Topic of the month May 2019: Swiss pension funds and responsible investment

Swiss pension funds and responsible investment

by Claude Amstutz, WWF Switzerland

Money, so they say, makes the world go round. Well, at WWF we strongly believe that it can do much more than that… and make an actual positive difference to the future of people and planet.

Finance must be sustainable

From banks lending credit, insurers providing cover against risk to pension funds investing their beneficiaries savings over generations, the global finance system powers the economic activities that affect our planet. And therefore, sustainable finance is the link between financial systems and ecosystems.

Sustainability is becoming increasingly important in the financial sector. With the Paris Agreement on climate change as well as the adoption of the Sustainable Development Goals (SDGs) in 2015, the international community established the groundwork for this and sent an unmistakable signal that sustainability is no longer an option but rather an indispensable prerequisite for successful business activities.

Pension funds play a key role

Because of their intergenerational mandate, occupational pension schemes are well suited to incorporating sustainability as an integral part of their activities. The significance of these funds should not be underestimated. The second-pillar pension system constitutes what is probably the most influential group of asset owners in the Swiss financial market. Moreover, these investors invest occupational pension assets globally in the interest of the beneficiaries and thus exert an important influence on the environment and society far beyond our national borders.

An important part of today’s Swiss financial system is the second-pillar pension system, representing around CHF 910 billion under management¹, or 133%² of Swiss gross domestic product. This makes the second-pillar pension system and its representatives a very influential investor group. By consciously allocating assets to sustainable technologies and activities, the second-pillar pension system, together with the entire finance industry, has the potential to shape markets and economies in a climate friendly and sustainable way.

Looking beyond Switzerland, a remarkable dynamic is discernible today: the European Commission, for example, is working purposefully to establish a financial system that promotes sustainable growth. Sustainability is already being incorporated into European legislation. With the introduction of the EU’s IORP II Directive as well as CSR reporting obligations, consideration of sustainability factors in the areas of reporting and risk management is becoming increasingly important, especially for pension schemes in the EU. In this country, we are not yet that far evolved with respect to the second-pillar pension system. Nonetheless, the importance of sustainability is also growing in Switzerland, as the current study clearly shows.

At WWF Switzerland, we expect pension funds to systematically take all relevant factors into account in the fiduciary management of occupational pension assets, including economic, environmental, and social factors. As shareholders and investors, pension funds represent the overall interests of their beneficiaries. With foresight, Swiss pension funds can serve their beneficiaries even in a rapidly changing environment: as stable partners in all phases of professional life and into retirement.

For a sustainable development of the second-pillar pension system, it is crucial that pension funds anchor consideration of sustainability risks and opportunities in the pension funds’ guidelines. This is the only way to ensure comprehensive fiduciary risk management and to exploit future opportunities for the benefit of society and the environment.

Swiss Pension Funds and responsible investment

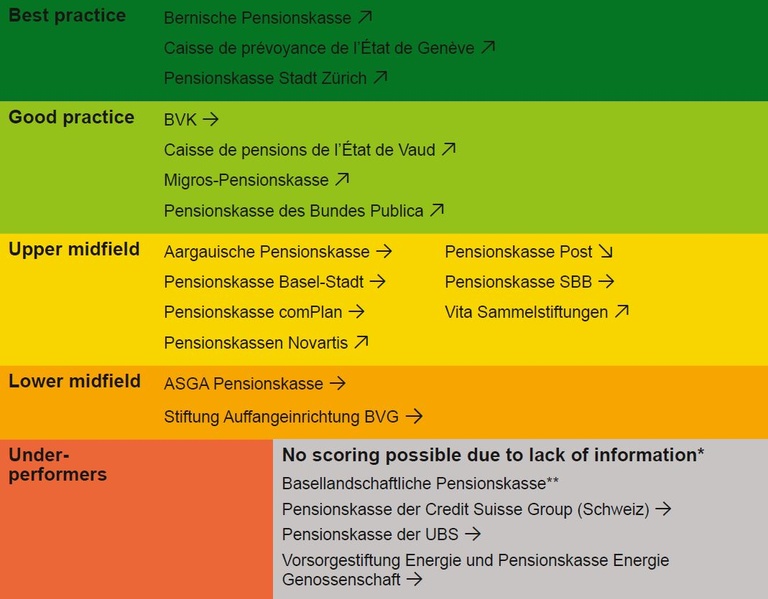

Classification of pension funds based on the WWF Pension Funds Rating assessment categories and changes compared to the WWF Pension Funds Rating 2015/2016

Source: WWF / Inrate 2018

The direction of the arrows shows whether the pension fund assessment has improved (⇑), whether it remained the same (⇒) or whether it worsened (⇓) compared to the WWF Pension Funds Rating 2015/2016. The rating methodology considers the fact that on average the pension funds are constantly improving and therefore the standards for the assessment categories must be adjusted on an ongoing basis. A worsening (arrow facing down) may therefore be attributed to a worsening of the pension funds themselves or to a “stricter” rating methodology. More detailed information on the rating methodology can be found in Chapter 3 of the comprehensive study (Rating Focus and Methodology).

