Article 173 of the French Energy Transition law

Implications,First Steps and Impact

Aimed at channeling funds to the law on Energy Transition and Green Growth, Article 173 of the law introduces, for the first time, disclosure requirements for asset owners on their management of climate-related risks and, more broadly, on the integration of social and environmental parameters in their investment policies. This paper takes a close look at the innovative new law that could transform the French responsible investment industry. The law also offers a glimpse to global investors of the possible reporting strategies that they could develop relative to their portfolios.

Climate reportingfor large investors

The implementing decree of Article 173 provides for different reporting obligations based on the size of the financial institutions. In total, 840 financial institutions now have ESG reporting obligations. Of these, 60 asset owners, with consolidated balance sheets worth more than €500m, have additional reporting requirements: management of climate change-related risks and their contribution to the financing of the green economy. Only one quarter of them have already made a commitment on climate and/or led a more or less expansive responsible investment strategy for several years. Globally, asset owners will need to significantly change their communication and reporting methods to comply with the intent of the law.

Who does Article 173 apply to?

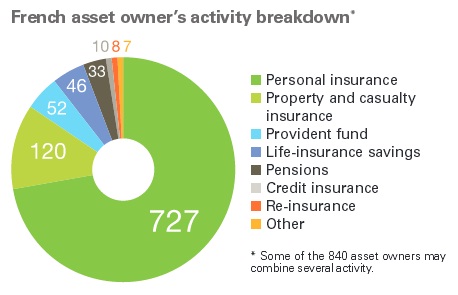

The law theoretically applies to over 840 asset owners – a broad spectrum comprising a myriad of small organizations.

With Article 173, France is the first country to introduce a law encouraging asset owners to integrate climate risk and environmental and social dimensions in their public disclosures. Asset owners in France make up a heterogeneously-organized whole. The category is home to players with extremely different activities and statuses. Consequently, the lawmakers also provided a legal scope for the concept of asset owner: the implementing decree lists categories of institutions subject to a reporting requirement. These include insurance companies, mutual funds, asset managers, provident institutions and public and private complementary pension institutions regulated by their respective French codes.

Novethic’s research shows that some 840 asset owners will from 2017 be required to explain their responsible investment policy. These comprise players of all sizes operating in the fields of insurance (health, life, property and casualty), provident schemes and pensions, together with a range of legal statuses (private, public, mutual).Personal insurance companies, in particular complementary health insurance entities, are by far the most numerous yet are often small structures with limited scopes.

The 430 French asset managers, members of the French Asset Management Association (AFG), are also subject to Article 173. However, they have already had ESG reporting obligations since July 2012 with the application of Article 224 of the Grenelle II law. Foreign asset managers are not impacted by Article 173 but may have to provide ad hoc reporting for their French clients. The French subsidiaries of large financial groups are potentially subject to requirements that do not apply to their parent companies.

Law requirementsfor investors

The implementing decree of the law provides an outline of the information requested from asset owners and asset managers. Although it allows investors some leeway, reportings must include the following major categories of information:

- A presentation of the general ESG policy must stipulate the content, frequency and resources used to inform investors, beneficiaries and clients. Sources of information used for ESG analysis must be provided, including non-financial data, ratings, reports, and internal and external analyses from the company’s reporting. If the entity has a policy to manage its ESG risks, it must describe them along with the internal procedures used to identify and assess them. Information on the integration of ESG criteria in investment policies may comprise “ distinctions by activity, asset class, investment portfolio, issuer, sector or any other relevant breakdown”.

- For asset managers, it must include a list of the funds integrating ESG criteria, as well as the share of these funds in the overall assets under management, together with any adherence to a specific charter, code, initiative or certification.

- The assessment of climate-related risks must also be explained: main data, climate scenarios used as reference, scope, timeframes and approaches (static or dynamic). These risks shall be broken down between physical risks and transition risks. The measurement of portfolio footprints, either “past, present or future, and direct and indirect”, must also be included. Contributions to national and international objectives on the climate and the energy transition shall also be disclosed. A complete range of methodological choices is also suggested for entities to explain their contribution to the energy or ecology transition: these can be assets invested in green equities or bonds, in infrastructures or theme-based funds which may be subject to green certification (eg. EETC Label) or similar initiatives.

ESG and climate reporting: where are we?

Article 173 of the French Energy Transition law, which was challenged in France’s highest constitutional authority, the Conseil Constitutionnel, remains a complicated measure for many investors. However, it could lead to the generalization of practices already well-implemented by the most engaged actors in the market.

Some 15 large investors are proactively showing the way

To download the full paper,please click here.