Topic of the month June 2013: Painting the Bond Markets Green

Painting the Bond Markets Green

The green bond market is coming on in leaps and bounds. This year has seen the first billion-dollar green bond issued, and each week seems to bring new ‘firsts’ for this emerging asset class. But a debate is raging about how best to develop the market – and many investors remain concerned over what, or who, decides when a bond is, or is not, green.

“We think it’s going to be a cornerstone market within three or four years – that’s the signal we get from investors,” said Christopher Flensborg, head of sustainable products and development at Swedish bank SEB – a pioneering arranger of green bond issues – at Environmental Finance magazine’s Environmental Bonds conference, held in London on 28 April this year.

The idea behind the market is straightforward: to harness the enormous volume of fixed income investment and direct a fraction of it towards projects, companies or initiatives that directly address the world’s environmental challenges.

Flensborg’s comments followed hot on the heels of the successful sale of the world’s first $1 billion green bond, by the International Finance Corporation (IFC) – the private sector arm of the World Bank – in February. That bond was quickly followed by a $500 million issue from Kexim, the Export-Import Bank of Korea, a government export credit agency.

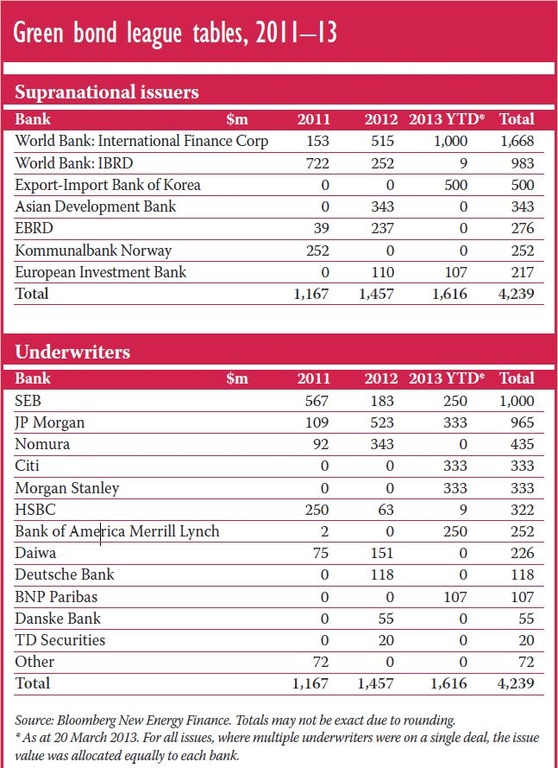

These types of green bond make up the bedrock of the market. First sold in 2008, they are typically issued by highly-rated multilateral financial institutions, with the World Bank Group (including the IFC) the largest issuer. The bonds carry exactly the same credit profile, and pay the same yield, as the issuer’s conventional bonds, but the issuer pledges to direct the revenues raised to finance environmentally-beneficial projects. Some $10 billion of such bonds have been issued - see table for a list of recent issuers and arrangers.

The Green Bond League Tables, 2011 - 2013

However, the market is broadening to take in a much wider range of issuers. A particularly promising market segment comprises bonds issued to finance individual renewable energy projects, or portfolios. This is an extension of the well-established project bond market in the US, which is used to help finance a whole range of infrastructure investments – including renewable energy projects. Here, the benchmark issue was the $850 million of 26-year bonds sold in 2012 to underwrite MidAmerican Energy’s giant 550MW Topaz Solar Farm.

Similar – albeit smaller – issues have been sold recently outside the US. In April, French semi-conductor firm Soitec sold a ZAR1 billion ($111 million) bond to fund a 44MW concentrating solar photovoltaic in South Africa. And in May, UK environmental asset manager placed a £60 million ($XX million) bond to refinance a portfolio of solar projects in the UK.

Meanwhile, France’s Crédit Agricole Corporate and Investment Bank (CIB) has led the creation of a market in socially responsible bonds from local government issuers in its home country, with the revenues directed towards social and environmental initiatives.

It also raised a €500 million ‘sustainability bond’ last year for Air Liquide, an industrial gas supplier. While the proceeds were not explicitly ringfenced, they were used to help refinance the purchases of two of its recent acquisitions – Gasmedi and LVL Médical, both suppliers of gases for healthcare purposes.

But this issue – which was largely placed with SRI investors, according to CIB – illustrates the problem of definition. While the bond would meet the sustainability criteria of some investors, it would not satisfy others. How, without substantial due diligence and post-placement monitoring, can investors be confident of the green credentials of the bonds they buy?

“The market is searching for the ‘Good Housekeeping’ seal of approval for what constitutes green bonds,” Ashley Schulten, a New York-based director at investment management giant BlackRock, recently told Institutional Investor magazine. “Who’s making up these standards? We need to develop some criteria for that.”

