The materiality of ESG factors for equity investment decisions: academic evidence

Executive Summary

This report presents the results of a study performed by the European Centre for Corporate Engagement (ECCE) at Maastricht University in cooperation with NN Investment Partners (NN IP) to gain new insights into the usefulness of environmental, social and governance (ESG) data for investment professionals. This unique empirical study focuses on evaluating the performance of global equity portfolios that are formed using ESG criteria. The most important findings are summarized below.

• Standard ESG ratings/scores typically used in equity selection tend to be higher for larger companies and vary across industries. Using ESG criteria in portfolio selection without the proper adjustments may therefore lead to undesirable size and industry tilts in equity portfolios.

• Levels of ESG scores display limited variation over time, illustrating that ESG factors are often long-term oriented. This supports the intuition that changes in ESG scores can be more informative about future returns than levels.

Adjusting for size and industry bias, we tested portfolio selection rules in the period from January 2010 through September 2014 based on various ESG (sub)criteria, with the following main results:

• Portfolios comprising stocks with high ESG score levels underperformed their lower-scoring counterparts in the majority of cases

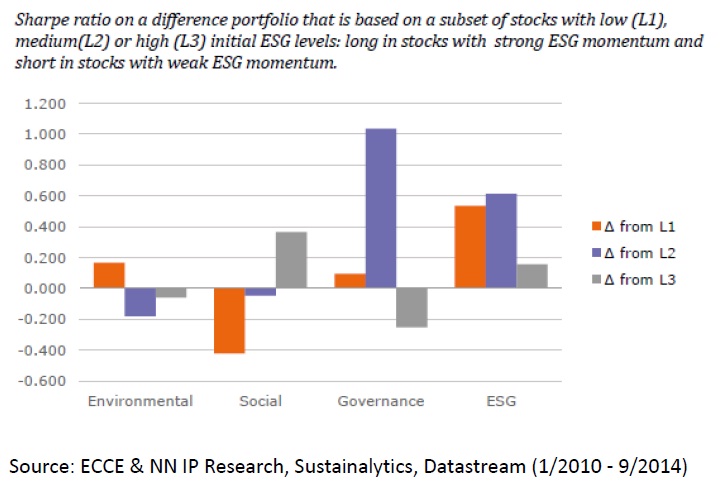

• Changes (or “momentum”) in ESG performance proved to be a more fruitful selection criterion but the performance improvement achieved through the use of momentum in scores revolved mainly around governance measures.

• Return differences between stocks with strong ESG momentum and those with weak momentum were largest among stocks that scored medium in terms of ESG levels, suggesting that stock selection benefits from joint consideration of levels and changes in ESG scores.

• Excluding firms with controversial behaviour from the universe has helped improve performance in the research period past years. We find that returns improved further when not only “severe” and “high” controversies but also “significant” controversies are excluded.

Introduction

This study, an ECCE-NN IP collaboration, is the first comprehensive investigation into the performance of international equity portfolios that are formed on the basis of various ESG criteria. Earlier academic empirical research suggests that to a certain extent the ESG score levels of publicly listed firms reflect intangible benefits of better corporate sustainability and governance. Because the benefits are believed to be largely intangible and materialize slowly, it has also been suggested that ESG performance influences the fundamental value of a corporation in a way that financial markets are slow to recognize. Much of that evidence stems from studies documenting positive risk-adjusted return (“alpha”) associated with U.S. stock portfolios that take ESG information into account, and from studies showing that firms with strong ESG levels earned higher profits than analysts anticipated.

Main results

This section examines stock selection based on both the level and the change in ESG scores that companies receive over time. Some academic evidence already suggests that the way investors may respond to changes in ESG scores depends on the firm’s current level of ESG performance. For example, investors may respond differently to improvements in ESG performance for a firm that was already performing well on ESG issues, than to equally material improvements displayed by a firm that has so far had a medium ESG track record.

To accommodate this intuition, this section reports on an analysis of stocks that are selected based on changes in ESG performance while also taking into account the initial level of their ESG scores. Stocks are sorted on their ESG score into three equally sized terciles (L1 “Low”, L2 “Medium” and L3 “High”). Subsequently, within each ESG tercile, stocks are sorted into three portfolios based on the change in ESG score. Per ESG tercile level, we take a “difference portfolio” that is long a portfolio of stocks with strongest ESG momentum and short the lowest-ranked counterpart.

Figure 1 reports Sharpe ratios regarding the various difference portfolios, where the portfolios are constructed using a universe of stocks that already have a specific initial level of ESG performance.

Figure 1: Using both levels and changes in ESG score to form portfolios

Conclusion

This report summarizes the results from the ECCE-NN IP research collaboration to gain new insights into the materiality of ESG scores for investors. More specifically, we extended the existing literature by (1) using an international dataset, (2) evaluating a wide range of ESG criteria to form portfolios (3) assessing the informativeness of not only levels of ESG scores but also changes (momentum) in ESG scores, and (4) an analysis of controversy-free portfolios (exclusions based on varying degrees of controversy severity).

To download the full report, please click here.