Topic of the month July 2016: Sustainability allows plenty of leeway for active management

Sustainability allows plenty of leeway for active management

This is generally the case for every mandate, but it is different to some extent here. Managing sustainable portfolios has a number of special characteristics. Sustainability filters, for example, change the investment universe – marginally in some cases, and radically in others. In the end, however, these portfolios are also measured using well-known performance criteria: good performance relative to the risk profile.

Implementing client constraints is part of the everyday work of a portfolio manager. “In principle, a sustainability filter is nothing more than a constraint for the management process. The search for sustainable securities that also provide high returns is the top priority for every fund manager: “To construct a good portfolio of sustainable bonds, it is important to combine one’s own experience with the needs of the client.”

Can green bonds be bought for SRI funds, if their issuers are not classified as sustainable? What, however, if the cover assets of the bond satisfy the green bond criteria, and the issuer receives support as a result for moving in a more sustainable direction? A variety of international initiatives are now working on a definition, e.g. the Green Bonds Principles and Climate Bonds Initiative. As a rule, asset managers assess each issue individually and permit investments in green bonds if the bond has a recognised second party opinion. How fund rating companies and auditors of labels and fund ratings rate such green bonds has not been resolved, however, since the issuer is always considered first in these cases, and when evaluating large quantities of data it is almost impossible to move to a finer level of detail at the level of the individual bonds.

Security selection is critical

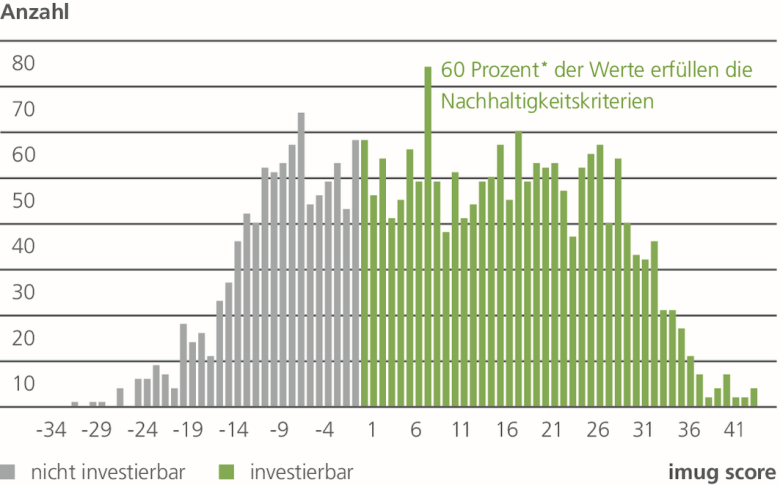

The procedure for equity funds is similar. The universe is filtered based on client requirements, and for a global equity index, such as Deka-Nachhaltigkeit Aktien, around 40 per cent of the stocks remain. “A securities universe like this allows a broadly diversified sustainable portfolio to be constructed based on risk-return factors – with adequate sources of alpha.

Whether equities or corporates, the individual selection of securities from the investment universe is the critical driver of performance. And the management of sustainable and traditional portfolios scarcely differ with respect to this decisive point. “The same fundamental or qualitative approach is used, and the same Deka sector specialists give their recommendations on individual securities.

Fund managers of sustainable funds take great care to find the best securities based on sustainability factors. Sustainability topics are increasingly being discussed in the one-on-one discussions with companies, and ESG criteria are increasingly being integrated into company evaluations.

Constant monitoring

Once a sustainable portfolio has been constructed, subsequent management is performed according to well-established models. The system helps to ensure compliance with SRI-criteria. Even at the order preparation stage, only securities that satisfy the list of client requirements can be purchased. Each portfolio is also continuously monitored, generally each quarter. If striking changes occur, for example a case of corruption is identified, the situation is handled immediately. This is, however, more of the exception, since investments are generally made in companies that are well managed.

As a result, the turnover rate is no higher than for a normal mandate. Having adequate leeway is very important for achieving this. Many sustainable funds do not use a benchmark – often due to very specific client requirements. This also means that each individual security in the fund must have convincing fundamentals. In the current interest rate environment, a global orientation can produce a better selection in the bond segment. The emerging markets can provide attractive sustainable additions to a portfolio, including from the point of view of performance.

Knowledge alone is not enough

The market for attractive bonds is highly competitive, particularly in the current phase of low interest rates. “Simply knowing which securities are attractive from a sustainability point of view is not enough. One also needs excellent access to the market”, states Eggerstedt. It is therefore important that Deka is a well-known market participant for its sustainable funds. “We receive many enquiries from issuers, asking whether we would like to get to know their companies or learn something about their projects.” This is a benefit many small providers cannot take advantage of.

The close contact between Deka analysts and companies also pays off. “We have an independent buy-side research platform”, according to Losen. Companies frequently talk with the analysts about where they have to make changes in order to be eligible for a sustainable fund. But even when all of the requirements are satisfied – the crucial factor is always the potential that a security brings to the portfolio. “Securities are only purchased when their prospects are convincing, and the level of risk is reasonable”, Eggerstedt and Losen agree.

For more information, visit us at www.deka.de

Author:

Saida Eggerstedt, CFA

Senior Portfolio Manager

Deka Investment GmbH

Author:

Jan Ludwig Losen, CFA

Portfolio Manager and Analyst

Deka Investment GmbH