* Pension funds in the assessment category “No scoring possible due to lack of information” did not participate in the rating survey and as a result the questionnaire remained unanswered. Their performance was assessed exclusively based on publicly available information, which consequently also may be incomplete. The fact that no publicly available information was found or that the pension funds concerned did not participate in the survey had a negative impact on the assessment (in particular the series of questions under II regarding responsible investment activities). It must be noted here that a below-average score does not necessarily mean that the pension fund in question is not undertaking any

responsible investment activities.

** No comparison with WWF Pension Funds Rating 2015/2016 is possible as at the time the Basellandschaftliche Pensionskasse had not yet been assessed.

Background and objective

The WWF Pension Funds Rating was carried out for the first time in 2015/2016 as a way of initiating a regular dialogue with the participating pension funds and their stakeholder groups. It is on this basis that the WWF Pension Funds Rating 2018/2019 has been carried out for the second time. The rating analyses and assesses the 20 largest pension funds in Switzerland (based on assets under management at the end of 2016). ³

The objective of WWF Switzerland is to encourage and promote dialogue with respect to responsible investment of the second-pillar pension system on a permanent basis. Furthermore, the rating provides a market overview and orientation aid for Swiss pension funds and their service providers. It is a practical compendium that offers an impartial assessment of the current state of responsible investment in occupational pension plans, the urgent need for action and best practices. Last but not least, the rating also contains clear recommendations for pension funds.

Overall results

The WWF Pension Funds Rating 2015/2016 revealed that most of the 20 pension funds are interested in the sustainability aspects of their investments. However, it appears to be the case that still only a few pursue a comprehensive approach to sustainability that integrates environmental, social, and governance- related aspects in their investment processes in a relatively systematic manner.

4 pension funds chose not to participate actively and were assessed solely on the basis of publicly available information. Due to the lack of information, no overall assessment was possible for these pension funds. Transparency is, however, of paramount importance. On the one hand, a thorough inventory is a necessary prerequisite for exercising fiduciary due diligence and for making successive and targeted improvements in this regard.⁴ This is because the management of sustainability-related opportunities and risks is already potentially economically significant today and will be even more so in future.⁵ On the other hand, it is also important to disclose one’s own sustainability-related policies and practices to external stakeholders and the critical public.

In this respect, most of the 20 largest Swiss pension funds are still relatively far from proactively contributing to the shift towards a sustainable society in line with the vision of WWF Switzerland for the second-pillar pension system (see Chapter 1.3 of the comprehensive study). Even the pension funds classed as “Best practice” require further action, especially in regard to measuring the sustainability impact of their investments as well as the systematic integration of sustainability factors, with the objective of improving these impacts.

Comparison with the WWF Pension Funds Rating 2015/2016

Progress has been made in many areas compared to the WWF Pension Funds Rating 2015/2016. Individual pension funds did have to be downgraded on various rating issues, and 1 pension fund was even downgraded a full rating category lower in the overall assessment. Nevertheless, a positive development is noticeable overall, although in view of the urgent and in some cases time-critical sustainability issues, for example climate protection, it has not yet gained sufficient momentum.⁶

Citations

1 Willis Tower Watson – Global Pension Assets Study 2018.

2 Willis Tower Watson – Global Pension Assets Study 2018.

3 Investment and Pensions Europe (IPE) (2017) Switzerland.

4 The fact that 4 pension funds did not actively participate in the WWF Pension Funds Rating and have published little information on responsible investment does not necessarily mean that these institutions do not carry out internal inventories

or take appropriate measures. Nonetheless, companies in general and pension providers in particular have a general interest in communicating such activities, where these exist, to the public, in keeping with the motto “Do good and talk

about it”. However, there may still be reasons to deviate from this in specific cases.

5 For climate-related risks and opportunities, see e.g. the final report of the 2017 Task Force on Climate-Related Financial Disclosures (TCFD), URL: https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Report-062817.pdf. Examples

include climate-related transition risks, such as stranded fossil fuel costs and market opportunities for renewable energies.

6 The latest report of the Intergovernmental Panel on Climate Change (IPCC) re-emphasizes the urgent need for effective climate measures, IPCC 2018: Global Warming of 1.5°C, URL: http://report.ipcc.ch/sr15/pdf/sr15_ts.pdf.

|

About WWF WWF Switzerland is the largest environmental organisation in Switzerland and is organised as a charitable foundation. It belongs |