Topic of the month October 2012: ESG Integration across Asset Classes - Fixed Income

ESG Integration across Assset Classes

Fixed Income Investments - A new Approach

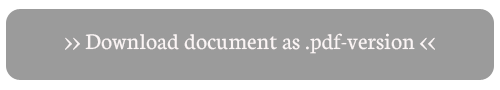

The world of investment is changing: asset owners and managers are becoming increasingly aware of the potential risk and value impact of environmental, social, and governance (ESG) factors, and their potential effect on an investment profile.

A common motivation for integrating ESG into the investment process is to actively manage key factors that are believed to be important drivers of risk and returns. In this context, ESG factors can be used to select better‐managed companies that can mitigate risks and exploit opportunities stemming from the key environmental and social issues.

Today’s financial markets have difficulty incorporating low frequency but high impact risks in financial valuations. Because traditional financial analysis tends to focus on short‐term earnings and operates within short‐term benchmarks, it may be difficult to reconcile with key ESG issues that are aimed at uncovering risks in the medium to long term.

Some asset owners have started to embrace the concept of ‘Universal Ownership’*, where they see the long-term exposure to the whole economy through their portfolio as requiring specific investment actions. Mitigating risks due to exposure to ESG factors and dealing with externalities in order to produce higher sustainable long-term returns has become an integrated part of the portfolio management process for many investors/asset owners.

In addition to the fiduciary dimension of ESG, many investors have a desire to reflect their values in their investment portfolios. These values could be based on religious views, international norms, institutional codes of conduct, legislative requirements, perception of controversial business activities and political pressure.

Another broadly accepted form of values investing refers to the management of reputational risk, for example, respect for human rights, international norms or conventions such as the UN Global Compact and the International Labor Organization Conventions, or avoidance of sin stocks.

Overall, the definition of best practice in ESG integration is evolving very quickly. A few years ago, being a UN PRI signatory was considered as advanced; it is now seen as a requirement for asset managers and, instead, the current focus is shifting to measuring better the effectiveness of ESG risk factors.

However, to ensure effective risk management, it is important that institutional investors understand the sources of ESG risks and have an overall appreciation of these risks at the portfolio level. A simple, yet effective, approach to ESG risk measurement can be built using the notion of risk exposure. For this, investors may require a portfolio analytic framework that could provide an overall attribution of the portfolio’s ESG exposures and risk management performance on key ESG issues. In measuring and attributing ESG risk, it is also important to have relevant benchmarks as a reference.

Fixed Income and ESG Ratings and Analysis

ESG integration in equity has led the way so far - but it is now crucial for investors to be able to incorporate environment, social and governance signals into other asset classes - and foremost in fixed income investments. Fixed income is of major importance for most investors, especially long term investors like asset owners for which fixed income represents a large share of their portfolios.

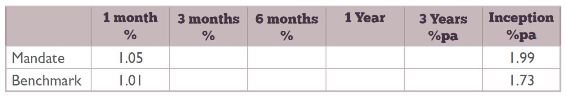

However, assessing the relevance of ESG contribution to default financial risk of an issuer is still a challenge. Despite a few ventures to cover parts of a fixed income portfolio from an ESG perspective, mainly by sovereign and supranationals, reaching a comprehensive coverage of that diversified universe has also been a challenge up to now, making it difficult for investors to expand into that asset class.

Local Government Super and their asset manager Omega Global Investors in Australia are leading the way in integrating ESG into fixed income analysis. They have constructed a government bond portfolio, based on MSCI ESG Sovereign Ratings and with an emphasis on ESG ‘mega or macro themes’ such as climate change, resource scarcity, human capital, population demographics and financial market instability.

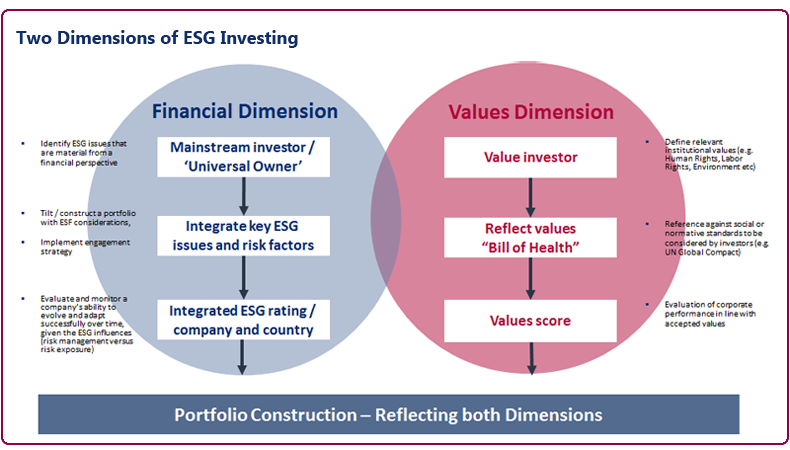

MSCI ESG Research’s sovereign risk analysis, which identifies a country’s exposure to and management of ESG risk factors, has helped to LGS / Omega to identify countries with lower debt levels; better regulations; less corruption; better key environmental and social indicators and greater resilience and with capacity to deal with current and future mega ESG challenges. The integration of ESG factors into fixed income analysis has helped LGS / Omega to meet their risk/return expectations, outperforming the benchmark since inception.**

Investment Performance (March – May 2012)

MSCI ESG Research – ESG Fixed Income Solutions

MSCI ESG Research has developed a full suite of ESG Fixed Income research and analysis solutions to identify ESG-driven investment risks that may not be captured by conventional analyses.

MSCI ESG Research is the first in the industry to provide a fully integrated set of ESG research and analysis tools covering the most common fixed income issuer types, including corporates, sovereigns, supranationals, agencies, and covered bonds. Coverage includes more than 9,000 issuers linked to 260,000 individual securities, and over 90% of the market value of the Barclays Global Aggregate Bond Index.

MSCI ESG Research’s ESG fixed income solutions help investors in multiple ways:

- to identify ‘long-tail’ event risks, systemic risks, and potential liabilities by taking advantage of the built-in MSCI ESG Sovereign Ratings model and the MSCI ESG IVA corporate ratings model;

- to monitor investments for ESG controversies and violations of global norms and conventions by using MSCI ESG Impact Monitor product functionalities aimed at investors sensitive to reputational risks;

- to screen fixed income portfolios for religious, ethical, or environmental or social criteria by using MSCI ESG Business Involvement Screening Research;

- and to create ESG index-linked investment products and benchmark the financial and ESG performance of fixed income portfolios.

MSCI ESG Research’s new fixed income offering includes ratings, scores, profiles and reports, available via monthly data feed and BarraOne. MSCI ESG Research is also partnering with Barclays to create a family of ESG Fixed Income Indices.

* Source: Integrating ESG into the Investment Process, Remy Briand, Roger Urwin and Chin Ping Chia, August 2011, p. 3

** Source: Global Sustainable Government Bonds, Investment Paper by LGS, 31st of May 2012

| Author: Martina Macpherson VP, MSCI ESG Research and PhD Candidate, University of St Andrews, RBF Martina.Macpherson@msci.com |

-----------------------

Free Trial & Further Information

yourSRI does offer a free trial access to its database, no obligations and no fine print - please register here and join now.

If you are interested in further information, please contact us.