Topic of the month July/August 2017: Regulatory easing: impact on energy sector

Regulatory easing: impact on energy sector

Anticipating de-regulation

Expectations of regulatory easing have not led the energy sector to outperform…

Despite market anticipation that the energy sector could be entering a cycle of de-regulation, the sector has underperformed the broad market index (MSCI USA Index) by more than 15% since the beginning of this year (through April 25th 2017).

As of March 2017, U.S. agencies responsible for regulating domestic energy production have been directed to identify and review regulatory barriers that may place unnecessary burden on coal fired electric utilities and fossil fuel producers.1 Further, several other environmental regulations either have been rescinded or are currently under review including the Clean Power Plan (CPP) and automobile fuel efficiency standards.2 Further, as of this writing, the future U.S. position on the Paris climate accord remains uncertain.3

Historically, global and regional regulatory pressure, for example the Kyoto Protocol and the EU emissions trading system (EU ETS), have been key drivers behind efforts to reduce carbon emissions and combat climate change. However, with the cost of renewable energy and electric vehicle batteries falling,4 technological and market factors may be taking the driver’s seat in altering the energy mix.

We identify three long-term factors5 that could dampen effects of de-regulatory policies limited to one jurisdiction, such as the US:

• The rise of renewable energy is being spurred by technology and market dynamics, and no longer primarily supported by subsidies and regulations;

• The aspiration for ‘clean air’ is leading to stringent vehicle fuel efficiency norms globally including increased adoption of electric vehicles;

• The quest to secure greater energy independence by major energy importers is further leading to increased adoption of renewable energy.

