The green supporting factor

Executive Summary

In the context of mobilising policy actions with regard to sustainable finance, the European Parliament and Commission are considering introducing a Green Supporting Factor (GSF) or Brown Penalty (BP) for capital reserve requirements.

The policy initiative suggests the introduction of a GSF or BP may support capital allocation that is consistent with EU climate and sustainability objectives. This paper seeks to estimate the potential impact that such a policy intervention may have both on capital reserves of European banks, as well as the cost and availability of capital to 'green' and 'brown' investments.

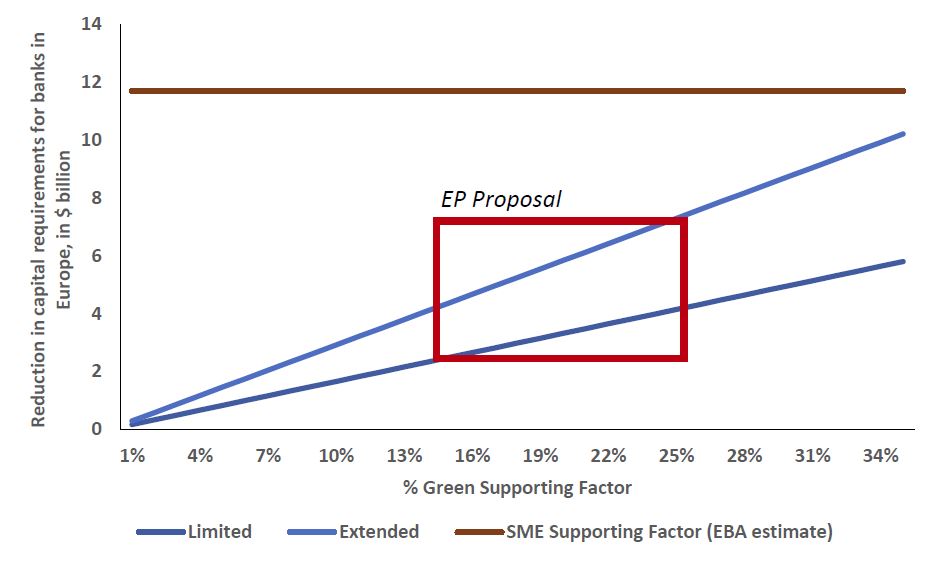

Regarding the effect on overall capital reserve requirements of banks, the analysis suggests that a Green Supporting Factor would have an overall limited effect if compared to the SME supporting factor.

The estimated effect is a reduction in capital requirements associated with a GSF of around €2-4 billion based for a limited definition and €5-8 billion for the expanded definition. In absolute terms and even under an expanded application, the total ‘capital savings’ related to the introduction of a GSF would likely be significantly lower than those identified in response to the SME SF, estimated by the EBA in 2016 at about €12 billion.

A brown penalty through strengthening capital reserves may have a more noticeable impact on investments in high-carbon assets.

Assuming a similar capital adjustment than for the GSF (15-25%), the simulated effects are in the ranges of €8-13 billion additional capital requirements for a limited application and €14-22 billion for an expanded application. Even stronger adjustments, such as 50% could lead to a €27-44 billion penalty. The main reason behind the stronger effect is the larger universe of high carbon assets compared to green assets on which such a penalty would be applied.

Figure 0.1: Estimated impact of a Green Supporting Factor on additional capital available to European banks (Source: Authors)

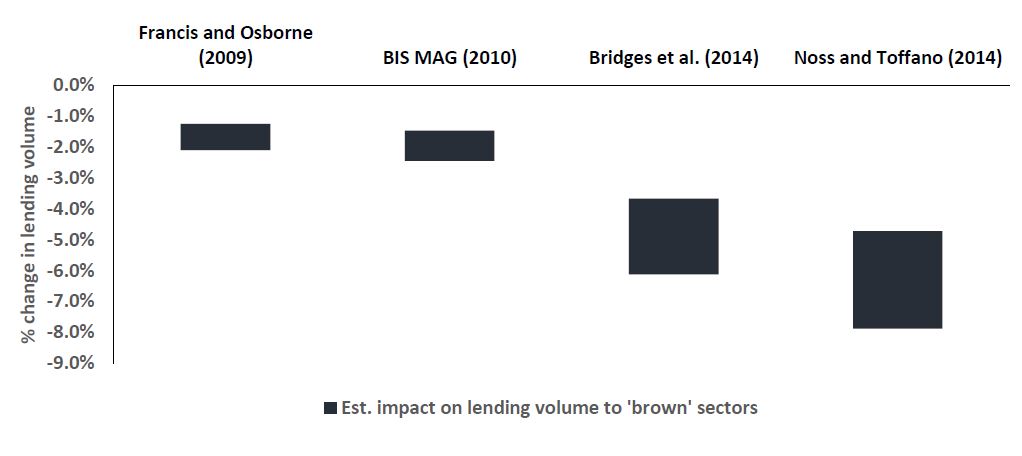

The economic analysis in turn suggests a potential positive impact on cost of capital for green investments for a GSF and a potential reduction in lending to brown assets for the BP.

The estimates suggest a reduction in the cost of capital of 5 to 25 basis points for green projects (with inverse expected effects for a Brown Penalty). This figure compares to first empirical evidence for a green premium of Green Bonds, which is estimated to be of a similar magnitude.1 In absolute terms, an adjustment of 5-25 basis points, while meaningful, is unlikely to fundamentally change the financing conditions for green assets and their attractiveness. To put this number into context, the range of the weighted average cost of capital – expressed in basis-points – for onshore wind projects in Europe is around 900 basis points. In terms of availability of capital, analysing a Brown Penalty suggests a potential reduction in lending to brown assets of up to 8%.

Fig. 0.2: Estimated impact of a Brown Penalty on lending volume to ‘brown’ assets (Source: Authors)

A significant challenge remains in defining ‘green assets’ as well as “high carbon” assets.

Suggestions for the GSF include the application of definitions such as those used by the Climate Bonds Initiative (CBI). However, these only cover definitions related to ‘real’ assets, not ‘financial assets’, which limits their application to companies as a whole. Moreover, there are a range of accounting challenges for physical assets. Thus, in order to reach the more significant ‘expanded’ application, a taxonomy of not just physical, but also financial assets is needed. Examples could include companies that have committed (and adhere to) science-based targets, as defined by the Science-based targets Initiative or the Sustainable Energy Investing metrics project, funded by the EU H2020 programme.

Similarly, for “high carbon” assets there is no consensus on one taxonomy, although the taxonomies that do exist tend to more directly respond to financial assets. Examples are the environmental risk classification by Moody’s, or the models applied by the Sustainable Energy Investing metrics project. Where it becomes particularly challenging is identifying ‘brown assets’ in high-carbon sectors with no clear transition pathway – notably industry and non-road transport – although a simple short-term solution would be to exclude them.

To read the full report, please click here.