Topic of the month November 2020: Sustainability Performance of CAT Bonds

Sustainability Performance of CAT Bonds

Starting Points, Function and Evaluation

By Dirk Schmelzer, Partner, Senior Portfoliomanager, ILS-Sustainability Expert, Plenum Investments Ltd.

Since the late 1990s, the capital market has developed into a substantial and responsible insurance carrier alongside the traditional reinsurance market. Particularly in the area of natural disasters, the capital market plays a key role by providing additional capacity on top of traditional reinsurance.

1. Structure and Function of Catastrophe Bonds

Catastrophe bonds transfer the risk of a natural disaster event to investors who pay for part of the losses.

In return, investors receive an insurance premium. From the investor point of view, catas¬trophe bonds are useful for diversifying a portfolio, since natural disasters occur regardless of the development of a national economy or the stock market which is why they have little correlation with traditional asset classes. This was impressively demonstrated in the 2008 financial crisis and the corona pandemic.

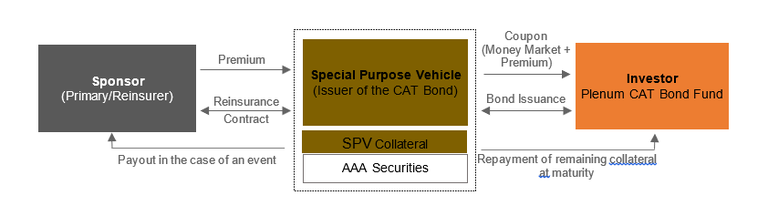

A catastrophe bond is structured (see chart below) to minimize the credit risk both of the sponsor ceding the risk and the investor assuming the risk. The reinsurance contract between the special purpose vehicle (the issuer of the CAT bond) and the sponsor provides for a maximum loss amount in case of the occurrence of a natural disaster event. Unlike the investor, the special purpose vehicle (SVP) typically has a reinsurance license. For the duration of the risk period, the sponsor regularly pays a pre-defined reinsurance premium to the special purpose vehicle for the risk assumed. The capital to collateralize the potential liabilities arising from the reinsurance contract is raised by issuing the CAT bond. For the term of the bond, the issue proceeds are depos-ited in a collateral trust account and invested in low-risk short-term US treasury bills or IBRD notes. Both the investment return on the collateral and the insurance premium are typically distributed to investors in form of a quarterly coupon payment.

Chart: CAT Bond Structure

If no natural disaster event occurs during the risk period, the CAT bond investor receives back the principal in addition to the coupon payments (insurance premium plus return on the deposited collateral). If, however, an event covered under the reinsurance contract does occur, the sponsor can draw on the deposited capital to meet his obligations, thus reducing the outstanding principal in proportion to the loss amount.

2. Why Does the Conventional ESG Approach Fail in the Insurance Industry?

The risk-based ESG approach cannot be applied to collateralized transfers of insurance risks to the capital market, since the risk of an event for the insurer does not increase by insuring controversial industries instead of residential property, for example.

In general, catastrophe bonds provide reinsurance cover to insurance companies, however, they have no direct financing function. This means that catastrophe bond holders do not invest in debt or equity of the insurance company. As a result, ESG analysis of catastrophe bonds refers primarily to the insurance book, i.e. the insured risks. It is therefore not the investment side of an insurance company (asset side of the insurance balance sheet) that is the focus of the ESG analysis, but the cash flow itself which has to be analyzed as to who receives the insurance benefit in case of an event.

3. Starting Points of ESG Analysis Tailored to the CAT Bond Market

The insurance industry is becoming more aware of the fact that it has to expand its ESG efforts on the asset side of the balance sheet to the liability side as well. More and more insurers announce their withdrawal from insuring coal-fired power plants. However, there are still major deficiencies in the availability of information on controversial business areas in the insurance book. This is because up to now, ESG criteria have not or only to some extent been considered in the underwriting process, a fact that is currently the biggest challenge in obtaining the transparency of the insurance book that is required for performing ESG analysis.

Insurance book

As regards the ultimate recipient of the insurance benefit, a distinction is made between individuals and companies. If the insurance benefit is paid to an individual as is the case in homeowners insurance for example, it can be safely assumed that the transaction is ESG neutral. This makes the business lines of the subject business (residential, commercial, industrial, extreme mortality) key differentiators with respect to the method of ESG analysis. Bonds covering industrial risks can be problematic in terms of sustainability, since they may include risks from controversial industries and therefore require a deeper analysis of the business sectors covered.

