Topic of the month December 2018: Sustainable investment with a factor strategy

Sustainable investment with a factor strategy.

by Heinrich Oberkandler, Sustainability Manager, BayernInvest

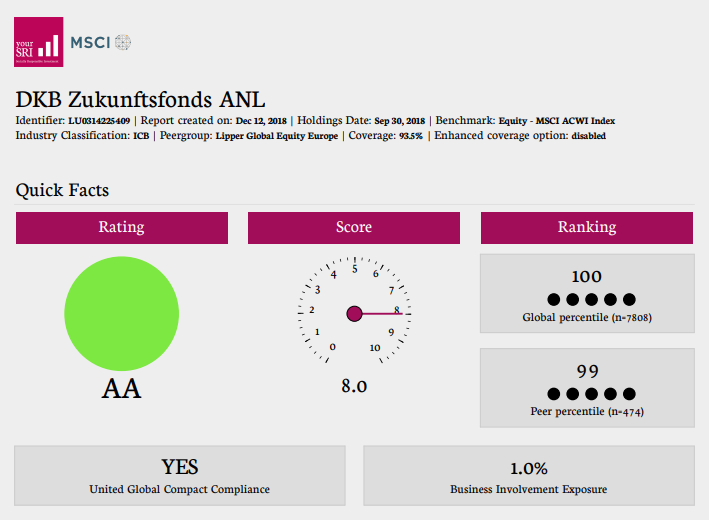

BayernInvest offers its institutional customers a range of investment solutions for implementing sustainable investment criteria. “DKB Zukunftsfonds” managed by BayernInvest has been awarded with top ratings for sustainability and performance by using its equity factor strategy.

Investors may have different reasons for seeking sustainable investment opportunities, but essentially they are all motivated to support conserving natural resources, integrating social aspects and to invest in companies with higher governance standards because these companies possess generally a lower risk. The European Commission shares this conviction and transferred these objectives into practice by its “Action Plan on Financing Sustainable Growth” released back in March this year. The plan includes a wide variety of measures for a sustainable financial system, which are currently being developed by specialists. The European Parliament and the Council have already introduced the issue of sustainability in the IORP II directive on occupational retirement provision. It stipulates that Institutions for Occupational Retirement Provision must incorporate ESG criteria into their business operations latest by 19 January 2019. From that point they will be obliged to inform the members of occupational pension schemes whether and to what extent their investment policy takes account of environmental, social and governance as well as climate protection aspects.

Sustainable fund solutions and ESG reporting

In this spirit, BayernInvest has further expanded its range of sustainable fund solutions. With immediate effect BayernInvest cooperates with MSCI ESG Research – in addition to its partnership with ISS-oekom. MSCI ESG Research describes itself as the world’s largest provider of sustainability analyses and ESG ratings.

Institutional investors at BayernInvest have access to various sustainable investment solutions, including:

• Actively managed sustainable European equity factor strategy

• Index/actively managed sustainable global/regional equities

• Index/actively managed climate optimized global/regional equities

• Index/actively managed sustainable Euro corporate bonds

• UN Global Compact-compliant investment strategies

Upon request, BayernInvest provides investors with a sustainable investment report, including, for example, information about potential controversies, ESG quality and ratings, or CO2 emissions of the companies in the portfolio.

Factor investing strategy

"DKB Zukunftsfonds”, managed by BayernInvest proofs that sustainability and good performance are no contrarian goals. The investment process includes both financial market factors (value, size, quality, etc.) and ESG criteria for selecting stocks. A preliminary selection excludes equities from the investment universe, which act in controversial business areas and -practices. This tactic minimises risk exposure from the start. Then a factor investing strategy is applied to create higher returns. Securities are selected which are expected to perform well as a result of certain factors or quantifiable company characteristics. The focus is on style factors, which quantify companies’ risks and opportunities outside the traditional market view, combined with active management of the portfolio based on macroeconomic factors.

DKB Zukunftsfonds is one of the “most sustainable funds”

Over a five-year period, “DKB Zukunftsfonds” generated a performance of s 4.95 per-cent p.a. (as at: 31 October 2018). The sustainable European equity fund selects promising equities from Europe (with a focus on the European Union), whose business lines and practices meet strict environmental, social and governance criteria. “DKB Zukunftsfonds” is ranked one of the most sustainable funds by yourSRI as at 30 June 2018. It is ranked in the top 1 percent of its peer group (Equities Europe of 311 funds), has an excellent ESG-footprint and its climate footprint is better than the average of the peer group and the benchmark.

|

About BayernInvest Kapitalverwaltungsgesellschaft mbH The Munich based BayernInvest Kapitalverwaltungsgesellschaft mbH is the competence centre for institutional asset management within the BayernLB group. As a full service provider, BayernInvest offers both asset management services as well as a central fund administration services (Master-KVG). Key competencies are a clear client oriented approach, characterised by excellent quality, flexibility and consideration of individual client needs. Total assets of BayernInvest are round about EUR 83 bn in mutual funds, segregated accounts and managed accounts. Therefore BayernInvest is one of the leading asset managers in Germany. For further information please refer to |

Disclaimer:

The sales prospectus, the key investor information and the annual and half-yearly report are the only binding basis for the purchase of fund units. These are available free of charge at www.bayerninvest.lu. | The views expressed may be subject to change at any time according to market and other conditions. BI assumes no liability that countries, markets and sectors will perform as expected. The returns and the value of the underlying investments may fall or rise and may result in the complete loss of the capital invested. Performance is calculated using the BVI method. | This publication is intended solely for professional investors within the meaning of Annex II EU Directive 2014/65 (MiFID II) with their registered office in Germany. Please note that this article cannot take the place of legal or tax advice. Before investing in a financial instrument, potential investors are responsible for examining the inherent risks and opportunities of an investment.