Why China’s Power Companies Should Re-evaluate Their Coal Capex Plans

Executive Summary

▪▪ There is a wall of capex flowing into coal power in China with very negative sustainability impacts

▪▪ At the same time, regulatory and market risks are rising

▪▪ The companies are failing to clearly communicate their strategy

▪▪ Investors should ensure money is spent in their interests before financial stresses grow

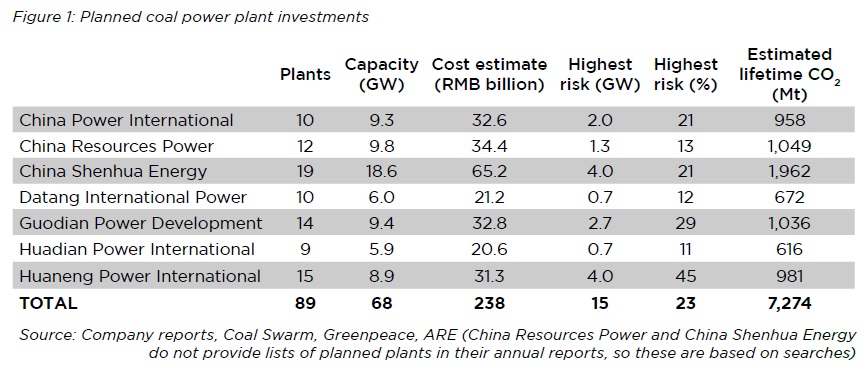

The seven leading listed Chinese power companies analysed in this briefing had plans in place at the beginning of 2016 to build up to 89 coal power plants with 68 GW of capacity over the next few years at an estimated cost of RMB 238 billion (USD 35 billion). But does all of this spend make sense?

This year we have seen a long list of regulations that will affect coal power prospects, including on sustainability factors – such as air, water, and carbon. At the same time, many provinces already face overcapacity, while new ultra-high voltage transmission capacity will bring pricing pressure even in poorly supplied regions.

The power companies’ 2016 interim results led to downgrades across the sector as analysts digested bad news on sector fundamentals. In our review, we looked for the power companies’ strategic responses to the continuing pressures and found worrying gaps. Plant utilisation trends continued to decline, affecting returns, yet the companies have not provided guidance on reductions to capex. They all have plans to build in regions exposed to high regulatory risk including for air and water standards. Overall, the disclosure does not allow investors to assess prospects for any of the companies.

We believe investors should apply greater scrutiny to capital expenditure plans and ask management to provide robust justification for continued spending or to cancel the investments. To support this dialogue, the following pages set out the investment projects per company, together with plant level analysis of air and water risks. This not only makes it clear where companies are taking on new capacity utilization risk, but also where they are compounding those risks with publicly sensitive regulatory risks.

The following table shows the summary figures per company on the basis of planned and permitted plants. Our research provides risk assessments for each plant based on local conditions for air pollution and water stress. The table shows the amount and proportion of capacity per company in the highest risk categories. These total 15 GW or 23% of the proposed 68 GW capacity additions.

While regulators have emphasised air and water, carbon related regulation is also a concern, especially as the Paris Climate Agreement came into force much quicker than expected on November 4, 2016. We estimated lifetime emissions for the plants on the basis of 30 year lifespans at a total of 7.2 GtCO2. This is approximately 1.6% of the total carbon dioxide emissions that can be emitted while holding temperature increases to two degrees. As the effects of climate change increase, so will the willingness to regulate to achieve China’s commitment to peak emissions by 2030 or earlier. This increases regulatory risks for plants built today.

For investors in these companies, our top questions are:

• What are your detailed capex plans by plant and by province?

• What are your hurdle rates of return for new coal plants?

• How do the financial models for the new plants change in light of new regulations, particularly on air, water, and carbon, and other market dynamics?

• How have you changed your investment plans to reflect changing market conditions?

Investors should press companies to postpone or cancel spend where companies are unable to satisfactorily answer these questions.

To download the full report, please click here.