The categories “commercial” (small business – non-industrial, transportation, small vehicles, other personal) and “extreme mortality” are considered non-problematic as by definition they do not cover controversial industries. However, since there is no single definition among the sponsors, a more detailed analysis of the

“commercial” category is imperative.

Use of Funds in the Case of an Event

Only in the case of an event is the cedant entitled to draw down funds to indemnify his policyholders. In the case of indemnity-based transactions, these funds can only be used if the cedant can prove that he has paid insurance benefits to the insured parties (paid claims clause). This is to ensure that the policyholders benefit from the insurance payment.

In the case of bonds with parametric or industry loss triggers, the occurrence of an event, provided it reaches the trigger point, results in a payment to the cedant. If and to what extent policyholders have sustained losses is not relevant. This means there is a basic risk equivalent to the discrepancy between the actual loss and the payment received from the CAT bond.

Since it requires an insurance event to trigger a payment of the catastrophe bond and claims of the insured parties have to be given priority, it can be assumed that even if the cedant goes bankrupt, the payment from the CAT bond will benefit the insured parties concerned.

Investment of Collateral and Premiums

In a CAT bond, unlike the fixed assets of an insurer, collateral and premiums are usually held in US money market funds or World Bank bonds within the special purpose vehicle.

The special purpose vehicle cannot employ a return-oriented investment strategy with respect to the issue proceeds of the catastrophe bond since they serve as collateral for the insurance risks and a shortfall in cover during the term has to be avoided by all means. Consequently, the collateral has to be invested at low risk. So it is a structural measure designed to avoid default risks rather than a return-oriented investment.

Secrecy Jurisdictions

ESG analysis also needs to address the question whether the company domicile of special purpose vehicles

in an “offshore” location such as Bermuda or the Cayman Islands constitutes a problem. These financial centers are criticized in particular for their role as tax havens and lack of transparency with regard to money laundering. Why the choice of domicile of CAT bond SVPs can be regarded as uncritical with respect to aggressive tax avoidance is set out in the following.

All methods of aggressive tax planning are aimed at not generating taxable income in high-tax jurisdictions, but in tax havens. Looking at the cash flow of CAT bonds, it soon becomes clear that there is no tax avoidance involved. The sponsor pays premiums to the special purpose vehicle for the risk assumed by the investor. These premiums are costs for the sponsor. While they do reduce the taxable profit, they remain due to the investor and do not revert to the sponsor. Hence, there is no transfer of income.

Income incurred by the special purpose vehicle from the money market investments and the insurance premiums received is distributed to the investor as a coupon. The income for the investor consequently is not transferred to a tax haven either, but is to be taxed in the tax domicile of the client, based on locally applicable law.

It is worth noting that Bermuda boasts a well-established insurance industry with a large number of operating companies which has taken decades to build.

4. Taking Collective Social Responsibility Through CAT Bonds

In essence, the business model of insurance is characterized by the fact that the insurance company collects premiums from the policyholder in order to cover losses and/or finance the reconstruction in the case of an event. The insurance premium is a fraction of the sum insured and depends largely on the probability of occurrence of the loss to be covered.

The insurance industry promotes individual responsibility both on the public and the private side. This follows from the fact that a lack of prevention and caution in handling risks leads to higher claims payments which in turn result in increased insurance premiums. To avoid the additional expense in the form of higher premiums, the policyholder will change his behavior to the extent that the loss can be avoided or reduced. At state level, this disciplinary effect frequently results in stricter building regulations (improved structural design, increased resistance of buildings) or enhanced infrastructure, for instance through higher levees or more effective drainage systems to mitigate the increasing risk of flooding.

Loss and damage research of insurance companies reveals cause-and-effect relationships which influence risk. Understanding these relationships allows for targeted risk-mitigating measures to be taken.

Increasing Resistance Through Reconstruction

Reinsurance is basically about protecting insurance companies or pools. The general sustain-ability contribution of the insurance industry and CAT bonds is mostly of an indirect nature. However, the sustainable impact of catastrophe bonds becomes apparent when reconstruction following a natural disaster is delayed or does not happen at all because of insufficient insurance coverage. The long-term effects of failing to rebuild the affected societies are often far worse and financially more expensive than doing reconstruction immediately following the disaster. This becomes particularly apparent when taking the 2010 earthquakes of the same magnitude in Christchurch (New Zealand) and Port-au-Prince (Haiti) and comparing the current relative development status of the two cities and societies.

Fighting poverty

In many cases, real estate is the livelihood of private households and makes up the bulk of their assets. Protecting it against the negative effects of insurance events reduces the risk of poverty in the case of an event and ensures prosperity. In extreme cases, the absence of insurance protection can result in an exodus of people and industries.