Renewable energy is getting cheaper, with or without subsidies…

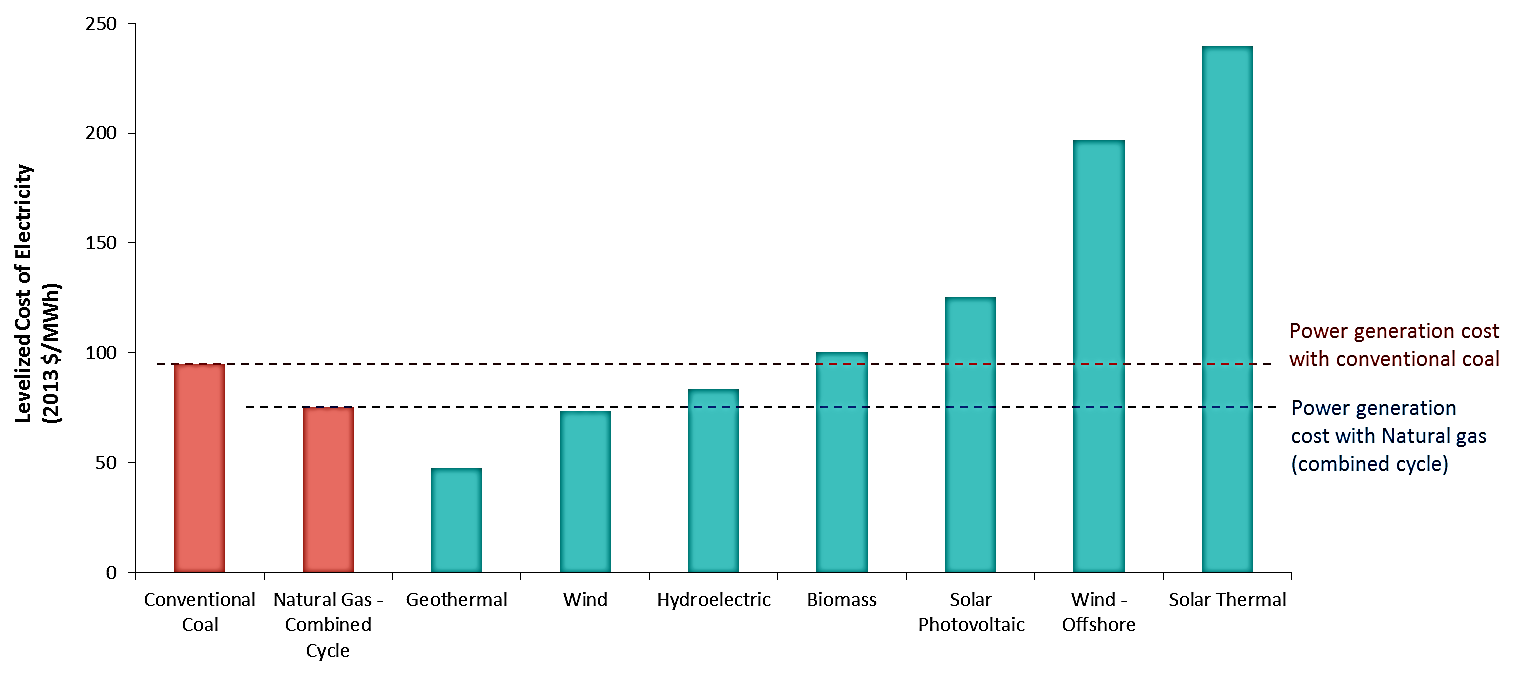

In our earlier research, we have highlighted how renewable energy is becoming more cost effective and how energy efficiency could dampen future demand for fossil fuels globally.6 During 2011-15, renewable power as a proportion of total power generation increased from 6.9% to 10.3%, driven at least in part by their falling cost. According to an EIA report, even without subsidies, the cost of renewable power generation could be below the cost of power generation from conventional coal by 2020.7

Whether there are changes in policy at the federal level in the US, Renewable Portfolio Standards (RPS) and targets adopted by states long before Clean Power Plan may continue to drive renewable energy demand within the United States.8 Falling renewable energy prices may further wean U.S. states that have targeted increases in renewable energy off their dependency on the federal subsidies for these programs. Meanwhile, increased adoption of renewable power could enhance individual states’ energy and water security – two issues of increasing strategic importance.9

…while local aspirations for ‘clean air’ – not just climate policy – fuel demand for electric vehicles in the U.S. and internationally…

