Potential Impact of Climate Change on Financial Market Stability

Detailed Summary

Climate risks have a vast potential to impact financial markets. Through the process of moving towards the 1.5° to 2°C target, fossil fuel assets can lose value. One way is through more frequent natural catastrophes which can lead to significant losses in asset value alongside insurance losses. Within the scope of this study, it was investigated whether climate changes results in a risk to financial market stability. To this end, the CO2 emissions financed by German equity funds were analysed, and a series of expert interviews were conducted, focussing on potential short to medium term risks. The study distinguishes between physical risks (e.g. increased storm damage) and transition risks (e.g. regulation that severely limits fossil fuel consumption). Liability risks are not considered.

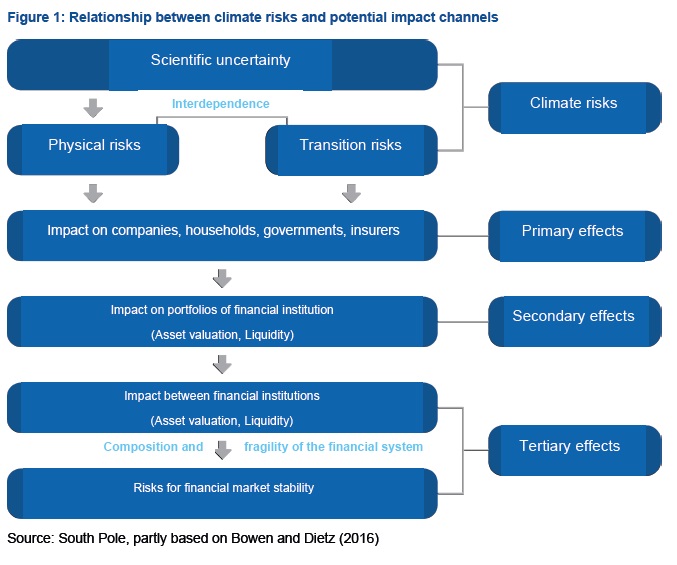

Relationship between climate risks and the financial market

Both physical and transition risks1 can have multiple impacts on the financial market. These can be directly on the financial market (primary effects), indirectly through investment by financial market players in impacted financial assets (secondary effects), or further indirectly through investment in impacted financial market actors (tertiary effects). See Figure 1.

This study examines four subject areas: physical risks, transition risks, pricing of risks and information required by investors for sensible management of these risks.

Physical risks of climate change

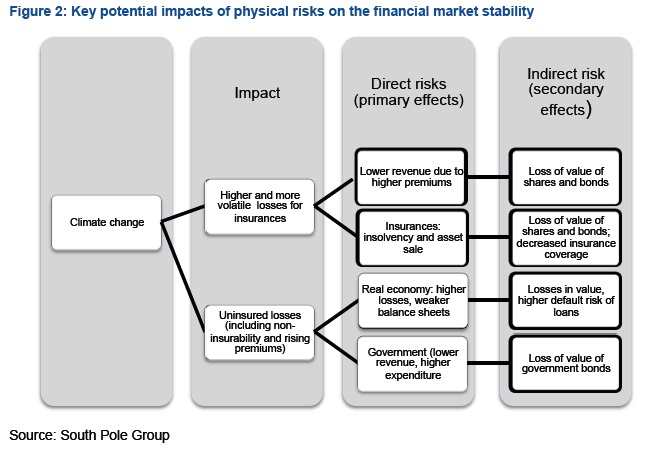

Physical consequences of climate change, such as extreme weather events, can cause direct risks for the financial market in the form of higher and more volatile losses for the insurance industry and possible operational risks such as the closure of bank branches in case of extreme events.

Unexpected events that are extremely unlikely could put financial-system relevant insurers in a financially difficult situation. On top of this, extreme weather events involve indirect risks for the financial markets in the form of uninsured losses or unpaid insurance losses in the real economy. This could further affect the financial economy through unexpected depreciation, higher default risk of loans, and, in extreme cases, downgrading the creditworthiness of companies and states. See Figure 2.

