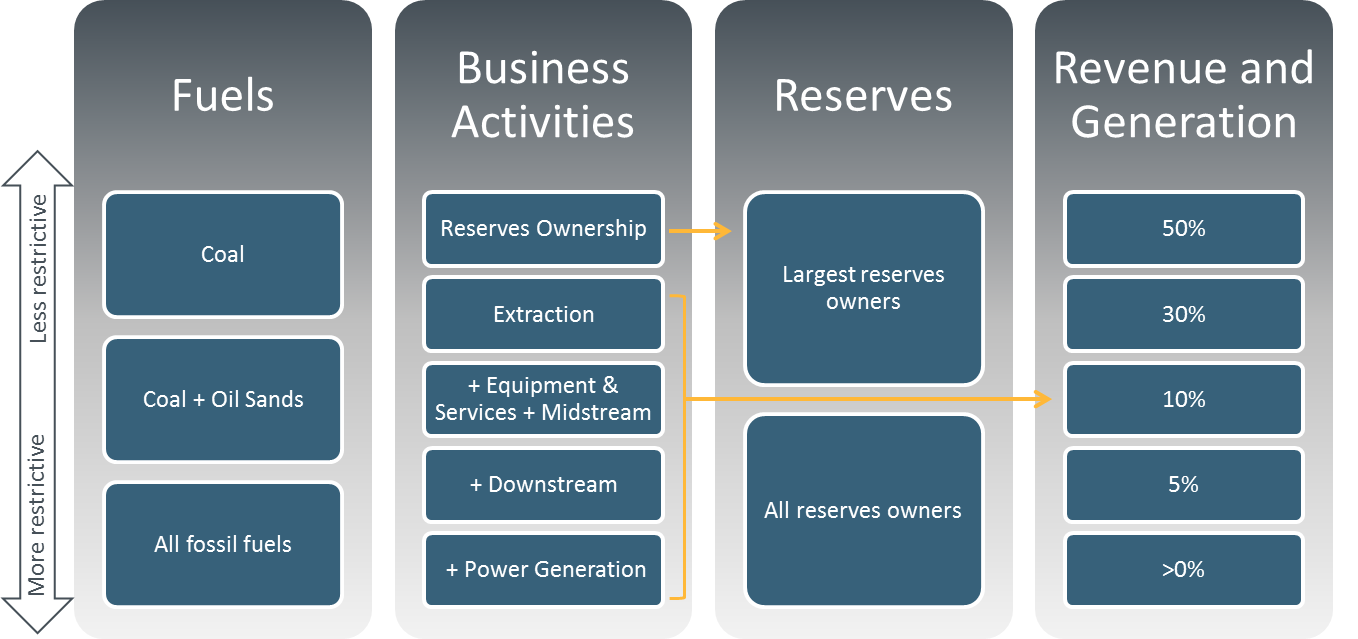

For an otherwise diversified portfolio, performance, risk, and return was not necessarily negatively affected by divestment action. The MSCI ACWI ex Coal Index and the MSCI ACWI ex Fossil Fuels Index respectively excluded any company with either coal reserves or fossil fuel reserves of any type. At the same time, these indexes are designed to closely track the peformance of the parent index.Their performance over the last five years suggests that eliminating holdings in companies that own fossil fuel reserves did not necessarily compromise investment performance in an otherwise diversified portfolio. The performance impact over longer historical periods varied, depending on the performance of the excluded companies owning fossil fuel reserves.

Figure 3, Index Performance (Source: MSCI ESG Research. Data as of May 1, 2016)

Impact on Portfolio Carbon Footprint and Comparison of Portfolio Carbon Footprint Metrics

In the context of divestment, current portfolio carbon footprints saw larger reductions through a revenue-and-generation approach than a reserves-only approach. For a portfolio otherwise replicating the MSCI ACWI Index, divestment from companies generating 30% of revenues or power from coal resulted in total portfolio carbon emissions 21% lower than the MSCI ACWI ex Coal Index, which eliminates coal reserves owners, and even 14% lower than the MSCI ACWI ex Fossil Fuels Index, which also eliminates oil & gas reserves owners.

Figure 4, Carbon Metrics (Source: MSCI ESG Research)

The chart above shows the three key portfolio carbon footprint metrics across five hypothetical portfolios. ACWI, in blue represents a portfolio replicating the MSCI ACWI Index. ACWI ex Coal, in yellow, represents a portfolio replicating the MSCI ACWI ex Coal Index, while ACWI ex Fossil Fuels, in grey, does so for the MSCI ACWI ex Fossil Fuels Index. ACWI ex 30%, in green, represents a portfolio based on the MSCI ACWI Index that had divested companies with 30% of revenues or 30% of power generation from coal, while ACWI ex 10% does the same with a 10% threshold. Data as of June 30, 2016.

For more information, please contactesgclientservice@msci.com

Author: |

For more than 40 years, MSCI’s research-based indexes and analytics have helped the world’s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative research. Our line of products and services includes indexes, analytical models, data, real estate benchmarks and ESG research. MSCI serves 97 of the top 100 largest asset managers, based upon P&I data as of December 2014 and MSCI client data as of June 2015. For more information, visit us at www.msci.comor email esgclientservice@msci.com. |