Topic of the month June 2016: The crisis of affordability in real estate

The crisis of affordability in real estate

You can count the number of cities where middle-income earners can likely afford an OK apartment on less than one hand.

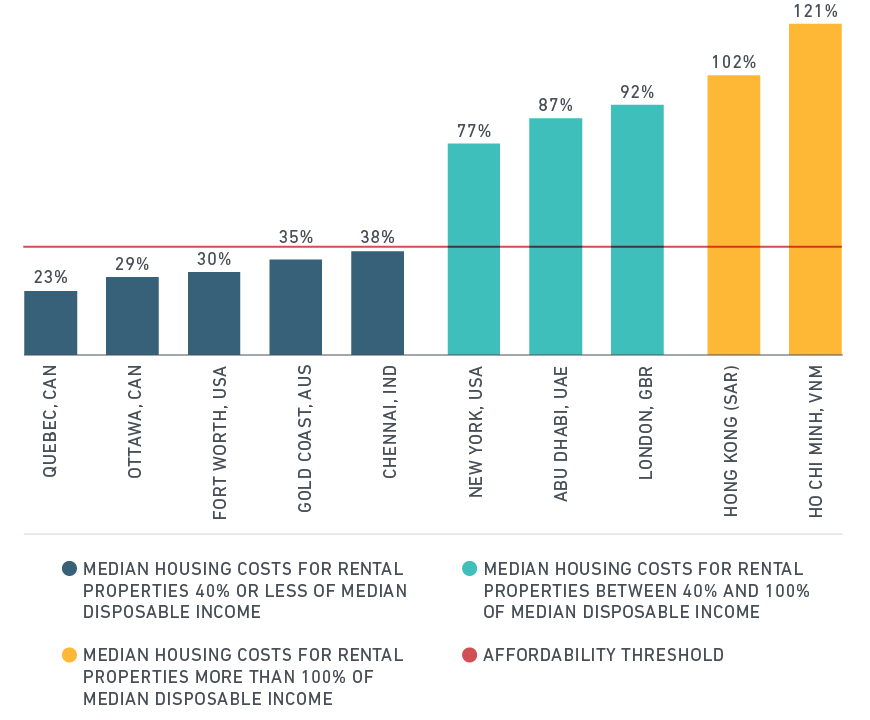

In only four countries – Canada, India, Switzerland and Saudi Arabia – among 97 surveyed were half of households whose disposable income fell at or around the local median able to afford to rent or buy a home, according to a report by Mario López-Alcalá that examines the affordability of residential and commercial properties worldwide.

The analysis assesses affordability by whether the cost of housing that accommodates no more than two people per bedroom exceeds 40% of a household’s annual median disposable income. In all, outlays for rent or mortgage payments exceeded what median households could afford in three-quarters of 307 metropolitan areas surveyed, as of Dec. 31.

The findings suggest both a crisis in housing for middle-income families and a need to rethink affordability, particularly amid a wave of urbanization. Two-thirds of the world’s population is expected to live in cities by 2050, up from 54% in 2014, according to the United Nations. The market for housing that middle-income households in metropolitan areas can afford could reach $502 billion annually by 2020, an increase of 7.3% from 2015, MSCI estimates.

An opportunity for institutional investors

The research arrives amid signs that the market for housing built for the wealthiest buyers may be softening.1 That raises the prospect of an imbalance for institutional investors whose portfolios may be overexposed to the luxury market or who have failed to diversify their holdings with properties that might provide a hedge in a downturn.

Fifteen percent of the 161 real estate companies listed in the MSCI Investable Market Index2 were exposed to cities in which median housing cost 100% of median disposable income. Though nearly 95% of companies managed or developed the majority of their residential portfolios in cities characterized by unaffordability, only 23 companies (14%) had offerings that targeted affordability.

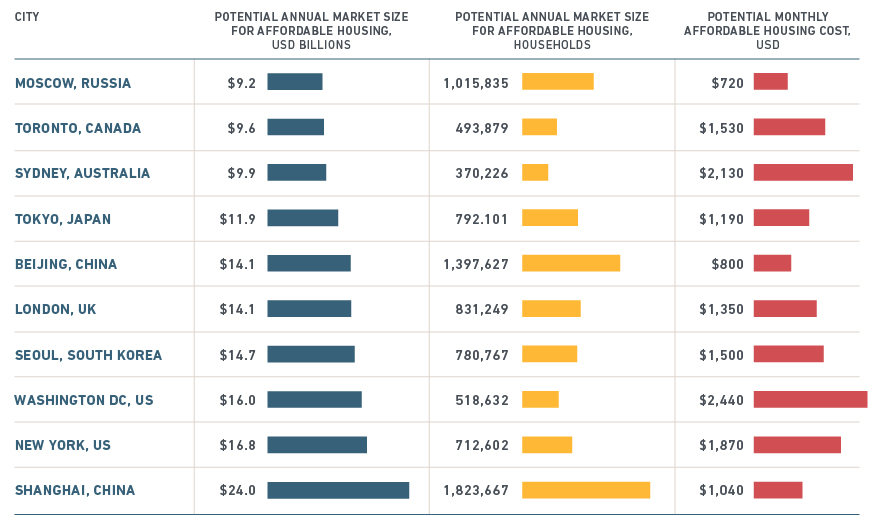

Demand for affordable housing also may present an opportunity for institutional investors, who have lacked a gauge of the market that might spur them to increase the supply. As the chart below shows, housing that cost $2,440 a month in Washington, D.C., $2,130 a month in Sydney or $1,870 a month in New York City all qualified as affordable, a reflection of housing costs in those cities relative to incomes there.

Source: FICO, ILOstat, Numbeo, US Census Bureau and MSCI ESG Research

The research suggests that the market for affordable housing has concentrated in a relatively small handful of cities. In all, 10% of the cities that MSCI surveyed represented about 54% of the market for affordable housing, and encompassed nearly 40% of the market based on the number of households. Rents were unaffordable for 89% and 79% of median-income household city dwellers in emerging and developed economies, respectively.

Where renting a home was (and was not) affordable for households in the middle as of Dec. 31, 2015

Source: MSCI ESG Research

The dearth of affordability extended to home buyers. In just six countries, including Canada, the U.S. and Saudi Arabia, could middle income households afford to purchase a home, though even those countries included cities marked by high levels of unaffordability. The affordability gap also encompassed small- and medium-sized businesses, which struggled to afford storefronts.

1 http://www.nytimes.com/2016/03/16/nyregion/at-dizzying-heights-prices-of-luxury-apartments-may-have-found-ceiling.html?_r=1

2 https://www.msci.com/msci-investable-market-indexes

MSCI serves 97 of the top 100 largest asset managers, based upon P&I data as of December 2014 and MSCI client data as of June 2015.

For more information, visit us at www.msci.com or email esgclientservice@msci.com.

Author:

Linda-Eling Lee

Global Head of ESG Research

MSCI