Topic of the month January 2019: The Case for ESG Integration

The case for ESG Integration

by Lara Kesterton, Vontobel Asset Management/mtx Boutique

Value-add if done well and pitfalls to avoid

Sustainable Investing is big business – accounting for over one quarter of global AUM and growing at 12 percent p.a.1 This paper examines the evidence driving this proliferating trend, showing that, done right, integrating ESG principles into the investment process can add value to portfolio returns. However, it is not without pitfalls that can detract from returns if not managed carefully. Therefore, we look in detail at one approach with proven success and discuss where and how ESG can add the most value. ESG investing has had particular success in Emerging Markets – we look into the evidence for why this is the case and what this means for investors.

As outlined in part 1 of this paper, Sustainable Investing is a broad church, encompassing many approaches to incorporating ESG factors into portfolio selection and management. In this part, we focus on “ESG Integration” meaning the systematic and explicit inclusion of ESG risks, alongside financial factors, into the investment-decision making process for the purpose of enhanced financial performance.2

Why Sustainable Investing matters and where it has the most impact?

The traditional belief has been that Sustainable Investing comes at the cost of financial performance. This has been countered in recent years with burgeoning academic support finding a positive correlation between ESG and corporate financial performance (CFP).

A meta study of 2,200 individual academic studies by Friede et.al. (2015) provides the most exhaustive overview of academic research on this topic. The report found that an overwhelming share (52 percent) of the studies on equities found a positive ESG-CFP relationship while only 4 percent display a negative relationship (see Figure 9, page 12).

Another influential meta study of 200 academic papers (Oxford, Arabesque 2015) had even higher ESG conviction, finding that good ESG practices:

- reduced companies’ cost of capital (in 90 percent of studies);

- improved operational performance (88 percent of the studies); and

- positively influenced stock price performance (80 percent of studies).

A recent Deutsche Bank (2018) report looked at over a decade’s worth of data and found that stocks with “a high ESG grade” did not demonstrate any loss of performance compared with their peers, while low-rated stocks did experience a performance-penalty.

There are many different explanations for the causal influence of robust ESG practices on financial performance. MSCI (2017b) investigated the main transmission channels and found that companies with higher ESG ratings are:

- more competitive, leading to higher profitability; and are

- less risky and less volatile as they are better at managing idiosyncratic/company-specific risks and suffered fewer incidents which can impact the share price.

In short, if deployed effectively, the application of ESG factors into the investment process can be a source of investment alpha.

The partnership involves close collaboration with the Hermes EOS team, enabling mtx to provide input on engagements and gain insights from the resulting discussions – which in turn provide useful insight for our ESG analysis. We also participate in Hermes’ biannual client counsels, in which we have the opportunity to discuss with and learn from other investors using the Hermes EOS service, and engage with Hermes on the current issues of most concern and on the development of their engagement activities.

ESG Integration as a risk management tool: avoiding corporate shocks

Vontobel’s mtx boutique uses ESG Integration systematically as a tool for avoiding tail risks – i.e., avoiding the most at risk / worst prepared companies and thereby supporting enhanced portfolio performance.

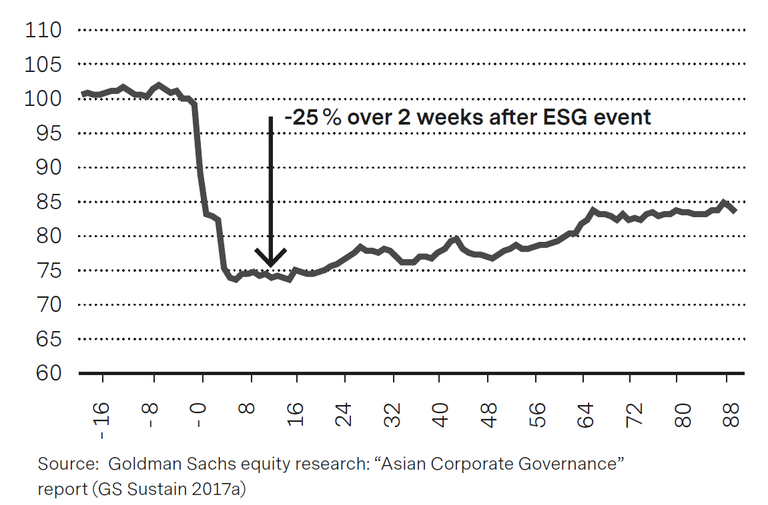

This is supported by a number of studies which conclude that it is more important to avoid the ESG laggards than find the best-in-class performers (GS Sustain 2017b).3 Likewise, MSCI (2018c) looked at the impact on performance and risk of 1,200 funds if the bottom ESG rated companies were excluded from the fund, and found that “the best result by far was achieved when the worst 30 percent of ESG-rated companies were excluded.”It appears that ESG’s greatest value is as a tool to avoid idiosyncratic shocks. The following graph illustrates how major adverse ESG events (e.g., labor strikes, corruption, fraud, embezzlement, serious worker safety incidents, environmental leaks/explosions, indigenous protests, supply-chain disruptions, class-action litigation, consumer boycotts for unethical behavior, etc.) can seriously impact the value of the company and therefore the company’s stock price.