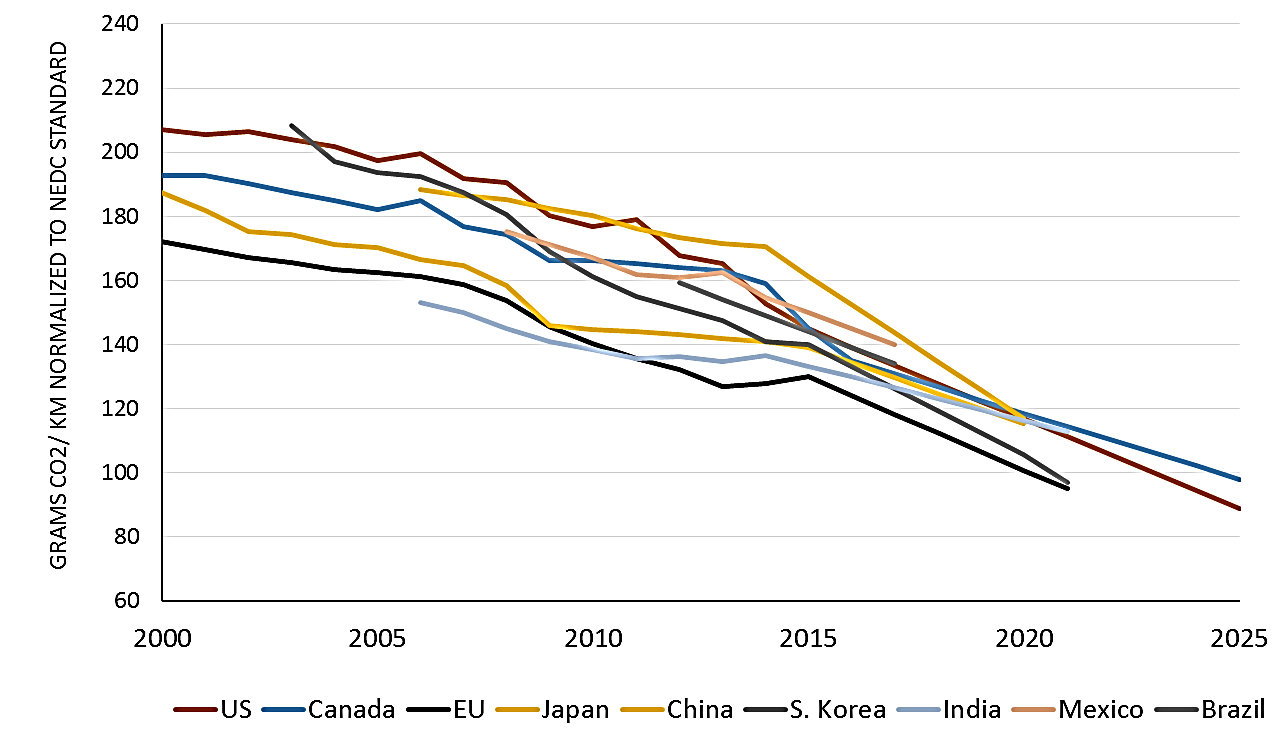

Transportation is one major sector that is dependent on fossil fuels.10 Current stringent vehicle energy efficiency standards targets in domestic and overseas markets are likely to limit the demand for fossil fuels in the future. Major overseas markets for automobiles, which are also major contributors to global carbon emissions, are targeting a reduction in the carbon intensity of vehicles in the range of 12% to 28% by 2020 compared to 2015 (see Figure 2).

This sector is also a major contributor to local pollution that leads to many health hazards.11 Demand for cleaner means of transport that improve local air quality has been growing. From 2011 to 2015, sales of electric vehicles increased by more than 800% with major growth coming in from China.12 One of the drivers behind increased adoption of electric vehicles is the rapidly falling cost of batteries.13 Even in the U.S. where the new administration is expected to cut vehicle pollution requirements,14 thirty U.S. cities are planning to invest billions of dollars in electric vehicles to reduce local air pollution.15

… and strategic energy security measures by net importers further bolster renewable energy deployment…

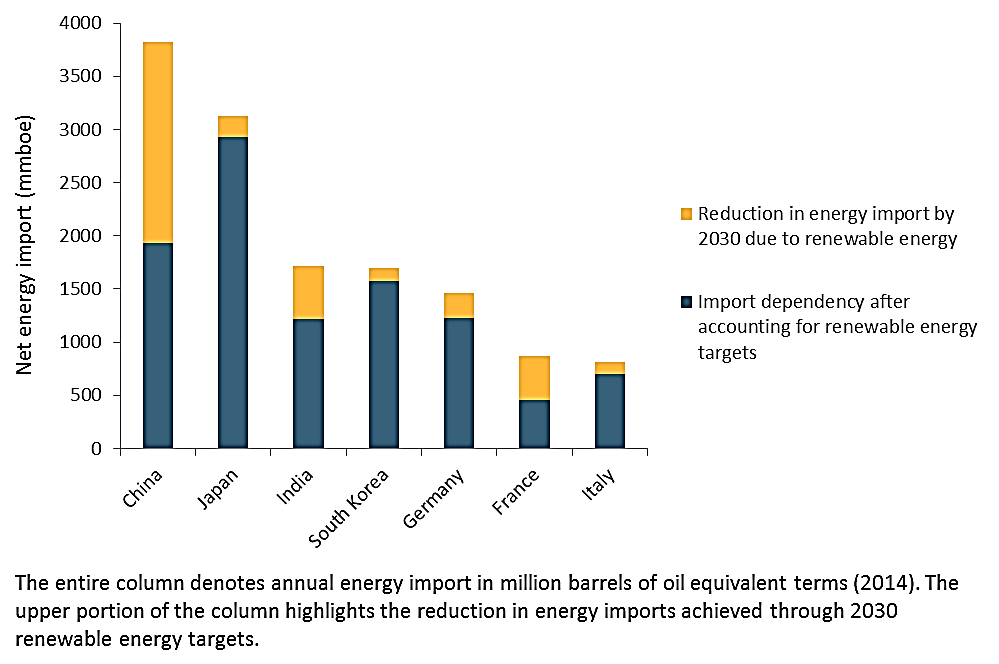

The strong demand-side case for renewables is bolstered by net energy importer nations that are seeking long-term energy security, and looking for ways to meet pre-existing country-level energy mix targets.16