In the short and medium term, it is very unlikely that the physical effects of climate change could cause a significant risk for the financial market stability in Germany and Europe. The insurance industry can adapt relatively well to direct risks since insurance premiums can be adjusted on an annual basis and the risk capital can be adapted continuously. A greater risk for the insurance industry is that changes in the probability of extreme events with very high losses are not directly reflected in the insurance models due to the use of historical-statistical data. This risk exists even without climate change but may be exacerbated by its implications.

Significantly rising losses due to climate change could mean that certain weather risks are no longer insured as premiums become too expensive. This increases the indirect risks for the financial market (secondary effects) through uninsured losses, which can cause losses in value for companies and a greater default risk of loans. In some cases, governments could react with aid programmes for such losses, which in turn would burden public finances. Massive indirect risks due to uninsured damages, leading to a downgrade of the creditworthiness of a government, are more likely for poorer and smaller countries, and therefore not very relevant for the German financial market, which is only marginally invested in bonds and shares of such vulnerable countries.

Due to its gradual development, the physical impact of climate change beyond extreme events hardly poses a short or medium term risk to the financial market stability, especially compared to extreme single-day losses on the stock market. However, more extreme changes cannot be ruled out in the longer term, since there are considerable uncertainties, particularly in the case of warming beyond 2° to 3° Celsius. The politically set 1.5° to 2° limit therefore primarily serves as a precaution against such scenarios.

Financial implications of physical risks can be exacerbated by the international interdependence of the German economy, among other things with regard to value chains and sales markets. However, there is only very little research available regarding those effects.

Transition Risks

Due to the low emissions of the financial actors themselves, physical risks (primary effects) are only marginally relevant. Transition risks primarily impact the financial market (secondary effects) through investments of financial market actors in affected companies. Companies can be affected, for example, by increased prices of CO2 and other greenhouse gas emissions, by stricter regulation of their energy efficiency, or by a decrease in the demand for emissionintensive products (e.g. cars with a conventional internal combustion engine). The potential magnitude of transition risks can be estimated with the help of CO2 price scenarios and assumptions about the general depreciation of investments in certain industries. The quantitative analysis within the framework of this study focuses on the examination of the financed emissions for a sample of German equity funds. Financed emissions allocate investors with a share of the annual emissions proportionate to their investment. If an investor owns 10% of the market capitalization, 10% of the company’s annual emissions will be allocated to them as financed emissions.

If the examined equity funds had to bear their financed emissions (Scope 1 and 2) in the oil and gas, energy, commodities, and industrial sector, this could lead to costs up to EUR 4 billion, representing 4.5% of the investments in these sectors and 1.2% of the total investment (assumption: EUR 99 per ton CO2 based on to the mean value of the EPA2).

Scope 3 emissions would be a further important analysis perspective but were not investigated in this study. Furthermore, equity funds only represent a fraction of the financial market.

Under the assumption that based on the high level of integration of the financial market with general macroeconomic development, the economic costs of climate change, amounting to approximately 2-5% of the GDP, are applicable for the German financial market. This would correspond to losses of EUR 262 - 655 billion per year. However, individual companies and sectors could be affected even more. In case of six energy and industrial companies in the DAX, for example, when factored in completely, UBA believe the CO2 costs could exceed 10% of the total earnings, when assuming social costs of carbon.3 The variance of the effects of CO2 prices on companies is very large.

To download the full report, please click here (English Version).

To download the full report, please click here (German Version).

1Liability risks are not a separate part of the study.

2In the context of this study, to estimate the possible CO2 prices, the approach for macroeconomic costs is used. It is based on the prices for climate impact costs of 80 EUR/tCO2e in 2010, as recommended by the EPA, but interpolated for the year 2014, which corresponds to 99 EUR/tCO2e (based on the recommended prices for 2010 and 2030).

3Own calculation based on the South Pole Group database (CO2 emissions scope 1 & 2 and revenue per company in 2014) and EPA (2012b) for CO2 costs (interpolation for 2014 based on values for 2010 and 2030)