Figure 1:

GS Sustain: Major adverse ESG events can lead to material underperformance

Average sector relative performance for 14 major adverse ESG events in Asia since 2007

A study from The Economist found that notable corporate crises “were deeply injurious to the companies’ financial health, with the median firm losing 30 percent of its value since its crises, when compared to a basket of its peers.”4

Good ESG performance acts as “insurance protection” against shocks

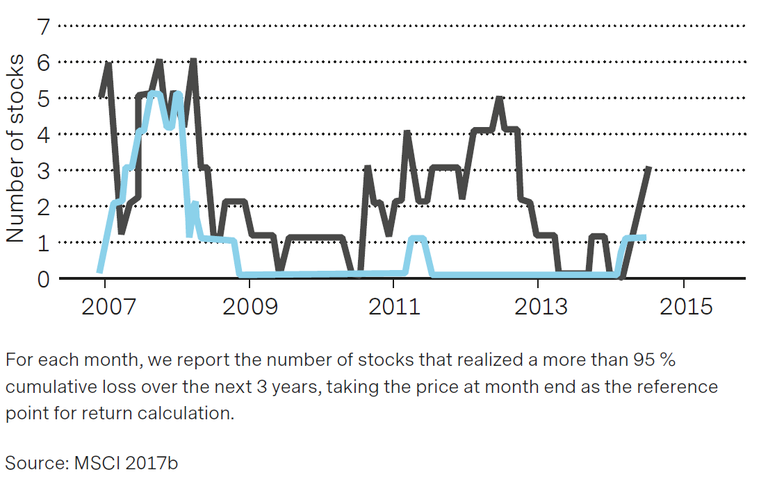

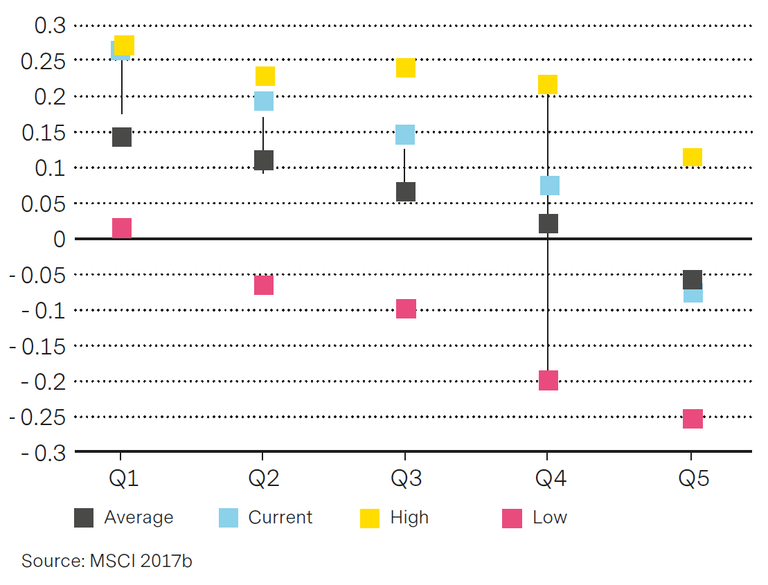

High ESG-rated companies show a lower frequency of idiosyncratic risk incidents, suggesting that they are better at mitigating serious business and operational risks (Figure 7). Hoepner et al. (2013) view this as an “insurance- like protection of firm value against negative events.” MSCI also found that companies with high ESG ratings have shown less volatile earnings and less systematic volatility (Figure 8) in line with the theory that they are less exposed to systematic risks. The chart indicates that excluding the bottom two quintiles of ESG performers has a significant improvement on volatility.

Figure 2:

Idiosyncratic incident frequency of top and bottom ESG quintiles

Figure 3:

Systematic volatility of ESG quintiles

|

About Vontobel Asset Management/mtx Boutique The mtx boutique is part of Vontobel Asset Management and responsible for managing CHF 1.7 billion across a range of equity |