Topic of the month January 2018: Two major themes for 2018: disruptive technologies and impact investing

Interview with Pierin Menzli, Head Sustainable Investment Research, Bank J. Safra Sarasin

Sustainably minded investors will have to get to grips with two key themes in 2018. First, far-reaching innovations such as artificial intelligence and blockchain technology are transforming the financial world and society as a whole. The potential applications are manifold. Second, impact investing continues to gain importance. In particular, liquid

investment solutions (equities and bonds) with positive environmental and social impacts will complement today’s mostly illiquid private market strategies.

What were the biggest surprises in the financial market in 2017?

Generally speaking, it was the consistently dynamic performance of equity markets in all regions of the world. Very few people had predicted this trend after the political turmoil of 2016. Another positive note is that the economic data as well as the company results reported to date that first made this rally possible are continuing to support it.

Have sustainably minded investors been able to benefit from this trend?

Yes, many investors have managed to profit from this scenario, albeit to a differing degree depending on the investment strategy, asset class and investment style. Sustainably oriented investors could also benefit specifically from the fact that many investment themes, such as climate-conscious investing in alignment with the 2-degree target or impact investing, continue to gain ground. This gives interested investors more and better investment opportunities, and a broader range of products and services. One of these services that is attracting increasing interest is the risk analysis of the portfolio’s carbon footprint.

What exciting new investment themes are you working on?

Our Sustainable Investment Research team can draw on a vast pool of expertise in different thematic areas. My challenge is to try and combine the know-how and experience of 15 investment specialists and use it as effectively as possible. Let me give you an example: the global activities of the online retailer Amazon have powered a dynamic and geographic expansion that has put many different industries and business models to the test, e.g. in the retail trade, health services, and logistics & distribution sectors. The challenge is to identify which companies have erected sufficiently high entry barriers to ensure their existence is not threatened by Amazon. Increasingly, we analyse these risks and opportunities in cross-sector research projects, as we need to draw on expertise from different specialist areas, such as technology and distribution, when making our investment decisions.

What new product developments can we expect in 2018?

At the start of 2017 we developed a specialised strategy for technology stocks that invests in disruptive technologies such as various applications for artificial intelligence and blockchain technology. Our experiences and results to date are very encouraging. In 2018 we plan to make this equity strategy available to all investor groups.

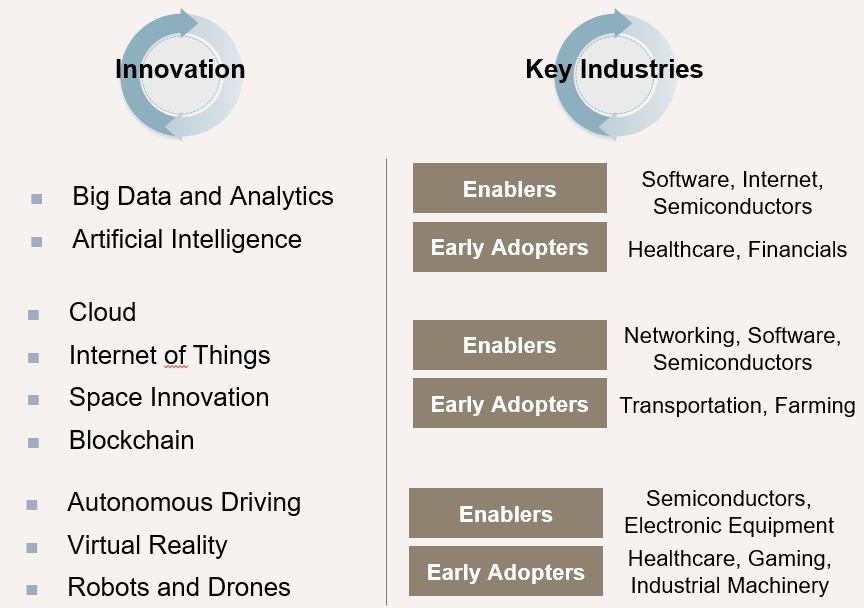

Investment concept: Technology Disruptors

The unique feature of this concept is on the one hand that we invest in very high-growth IT innovators that lead the field in the development of cutting-edge technologies. On the other hand, we select the dominant technology users in sectors such as financial services, industrial goods or healthcare.

What added value can the sustainable investment analysis contribute here?

We benefit from a large and specialised internal research team. In addition, we frequently use external specialists and maintain a constant academic exchange with international experts in these thematic areas.

What about impact investing, which everyone seems to be talking about at the moment?

We’ve been involved in sustainable investing for a long time now, and I see impact investing as a natural development of this. Increasing emphasis is being placed on reporting, as well as a commitment when reaching investment decisions to make a positive environmental or social impact, for example by improving access to healthcare or education. We can offer interested investors an impact reporting that reflects these impacts, and which is also aligned with the United Nations Sustainable Development Goals (SDG’s). Over the past 12 months we have significantly expanded our research activities in the field of impact investing. Over the coming months we are due to launch several investment vehicles specialising in impact investing. Here the focus is on liquid asset classes such as bonds and equities, for which there is growing investor interest. We have incorporated several innovations in the selection process for impact investing vehicles so as to achieve a positive environmental or social impact in our investment portfolios.

Author:

|

About Pierin Menzli Pierin Menzli is the Head of Sustainable Investment Research at Bank J. Safra Sarasin. He has 15 years of experience in institutional asset management with a focus on sustainable investing. He is a co-founder and member of the board of Contrast Capital, a specialist advisory consultancy. Before, Pierin Menzli was the Head of Research at SAM (RobecoSAM) where he led an international team of financial and sustainability analysts. He started his career as financial and sustainability analyst at SAM. He holds a Master of Arts with a specialization in environmental economics of University of St.Gallen (HSG). Pierin is a current board member of Swiss Sustainable Finance (SSF). |