Increased deployment of renewable energy has been cited as one of the long-term measures to enhance the energy security of EU nations,17 as well as major Asian energy importers such as China, Japan and India.18

As per our estimates, if the top seven energy importers excluding the U.S. were to meet their 2030 renewable energy targets, holding other factors equal, the energy import market would likely shrink by approximately 13% (see Figure 3). The impact on the energy import market and overall global demand for fossil fuel could be even higher if one accounts for decreased energy demand in these countries due to targeted energy efficiency standards.19

… which, paired with ‘sticky’ energy supply, may dampen the long-term impact of U.S. energy and environmental policy.

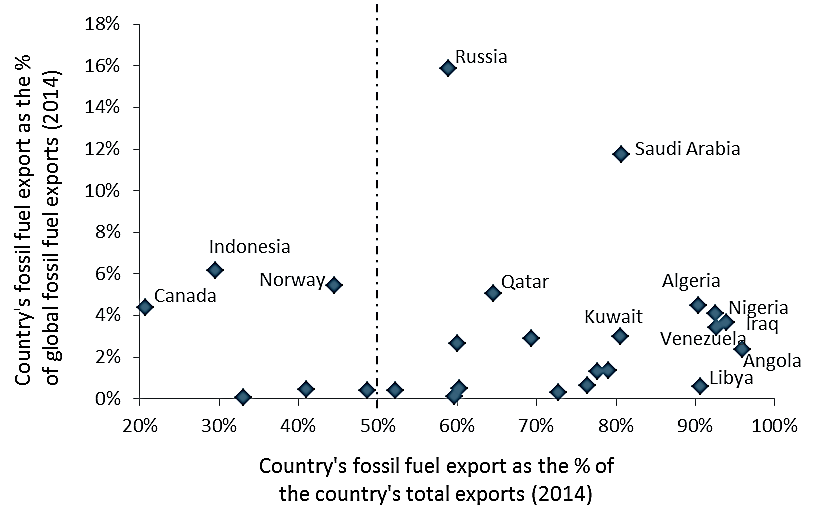

While the above three factors discussed are likely to exert downward pressure on global fossil fuel demand, the race by major energy exporters to maintain global energy market share could keep supplies higher. Countries that depend heavily on fossil fuel income (i.e. deriving more than 50% of their export income from fossil fuel exports) accounted for close to 60% of the global fossil fuel exports in 2014, while Russia and Saudi Arabia alone accounted for more than a third of that (see Figure 4). The rush to exploit reserves before fossil fuel demand goes into decline is likely to keep energy supply levels higher.20 A U.S. focus on enhancing domestic production of fossil fuels is likely to further fuel global oversupply, as has been the case with natural gas production.

While de-regulatory efforts in the US could benefit energy sector companies in the short-term, at least investors appear to be paying more attention to the longer term macro headwinds of alternative fuel cost trends, local demand for clean air, and the strategic agenda of net energy importers.

https://www.msci.com/www/research-paper/regulatory-easing-potential/0656548580

Footnote and References:

1) https://www.whitehouse.gov/the-press-office/2017/03/28/presidential-executive-order-promoting-energy-independence-and-economi-1

2) http://www.reuters.com/article/us-usa-trump-autos-idUSKBN16M2C5

3) http://fortune.com/2017/01/30/donald-trump-paris-agreement-climate-change-withdraw/; https://www.bloomberg.com/news/articles/2017-04-17/exxon-and-shelljoin-ivanka-trump-to-defend-paris-climate-accord;

4) Global Trends in Renewable Energy Investment 2016 (http://fs-unep-centre.org/sites/default/files/publications/globaltrendsinrenewableenergyinvestment2016lowres_0.pdf)

5) Lower oil prices but more renewables: What’s going on? (http://www.mckinsey.com/industries/oil-and-gas/our-insights/lower-oil-prices-but-more-renewables-whats-going-on); BP warns of price pressures from long-term oil glut (https://www.ft.com/content/28607ed2-e305-11e6-8405-9e5580d6e5fb); BP Energy Outlook 2017 (http://www.bp.com/content/dam/bp/pdf/energy-economics/energy-outlook-2017/bp-energy-outlook-2017.pdf)