The multilateral banks that have led the creation of a green bond market have, by and large, reassured investors with transparent processes and thorough post-issue communication about how the proceeds of their environmental bond issues have been used. Indeed, quasi-government institutions such as the World Bank or the European Investment Bank have very high standards of governance, and are trusted by investors to do what they say.

However, if the green bond market is to grow as its advocates would like, it faces two related challenges. First, as the market moves down the credit spectrum, issuers will be less well-known to investors. Second, as the number of issues proliferate, it will become impossible for investors to carry out the necessary due diligence on each bond’s environmental credentials.

“What’s considered green is different for everyone,” Stephen Liberatore, a managing director at New York-based pension provider TIAA-Cref, told Environmental Finance. “Our investors need to be comfortable” with how green bond proceeds are being used.

He notes that Cicero, a Norwegian environmental research institution, offered certification to investors and arrangers of the Kexim and IFC bonds that the proceeds will be used as promised. “Reaching out to Cicero is a great first step. But I’m sure we’ll evolve to a more common standard, to a standard that can be applied more broadly,” Liberatore added.

Step forward the Climate Bonds Initiative (CBI). The London-based investor-focused NGO has been working on a set of standards to certify the environmental credentials of green bonds and, again as reported by Environmental Finance, they have recently been applied for the first time to a bond.

That bond – to be issued by an as-yet unidentified issuer – is linked to a portfolio of wind farms, and has been audited by Norwegian verification and consultancy firm DNV Kema using the CBI’s International Climate Bond Standards and Certification Scheme.

CBI chief executive Sean Kidney concedes that it’s been an uphill struggle to get the first bond certified, but he told Environmental Finance that “there’s lots of interest in the model … And getting out a certified bond will send a jolt of electricity through the market.”

It remains to be seen whether the industry will coalesce around the Climate Bonds standards – the initiative is working on standards for wind, solar, biofuels and energy efficiency bonds, among others. Some within the finance sector mutter that the standards are insufficiently business-friendly. Some leading bankers are understood to be working on a parallel certification model.

But while the ‘pure-play’ environmental bond market is going through its growing pains, there is clearly a much broader universe of fixed income assets that would potentially be of interest to environmentally-concerned investors.

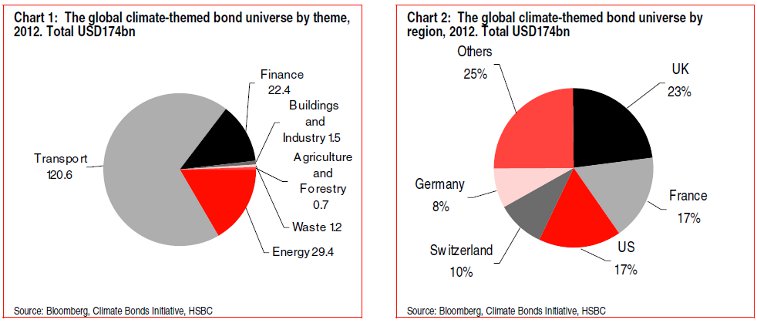

The global climate-themed bond universe by theme, 2012

Last May, HSBC published a research note that attempted to size the ‘climate-themed’ market. It found at least $174 billion of bonds issued by entities whose activities “are fully aligned with the climate economy”. Low-carbon transport, predominantly rail, accounted for $119 billion, with renewable energy equipment makers or projects making up $29 billion. Climate bonds from development banks and Eurofima, a rail financing institution, added a further $22 billion.

Moreover, bonds from issuers with more than 50% of their revenues linked to climate themes add another $210 billion to this figure. HSBC has identified another $369 billion of paper which may be aligned to climate themes, but where more disclosure is needed.

The bank is soon to publish an updated version of the research, again collaborating with the Climate Bonds Initiative. “This report … re-frames the scope of the investable universe for climate-themed bonds – and could help to overcome perceptions among investors that this market is niche, lacking scale and liquidity,” HSBC analysts Nick Robins and Zoe Knight wrote at the time.

Challenges no doubt exist in helping to direct some of the enormous volumes of fixed income investment towards the low-carbon economy, but progress is clearly being made – and the potential of the green bond market is massive.

| Author: Mark Nicholls, Contributing editor at Environmental Finance |

-----------------------

Free Trial & Further Information

yourSRI does offer a free trial access to its database, no obligations and no fine print - please register here and join now.

In order to show the advantages and offerings of one of the leading databases in responsible investing worldwide, yourSRI is hosting a series of webinars. Click here to register

If you are interested in further information, please contact us.