Carbon Clampdown

Anthony Hobley, CEO of the Carbon Tracker Initiative

This report on the recently reinvigorated EU carbon market (EU-ETS), written by Carbon Tracker’s new Head of Research, Mark Lewis, is a timely reminder of the importance of policy in the fight against climate change. Whilst Carbon Tracker’s work has always factored in the impact of relevant policy approaches, this is our first dedicated piece on the subject of carbon pricing, and I would therefore like to explain why we think the time is now right for such a report.

Carbon Tracker has made its name through its pioneering research on carbon budgets. Our approach has always focused on the intrinsic disconnect between the business-as-usual development of the fossil-fuel sector on the one hand, and the low-carbon pathway necessary to achieving a climate-secure energy system on the other. Our objective has always been to illuminate the financial risks inherent in fossilfuel capex plans that ignore the increasingly intertwined policy, technology, and shareholderdriven constraints on the future development of coal, oil, and gas resources.

Against a backdrop of escalating scientific concern about climate change, we see the signals from policy-makers regarding the need for stronger instruments to mitigate the dangers. Carbon pricing is one of the most important of these instruments; and no serious authority or expert contests that putting a material price on carbon around the world is the most economically efficient way in which to speed up the global energy transition already underway.

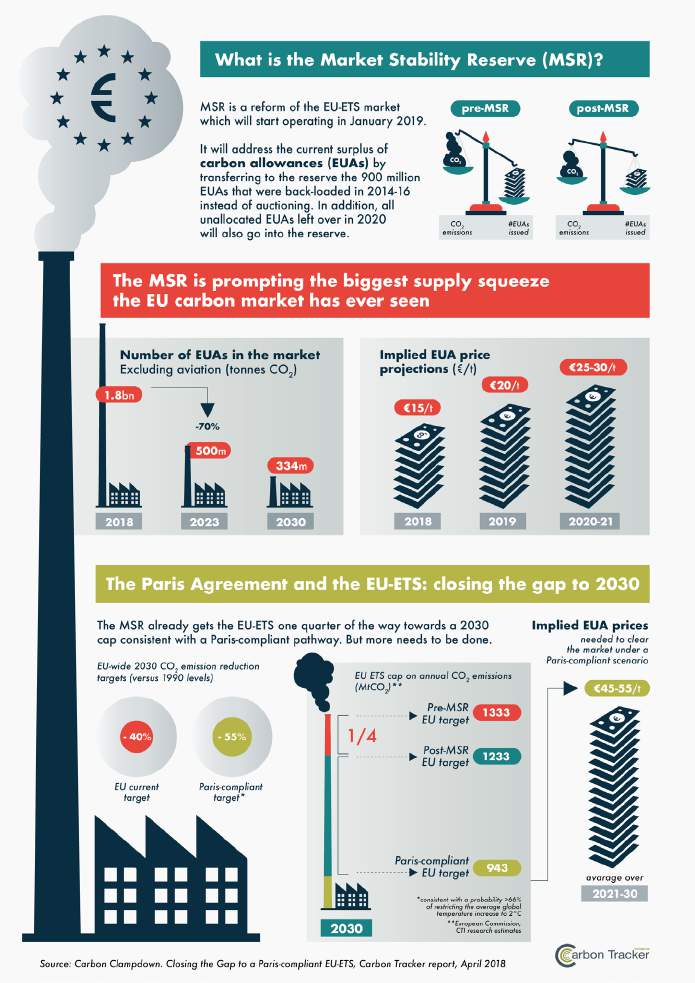

This report therefore aligns with what we see as an important part of Carbon Tracker’s mission: to translate climate-related financial risks – whether of a policy, regulatory, or technological nature – into terms that the financial and investment community can act upon. In keeping with Carbon Tracker’s raison d’être, the report examines the connection between the EU-ETSand the EU’s overall carbon budget under a Paris-compliant pathway.

As Mark explains, following the recent reform of the EU-ETS the EU carbon market is now on an upward trajectory. Yet as Mark’s report also makes clear, if the EU ultimately acts to align its emissions targets for 2030 and beyond with the Paris Agreement, then the cap on emissions in the EU-ETS will have to be tightened significantly further over the next decade.

Given that some member states are already calling for action to align the EU’s 2030 emissions target with Paris, and that the European Commission is now required to devise a long-term strategy for reducing the EU’s longterm emissions in line with Paris by the end of Q1 next year, this means that there are material latent risks to investors in coal-fired generation in Europe that go above and beyond those already brought into stark relief by the recent EU-ETS reform.

And looking at policy initiatives in other key jurisdictions around the world – such as China’s recent decision to establish a national emissionstrading system – the importance of carbon pricing as a policy and regulatory tool is only likely to grow over the next decade and beyond.

As such, our venture into in-depth research on carbon pricing is an explicit recognition of the importance of policy in the fight to keep the increase in the average global temperature to “well below 2°C” as stated in the Paris Agreement, and from now on we will be keeping a close eye on carbon-pricing initiatives globally as they continue to unfold.

To download the full report, please click here.