Global Climate 500 Index 2016

INSURERS MUST WAKE UP TO THE RISKS OF CLIMATE CHANGE AND BACK THE LOW-CARBON ECONOMY

Climate change poses a double threat to the insurance industry. It faces mounting costs from claims relating to the physical impacts of climate change and knock-on events such as th disruption of global supply chains. At the same time, the investment portfolios that enable it to meet claims are themselves exposed to climate risks in the transition to the low-carbon economy.

Speaking to insurers last year, Mark Carney, Governor of the Bank of England and Chairman of the international Financial Stability Board, warned that investors face “potentially huge” losses from climate action that could leave vast reserves of fossil fuels as worthless stranded assets.

Climate risk is now a mainstream issue for institutional investors. The FSB has set up a task force chaired by former New York Mayor Michael Bloomberg which will make recommendations to the G20 on how asset owners, the companies they invest in and financial intermediaries should report the potential impact of climate change on their bottom line.

The global commitment to limit climate change to two degrees also presents asset owners with new opportunities. In the same “Tragedy of the Horizon” speech Governor Carney observed: “Financing the de-carbonisation of our economy is a major opportunity for insurers as long-term investors.”

AODP’s annual Global Climate 500 Index rates the world’s 500 largest asset owners on their success at managing climate risk in their portfolios, grading them from AAA to D, while “laggards” taking no action are rated X. It reveals that as a group the world’s biggest insurers are ignoring warnings on climate risk and lagging behind pension funds on the three key capabilities required to protect their portfolios: risk management, engagement and lowcarbon investment.

"Insurers are way behind pension funds in

protecting their portfolios from climate risk.

Only one in eight is taking tangible action

compared with one in four pension funds."

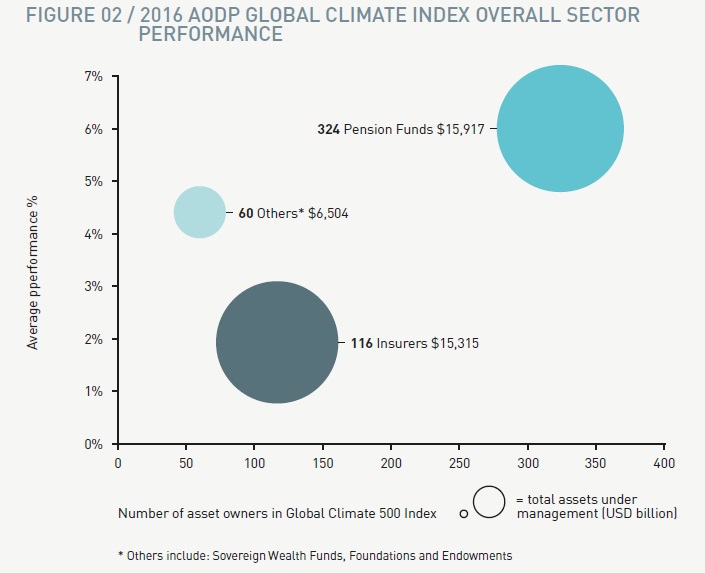

This special report focuses on 116 insurers with $15.3 trillion of investments and compares their performance with 324 pension funds with $15.9 trillion. These two groups account for over 80% of the $38 trillion of assets covered by the Index. The Index identifies 31 asset owners who are leaders on managing climate risk, rated A+.

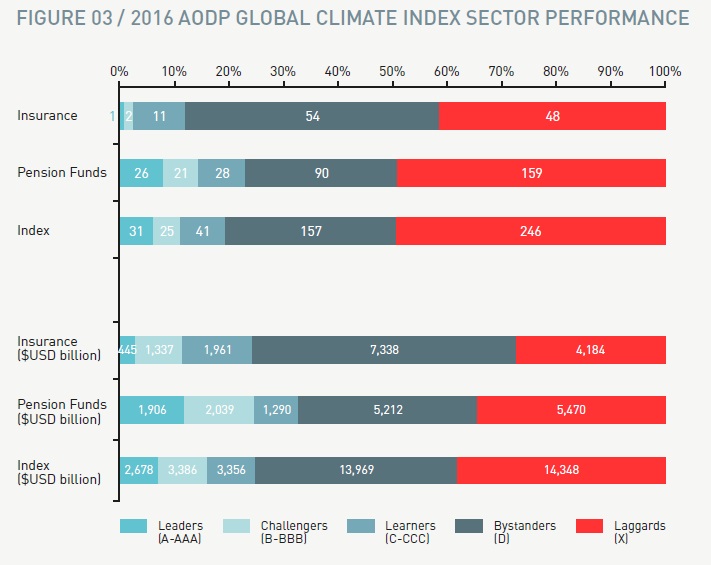

They include 26 pension funds, but just one insurer, Aviva. Across the Index just 14 insurers, one in eight, are taking tangible action to manage climate risk in their portfolios, rated C+, compared with one in four pension funds.

INSURERS ARE LAGGING BEHIND PENSION FUNDS ON CLIMATE RISK

Insurers are lagging way behind pension funds in protecting their portfolios from climate risk. Just one in eight (12%) with a quarter of Index insurance

assets is taking tangible action to manage this risk, rated C+ (learners, challengers and leaders), compared with nearly one in four pension funds (23%) with a third of pension assets. Global leaders on climate risk, rated A+, include just one insurer, but 26 pension funds.

More insurers than pension funds recognise climate risk as an issue, by 59% to 51%. Nevertheless, two fifths of the world’s biggest insurers show no sign of action, leaving $4.2 trillion exposed to climate risk. Nearly half of pension funds are “laggards” putting $5.5 trillion at risk.

Insurers are specialists in risk management, their business models built around forecasting the probability of loss-making events. However, while they may understand the implications of climate change in their underwriting, these experts are failing to join the dots on the investment side.

If insurers face significant losses to their investments as a result of climate change, it will reduce their long term capacity to cover future claims and put clients’ policies in jeopardy. Given the relatively few insurers currently taking action, there is a risk of systemic failure which could have catastrophic effects on the wider economy.

To download the full report, please click here.