Time is a crucial factor to minimize negative aftereffects of disaster events. A rapid deployment of capital through catastrophe bonds in the event of a loss helps to stabilize the affected societies and to master the challenges facing them in the aftermath of a disaster event (such as epidemics, migration waves, unemployment, reconstruction, etc.).

Improving Health

An increasing number of government and international organizations use catastrophe bonds as an instrument against the spread of pandemics. In 2017, the World Bank launched the first ever pandemic insurance in the form of a CAT bond in the amount of USD 500 million to ensure the financing of emergency measures to prevent the spread of pandemics (Pandemic Emergency Financing Facility – PEF). The CAT bond was structured in such a way that the premiums were financed by various industrialized countries such as Germany and Japan whereas the risk of loss was assumed by the capital market.

Scientists believe that an outbreak like the Spanish flu of 1918 today would claim more than 33 million lives in just nine months. The costs are estimated at nearly five percent of the worldwide BIP. According to the head of the World Bank, this would be equivalent to more than USD 3.6 trillion. However, local epidemics also cause enormous losses such as the Ebola outbreak in West Africa in 2014 which revealed major shortcomings of the crisis management system. Today the economic losses of the Ebola outbreak are estimated at USD 10 billion; those of Covid-19 cannot yet be assessed.

The spread of infections is not limited to their place of origin. Time is a crucial factor in fighting pandemics, particularly since air travel is supporting a rapid worldwide propagation of infectious diseases.

Promoting Global Partnership for Sustainable Development

Increased and targeted safeguarding against disaster events in poorer regions is steadily evolving into a key element of supranational engagement, since the gap between insured losses and total economic losses has always been large and is close to 100% in underdeveloped regions.

Mobilizing additional financial means from various sources enables even emerging and developing countries to afford to safeguard against natural disasters. The World Bank, countries and subsequently the capital market perform important financing functions.

Stabilizing the Insurance System

Assuming that insurance losses will further increase due to demographic factors and a growing frequency of natural disasters, the capital market plays a key role in covering such risks. The risk-bearing capacity of the traditional insurance industry for extreme risks is limited. Transferring insurance risks to the capital market therefore reduces the vulnerability of the insurance industry in the event of a disaster.

Is the reinsurance system up to the great challenges and is there sufficient capital to cover the future growth of losses? In 1992 when hurricane Andrew in the US caused an insured loss of USD 15.5 billion, several insurers subsequently had to file for insolvency. Covering these so-called peak risks requires a higher capitalization of insurance companies. It quickly became clear that the increase in natural disaster events called for additional risk bearing capacities. At the same time, it demonstrated the need to raise alternative risk capital in order to stabilize the traditional insurance system which is known for its deeply nested structure. This was achieved with the help of the capital market through so-called insurance-linked securities.

5. Summary

Applying ESG criteria to catastrophe bonds requires a new way of thinking. It is not the investment side that takes center stage of the analysis, but the insurance contract. This is because the core business of the insurer happens on the liability side of the balance sheet and the payout of catastrophe bonds is linked to a specific event and therefore occurs purposefully. This raises the question as to what extent the insurance industry is willing and able to create the required trans¬parency. Insurers failing to meet these standards run the risk of forfeiting their progress on the asset side of their balance sheet if they are not able to adjust the liability side accordingly. In the end, their credibility is on the line.

Those who perceive catastrophe bonds only as an investment instrument fail to recognize the special features of this investment vehicle, namely its function as a facilitator to take social responsibility and its stabilizing effect on the existing reinsurance system.

The question is not whether it is the role of investors to assume reinsurance risks but how we can join forces to tackle the growing losses and the challenges involved which are increasingly caused by natural disaster events.

Anyone who wants to take social responsibility places emphasis either on the impact an investment in catastrophe bonds makes or on the challenge involved. Taken from this perspec¬tive, capital optimization in the insurance industry by transferring risks to the capital market is just a means to a good end. Hence, the primary insurer takes on the role of distributor of cash flow in the case of an event.

Author:

Contact:

|

About Plenum Investments Ltd. Plenum Investments Ltd. is an independent investment manager specializing in insurance risks for institutional and professional clients. The core competence lies in the management of natural catastrophes, longevity risks and regulatory insurance capital. The investment focus is on transparent and sustainable investment solutions. Plenum Investments Ltd. is an established provider in the UCITS CAT Bond Fund segment and is a leader in the sustainability analysis of capital market-based transfers of insurance risks. As a licensed asset manager, Plenum Investments Ltd. has been subject to the Swiss Collective Investment Schemes Act (KAG) since 2001. It is overseen by the Swiss Financial Market Supervisory Authority (FINMA). |