ESG - Environmental, Social & Governance Investing

• ESG – a measurement system of potential inequalities

Environmental, Social and Governance (ESG) investing has gained popularity over recent years, partly as a growing number of investors have focused on the ethical impact behind their investment decisions. We believe that the evolution within ESG today means it offers a measurement system to capture potential inequalities and, equally, manage reputational and operational risk that may impact long-term corporate profitability. The growth in ESG investing is being fuelled by the sharp rise in AuM, robust performance, new sources of information, availability of investment product and the growing research that emphasises enhanced risk adjusted returns. Globally, there are believed to be about 350 equity funds classified as ESG with a combined AuM of US$111bn. The bulk of these funds are domiciled in the USA or Europe.

• ESG – Environmental is strongest in USA & Japan, Governance in Europe

The return profile for MSCI ESG indices appears no worse than investing in MSCI regional benchmarks. Yet, the use of ESG ratings and scores suggests high scores and ratings offer better risk-adjusted returns, often with lower volatility, and muted drawdowns. Breaking down the components of ESG suggests Environmental factors are the strongest performers in the USA and Japan, while, in Europe, Governance factors provide much better risk/reward. Although the evidence is not conclusive across the regions, we see some merit in combining high and low ESG scores with the Momentum of the Score. High and rising ESG factors have an increasing probability of outperforming Low and falling ESG factors. This method of ESG 'integration' is shown to be more relevant than the use of ESG 'exclusions'. For ESG stock screens see Pages 23-25.

• Size, Value and Quality help to explain much of what is ESG

There appears to be growing evidence that E, S and G factors may have some merit as standalone alpha sources, particularly from the point of view of portfolio construction. However, it is noteworthy that traditional quantitative styles like Size, Value and Quality go a long way to explain high factor loading or factor contributions to ESG.

• ESG can enhance your portfolio returns

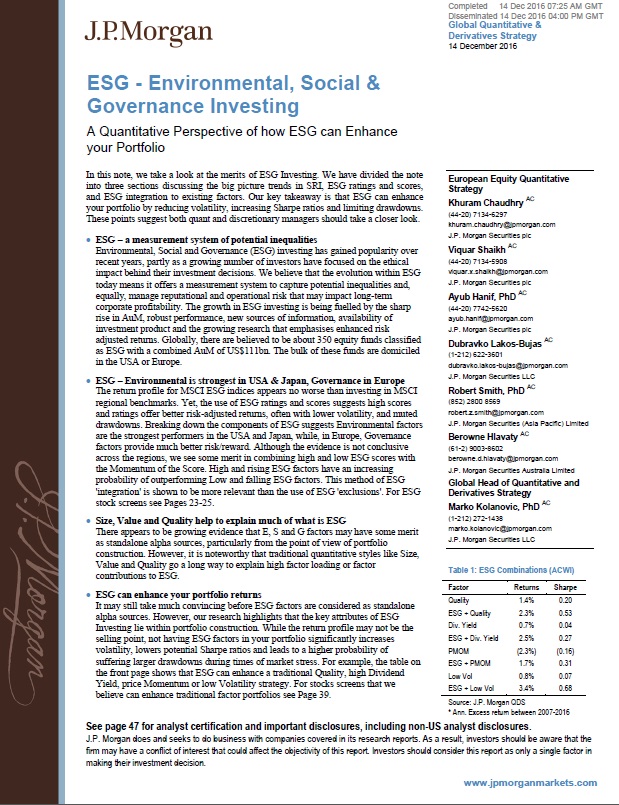

It may still take much convincing before ESG factors are considered as standalone alpha sources. However, our research highlights that the key attributes of ESG Investing lie within portfolio construction. While the return profile may not be the selling point, not having ESG factors in your portfolio significantly increases volatility, lowers potential Sharpe ratios and leads to a higher probability of suffering larger drawdowns during times of market stress. For example, the table on the front page shows that ESG can enhance a traditional Quality, high Dividend Yield, price Momentum or low Volatility strategy. For stocks screens that we believe can enhance traditional factor portfolios see Page 39.

INTRODUCTION

In this research note, we take a look at the merits of ESG (Environmental, Social and Governance) investing through a quantitative lens to gain a better perspective of how ESG investing may potentially enhance equity portfolios.

Our note is divided into three sections: 1) aims to address the 'big picture' trends in ESG investing; including what is ESG? Why is it growing in importance?, and, How are investors using ESG?. We then discuss 2) ESG ratings and scores from third party data providers and discuss how they compare, what are the definitions used, and how do the components of ESG interplay with one another. Finally, 3) we use the approach of ESG integration to better understand how traditional quant factors respond and are impacted by ESG factors in an equity portfolio.

ESG, which is a branch of Socially Responsible Investing (SRI) has become a major topic of discussion in recent years as market participants look towards more longterm, sustainable and socially responsible approaches to investing. There is a growing understanding that all investments have an impact. For example, capital investment can finance either socially desirable or socially destructive businesses or outcomes. The ways we spend and invest can dramatically influence the consciousness of society.

Since the turn of the millennium and more recently, the world appears to have increased its commitment to ensuring environmental sustainability; curbing ‘climate change’ risks is now firmly on the political agenda, and recent socio-economic trends are becoming increasingly focused on economic growth that benefits all in society. We are starting to see exponential growth in Impact investing, which is defined as “direct investments made into companies, organisations and funds with the intention to generate social and environment impact alongside a financial return”1. This definition highlights the key aspirations of ESG integration: generating both financial and measurable societal benefits. How does ESG aim to achieve this? The driving principle is to minimise company specific exposure associated with ESG issues. The challenge is thus to integrate a more wholesome set of ideals into the investment process without giving up returns.

There have been several studies on ESG/SRI based investing over the years. Initial ideas focused on the concept of negative screening whereby perceived sinful stocks/industries etc. would be excluded in stock screening. Found to be detracting from risk-adjusted performance2 these efforts quickly led to more holistic measures along ESG lines. Simultaneously, the availability and quality of ESG metrics and reporting have increased, enabling institutional investors to overlay discretionary and more systematic ESG views on their holdings. Equipped with a potential new toolkit many investors are now focused on the impact of ESG factors on risk-adjusted performance. In this note, we look at the origins of ESG strategies, the current landscape, their overlap with traditional risk premia, inclusion within a multi-factor framework and essentially investigate whether ESG can add alpha?

To download the full report, please click here.