6) See, for example, Beyond Divestment: Using Low Carbon Indexes (https://www.msci.com/documents/10199/031bf397-5920-4fef-b743-0c879ae46610)

7) Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2015 (https://www.eia.gov/outlooks/archive/aeo15/pdf/electricity_generation_2015.pdf ) (page 6)

8) Why Donald Trump won‘t hold back solar and wind power (http://www.cnbc.com/2017/01/24/donald-trump-cant-stop-back-solar-and-wind-power.html); U.S. states uncertain what Trump victory means for wind and solar power (http://www.cbc.ca/news/technology/trump-victory-wind-solar-energy-1.3947970)

9) https://phys.org/news/2015-06-california-tackles-water-energy-interdependence-decision-makers.html; http://www.ucsusa.org/clean-energy/california-and-westernstates/clean-energy-opportunities-california-water-sector#.WPCmn8tMQpE

10) World energy balance (2014, IEA), (https://www.iea.org/Sankey/)

11) Overview of Air Pollution from Transportation (https://www.epa.gov/air-pollution-transportation/learn-about-air-pollution-transportation) Global Trends in Renewable Energy Investment 2016 (http://fs-unep-centre.org/sites/default/files/publications/globaltrendsinrenewableenergyinvestment2016lowres_0.pdf )

12) Global Trends in Renewable Energy Investment 2016 (http://fs-unep-centre.org/sites/default/files/publications/globaltrendsinrenewableenergyinvestment2016lowres_0.pdf )

13) Global Trends in Renewable Energy Investment 2016 (http://fs-unep-centre.org/sites/default/files/publications/globaltrendsinrenewableenergyinvestment2016lowres_0.pdf )

14) http://www.reuters.com/article/us-usa-trump-autos-idUSKBN16M2C5

15) http://www.independent.co.uk/news/world/americas/us-politics/us-cities-electric-vehicles-los-angeles-new-york-chicago-10-billion-donald-trump-fossil-fuels-

a7630881.html; http://fortune.com/2017/03/15/electric-vehicles-cities-demand/

16)Lower oil prices but more renewables: What’s going on? (http://www.mckinsey.com/industries/oil-and-gas/our-insights/lower-oil-prices-but-more-renewables-whats-going-on)

17) Energy Security Strategy (https://ec.europa.eu/energy/en/topics/energy-strategy-and-energy-union/energy-security-strategy)

18) http://www.japantimes.co.jp/opinion/2015/12/09/commentary/world-commentary/china-india-can-drive-renewable-revolution/; http://ieefa.org/wp-content/uploads/2017/03/Japan_-Greater-Energy-Security-Through-Renewables-_March-2017.pdf

19) Decoupling of global emissions and economic growth confirmed (https://www.iea.org/newsroom/news/2016/march/decoupling-of-global-emissions-and-economicgrowth-confirmed.html)

20) BP warns of price pressures from long-term oil glut (https://www.ft.com/content/28607ed2-e305-11e6-8405-9e5580d6e5fb); BP Energy Outlook 2017 (http://www.bp.com/content/dam/bp/pdf/energy-economics/energy-outlook-2017/bp-energy-outlook-2017.pdf)

Author: |

About MSCI ESG Research MSCI ESG Research LLC is the world’s largest provider of ESG research and data1. We have over 40 years of combined experience in ESG based on legacy firms IRRC, KLD, Innovest and GMI Ratings. We analyze 6,400 companies (11,800 total issuers including subsidiaries) to help institutional investors understand how ESG factors can impact the long-term risk and return profile of their investments. MSCI Inc. is the world’s largest provider of ESG indexes2 with over 700 ESG Equity and Fixed Income Indexes designed to help institutional investors more effectively benchmark ESG investment performance, issue index-based investment products, as well as manage, measure and report on ESG mandates. For more information visit our ESG webpage, contact us or join our mailing list. 1 By number of clients based on public information produced by Sustainalytics, Vigeo/EIRIS and Oekom as of April 2017. 2 By number of indexes and by assets tracking the indexes compared with publically available information produced by FTSE and S&P Dow Jones as of April 2017 |