The $2 trillion stranded assets danger zone

EXECUTIVE SUMMARY

Don’t get trapped in the danger zone

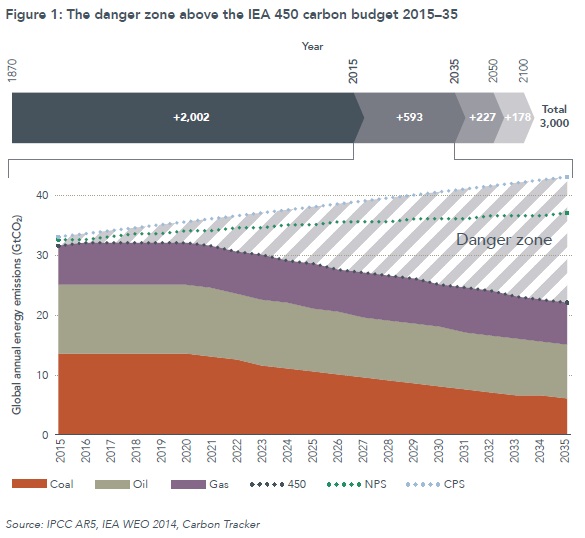

There is a clear danger zone above a 2°C scenario where excess capex and CO² emissions need to be avoided. All energy players have the chance to navigate around this by staying within the carbon budget. This will give the world an opportunity to reach the ultimate destination – a world that has prevented dangerous levels of climate change. Our analysis here focuses on the marginal production between the IEA 450 Scenario and business as usual for the coal, gas and oil sectors to 2035.

Carbon vs $capex

The table below summarises the overhang of unneeded capex (through 2025) and avoided CO² (through 2035) across the 3 fossil fuels in a 2°C-compliant 450 Scenario, compared to business as usual indicated in the industry databases. This makes the difference in financial and carbon significance clear. The greater scrutiny required for new projects is also obvious, accounting for 89% of unneeded capex and 67% of avoided CO². Over $2 trillion of capex needs to not be approved in order to avoid around 156 GtCO² of emissions – the equivalent of cutting supply and the subsequent emissions by around a quarter in the markets covered in this analysis. It is clear that oil represents around two-thirds of the financial risk but a fifth of the carbon risk, whilst coal carries around half of the carbon risk, but only a tenth of the financial risk. Gas is low in terms of the carbon risk, but still carries around a quarter of the financial risk.

INTRODUCTION

Changing times for the global energy sector

In the five years since we started looking at fossil fuel resources in relation to carbon budgets, the world is a very different place:

• Chinese thermal coal demand peaked in 2014;

• The seaborne thermal coal market appears to be in terminal decline according to Goldman Sachs;

• US shale gas, renewables and air pollution measures have displaced coal;

• The oil price halved in 6 months in 2014;

• Falling commodity prices have seen operators seeking to cut costs;

• Resource exporting nations have lost receipts and suffered weakened currencies;

• US shale oil has changed the oil market dynamics, with the Organization of the Petroleum Exporting Countries (OPEC) pursuing market share, rather than holding up prices;

• The KeystoneXL pipeline – first proposed in 2008 – was rejected by US President Obama in November 2015;

• Utility scale solar PV installations have reduced in cost by 29–65% (depending on the region) since 2010 according to the International Renewable Energy Agency (IRENA);

• The United Nations Framework Convention on Climate Change Conference of the Parties (UNFCCC COP) is alive and well in the run up to Paris 2015 with Intended Nationally Determined Contributions (INDCs) bringing the world closer to a 2°C pathway;

• The Bank of England has recognised that not all fossil fuels can be burnt if we are to prevent climate change;

• Citi’s Energy Darwinism II report concluded that action on climate change would be slightly cheaper than a no action scenario;

• Wood Mackenzie Ltd identified $200 billion (bn) of oil and gas capex cancelled in 2015.

CARBON BUDGETS

Our analysis has always used a carbon budget as a reference point for understanding future demand for fossil fuels. We have completed further demand analysis this year to better understand the range of potential demand levels, (see demand paper and Lost in Transition).

Two degrees or not two degrees

We are taking this opportunity to recap the carbon budget context, and identify the marginal area between a 2°C scenario and business as usual that we focus on here. In the run up to the Paris UNFCCC COP we focus on a global warming threshold of 2°C above pre-industrial levels as the internationally agreed objective. The projected cumulative impact of 134 INDCs is to reduce emissions in line with around 2.7°C of warming; meanwhile others push for a 1.5°C target. It is clear that every 0.1°C of warming that can be avoided will count, and that the carbon budget is tight on any of those pathways. As our recent ‘Lost in Transition’ analysis shows, there is only a downside for fossil fuel demand from business as usual.

CARBON CAPTURE & STORAGE (CCS)

Carbon Tracker did consider CCS previously in our 2013 Unburnable Carbon analysis with the Grantham Institute at LSE. This research indicated that by 2050, the carbon budget would be increased by around 125 GtCO² or 14% if the IEA’s idealised scenario of 3,800 CCS projects resulted. This surprised those involved, who expected it to make more difference. At the end of 2014, there were a reported 13 large-scale CCS projects operating that capture a total of 26 MtCO² per year. In the 450 Scenario, annual CO² capture must rise to over 4 Gt by 2035 – a level 150 times greater than today.

Timing

Given where the technology and deployment currently is, it is difficult to see CCS coming in at scale, at a reasonable cost before 2030. This means that in the timescale considered in our analysis to 2035, it makes a small contribution to increasing fossil fuel consumption within the carbon budget. The IEA’s 450 scenario indicates around 24 GtCO² being captured by CCS by 2035, which we have allowed for in our demand projections. This is equivalent to extending the complete IEA 450 scenario carbon budget by 4% to 2035. CCS may yet have a significant contribution to make – but not until post-2050.

Who will pay?

Some of the barriers to CCS relate to questions over permitting, liabilities and subsidising the cost. Certainty is needed over who is responsible for ensuring that the carbon remains stored in the ground, and what the penalty would be if it did not. The industry has called for subsidies to promote investment in CCS facilities.

To download the full report, please click here.