Topic of the month June 2017: Reducing Emissions from Passenger Cars

Reducing Emissions from Passenger Cars

The high number of news articles about reducing emissions from passenger cars in the past year indicates continued strong interest from customers and investors. An increasing number of global auto makers have by now announced ambitious targets for launching fully electric vehicles. Clearly, Tesla’s success in launching the Model 3 shows consumers want this product, but regulation plays an equally important role. Volkswagen, tarnished by its diesel scandal, seems to lead the transformation trend of its powertrain with the most ambitious targets out there. In addition diesel is becoming more of a pariah as more and more city governments plan to ban diesel cars from their centres: Athens, Paris, Madrid and Mexico City announced in the past months they want diesel cars off their roads by 2025. This creates additional needs for emission reduction technology as diesel was one way to improve on fuel economy. Car manufacturers are responding, with even Volkswagen now aiming to play a leading role in the transformation trend for powertrains. Out of the available technologies, we expect the so-called mild hybrid technology to be adopted broadly to help reduce emissions in the near term.

Emission Standards (CO2 & NOx)

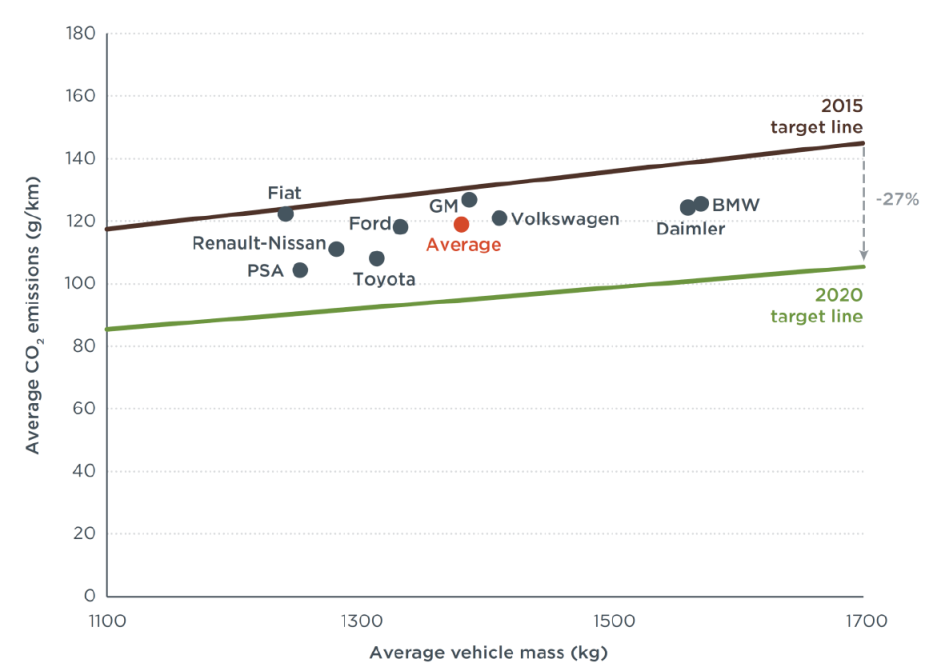

Emission standards are becoming more strict and closely aligned globally. European standards will provide the most challenges for car manufacturers in the near term as new test procedures will be introduced in Europe this year to better reflect real world driving conditions outside of the laboratory. The current NEDC (New European Drive Cycle) test for CO2 will be replaced by the World Harmonised Light-Duty Vehicle Test Procedure (WLTP). For Nitrogen Oxide (NOx) and particles the standard laboratory test will be complemented by the Real Driving Emissions (RDE) test procedure. These new test procedures will pose additional challenges to manufacturers to meet requirements and will increase additional investments in technology reducing emissions. Future standards (beyond 2025) are expected to become even more strict. Even though car manufacturers have already made substantial progress, by improving fuel efficiency by over 30% since 2000, the challenge ahead remains substantial. The figure shows how some leading brands are on track to meet the 2020/21 EU standards, while others have a long way to go. Average emission targets have been calculated on the average vehicle mass in the fleet. As heavier vehicles are allowed to emit more CO2 the line is upward sloping. Non-compliance on a fleet wide basis is not an option, as the fines imposed are harsh.

Hybrids

An important way to arrive at a fleet mix of cars with lower emissions is to increase the level of electrification. Ultimately fully electric vehicles are likely to play a leading role; by default should we move to a zero emission standard. In the interim period car manufacturers are likely to increase the proportion of hybrid cars in the fleet mix. A hybrid car is basically a car equipped with two propulsion systems: a conventional engine and an electric motor.

When we talk about hybrids we can distinguish four types:

1. Full/strong hybrids

2. Plug in hybrids

3. Mild hybrids (48V)

4. Performance enhancing

To start with the last one: performance hybrids typically are premium cars equipped with hybrid technology purely to enhance the performance (acceleration and speed) of the car. Improving fuel economy is less of a priority. Full or strong hybrids have been around for some years now with the Toyota Prius a clear leader. In full hybrids the electric motor is powered by a battery charged by the combustion engine which serves as an electricity generator. The electric motor is able to power the car for a short time period and up to certain speeds. This helps optimize the load and the speed the combustion engine runs at, reducing fuel consumption. Plug-in hybrids are similar in that both the combustion engine and the electric motor are connected to the wheels. But the plug-in hybrids tend to have larger battery packs which can be charged externally by a power grid. Both types of technology come with substantial costs as the car is basically equipped with two full powertrains and expensive batteries.

It is for this reason that the mild hybrid, also known as 48 Volt (48V), is currently seen as the most attractive to meet near term emission standards. The 48V hybrid technology is able to provide 50%-70% of the fuel savings at 30% of the costs compared to a full hybrid car and is easy to install in both diesel and petrol engines. China and Europe are expected to be leading adopters because their future regulations make this an attractive bridge technology, the standards for the US will only become more strict by 2025. Expectations are for 10% market penetration by 2025. Based on an average system costs of €1000 per vehicle and 100 million units in annual vehicles sales this would imply a market opportunity of €10bn by 2026.

From an investment perspective, some of the leading automotive suppliers who deliver technology directly to the car manufacturer could benefit the most from this trend. This includes specialists such as Delphi Automotive, Valeo and Continental that offer crucial electrical components and integrated systems for this technology.

Author: |

About NN Investment Partners NN Investment Partners is the asset manager of NN Group N.V., a publicly traded company listed on Euronext Amsterdam. NN Investment Partners is head-quartered in The Hague, The Netherlands. NN Investment Partners in aggregate manages approximately EUR 194 bln* (USD 208 bln*) in assets for institutions and individual investors worldwide. NN Investment Partners employs over 1,100 staff and is active in 15 countries across Europe, U.S., Latin America, Asia and Middle East. NN Investment Partners is part of NN Group N.V., a publicly traded corporation. On April 7 2015, ING Investment Management was renamed to NN Investment Partners. NN Investment Partners is part of NN Group N.V., a publicly traded corporation. For more information visit: www.nnip.com *Figures as of 31 March 2017 |