Topic of the month January 2016: Clean technology funds

Clean technology funds – decarbonising towards a sustainable economy

You don’t have to go back many years to remember a time when the words investing and sustainability only coexisted in marketing brochures. In the real world of investing, the two rarely met. Today, the situation is completely different. There is a strong, ongoing, global drive from both regulators and investors demanding that corporations commit to building a longer-term sustainable economy. A joint venture, spearheaded by investors and the United Nations Environment Program (UNEP), has produced the Montreal Carbon Pledge, in which signatories commit to measuring and publicly disclosing the carbon footprint of their investment portfolios on an annual basis. With such a united front from the public and private sector that affects services and products integral to our daily lives, it is already driving investor behaviour.

Going to the source

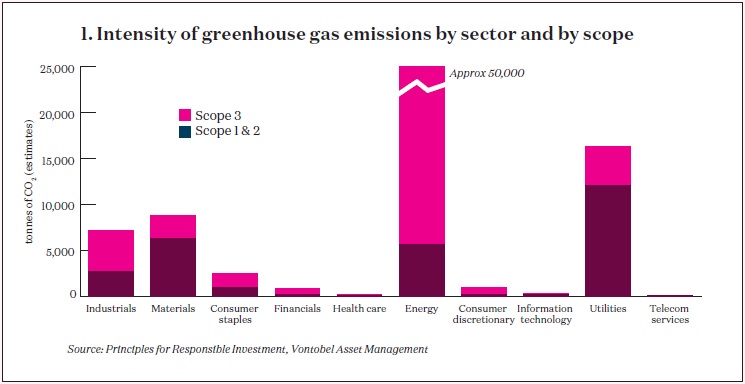

The vast majority of greenhouse gases are coming from energy-related sectors, of which more than 80% are attributable to electricity and heat generation, industry and transportation. Investors hoping to decrease their carbon footprint by not investing in these sectors at all would be fooling themselves. These sectors affect every business and every person on the planet, ignoring them is simply not an option. The question therefore becomes: How can the biggest emitters of greenhouse gases decarbonise?

Calculating correctly

To effectively decarbonise our society, we need to address the high emission activities of corporations, which requires a full understanding of their greenhouse gas emissions throughout the entire product lifecycle. These are defined as scopes 1, 2 and 31:

Scope 1- All direct emissions of the company’s own facilities and operations

Scope 2 - Indirect emissions from consumption of purchased energy: electricity, oil, gas, heat, etc.

Scope 3 -upstream supply chain: waste generated, employee commuting, etc.; downstream sold products: distribution of products, use of products, disposal, etc.

Until recently, companies have focused on emissions that fall under scope 1 and 2 and these are fairly well standardised and widely available among listed companies in developed markets. However, scope 3 is still in its infancy and leaves much room for individual interpretation (despite accounting standards being defined). Scope 3 emissions are not a mere detail, they are in fact often far larger than those in scope one and two.

Emissions under scope 3 are further classified into upstream and downstream. Upstream emissions include those indirect emissions generated by the company’s operations, e.g. from supply chain andemployee commuting. Downstream emissions include future emissions from the products sold by the company, including recycling costs, they are the emissions that often have the largest carbon footprint. For example:Honda’s sustainability report shows that almost 90% of all emissions are generated by the use of the vehicles it sells. It is therefore clear that the focus of decarbonisation should concentrate on the biggest emissions contributors, those which fall under scope three, particular those that are classified as downstream.

Currently, many investors will measure only scope 1 and 2 (and increasingly also scope three upstream), which does not give a full account of a company’s carbon footprint. What is in fact required is a holistic approach which takes into consideration the full lifecycle impact (including all of scope three), relative to peers. Such a holistic approach reduces climate risk and still maintains a well-diversified portfolio with limited tracking error.

Reducing the emission profile of a portfolio by investing in clean technology companies

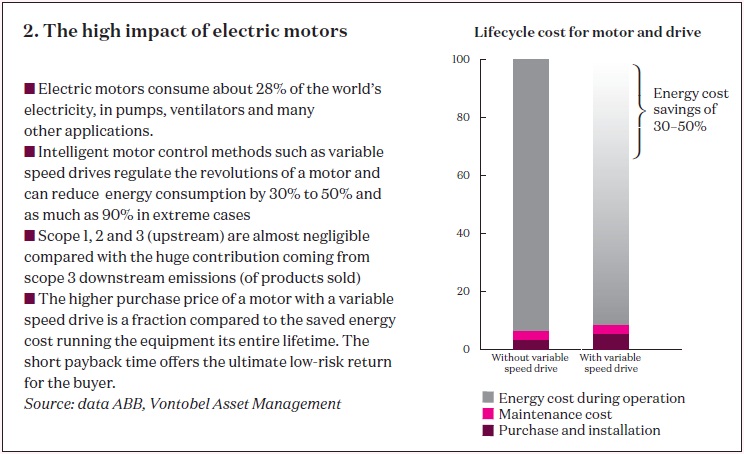

Clean technology companies offer a direct, solution-oriented approach to greenhouse gas reductions and a more environmentally sustainable future. Cleantech investing focuses on the companies that develop technologies, products, processes or services that materially increase resource efficiency and thereby lower greenhouse gas emissions in areas where absolute emissions are highest. It also takes into consideration factors that go beyond the ‘mere’ carbon footprint, such as the reduction of materials used and end of life recycling aspects.

As we know, most greenhouse gas emissions occur in power generation, heating, transportation and industrial businesses. Cleantech investing involves allocating capital to businesses that can have the biggest greenhouse gas reduction impact thanks to innovation, economic viability and scaling up potential. Such companies also offer above average revenue growth and can command healthy profit margins as consumers will increasingly buy products with higher energy efficiency, thus lower running cost.

Thematic clean technology funds provide a solution

Thematic clean technology equity funds are leading the initiative to tap institutional investors’ money to finance the decarbonisation of economic activities and thus are playing a prominent role in the formation of a ‘sustainable financial system’. Cleantech funds directly target clean energy and energy efficient solutions, effectively channelling institutional money into companies that support the realisation of a low carbon economy.

Dedicated thematic fund managers develop specialised, qualitative industry expertise enabling them to optimise the mix between disruptive and high potential technologies and the proven, economically viable and socially accepted ones. Well balanced cleantech portfolios will not only increase environmental effectiveness but also reduce volatility and offer superior investment returns.

1 The Greenhouse Gas (GHG) Protocol is the most widely used international accounting tool to quantify and manage greenhouse gas emissions.

Author: |

For more information, visit us at www.vontobel.com