Topic of the month October 2018: Water in emerging markets – from challenges flow opportunities

Global water supplies have been stressed to alarming levels, with emerging markets – counted on as the world’s key growth engines – hit hardest by the global water crisis. Innovative water solutions spur a wealth of new investment opportunities across these markets, with water’s impact across multiple SDGs making it an ideal investment theme for investors seeking to maximize the sustainability impact of their investments.

by Dieter Küffer, CFA, Senior Portfolio Manager for the RobecoSAM Sustainable Water strategy, RobecoSAM, Zurich

Water is a finite and irreplaceable resource that is fundamental to socio-economic development and growth, healthy ecosystems and human well-being. It is only renewable when well managed. Challenges like population growth, rapid urbanization and rising living standards as well as climate change, pollution and crumbling infrastructure are putting pressure on global water resources, threatening human health, local development and global economic growth. Coupled with several decades of underinvestment in water infrastructure, these trends have created an urgent need for more investment in water technologies that make the best use of limited water resources – a trend that investors can support and tap at the same time.

Emerging markets at the forefront

Water technologies are a global growth market, but a precarious combination of factors has placed the world’s less developed regions at the epicenter of the water crisis. As a result, the two megacountries China and India may be the most prominent emerging economies that are grappling with deepening and unresolved water challenges – but certainly not the only ones.

As water levels reach distressingly low levels, nearly half of the global population is expected to live in areas marked by severe water stress by 20301, with BRICS countries accounting for roughly 60 percent of these people2. The world’s less developed regions are also disproportionately impacted by natural disasters associated with climate change, 90 percent of which are related to water3. Critically, developing countries generally lack the infrastructure to buffer the devastating impact of more frequent floods and droughts on public health and regional economies.

The water challenge facing developing countries is rendered even more acute by the fact that these economies are typically dominated by water-intensive agricultural activities, with many local farms ill-equipped, inefficient and excessively polluting. The fact that most agricultural irrigation uses raw wastewater complicates global water scarcity and water pollution issues. In its 2017 Water Development Report, the UN noted that 80 percent of wastewater released to the environment is not adequately treated – a highly contaminating problem for both local groundwater and global waterways as populations, food production and industrial expansion increase.

A joint investment and innovation effort

Emerging countries on every continent are rising to the challenge and have embarked on massive infrastructure programs to ensure sufficient freshwater supplies and support the growth of their manufacturing and industrial sectors. China, for example, plans to spend 0.75 percent of its GDP on water treatment under its 13th Five Year Plan4.

However, given the enormous cost of building new and upgrading existing water infrastructure, the water challenge cannot be resolved by the public sector alone. It will also require serious innovation and investment from private sources. Companies from a broad swath of sectors are already spending billions on water-related projects to secure water resources, satisfy regulatory requirements and meet the demands of shareholders and other stakeholders pushing for better water stewardship and water management5. Not surprisingly, much of this investment activity is focused on emerging markets.

French food giant Danone, for example, will spend nearly USD 60 million in Sub-Saharan Africa and China to secure water for dairy and fruit products. Electronics maker AU Optronics has invested USD 1.5 billion to improve water efficiency across its production sites. And Coca-Cola will spend USD 160 million on new water plants in Cambodia and Bangladesh and pumped a total of USD 2 billion into water efficiency projects between 2003 and 2014.6,7

Refreshing solutions

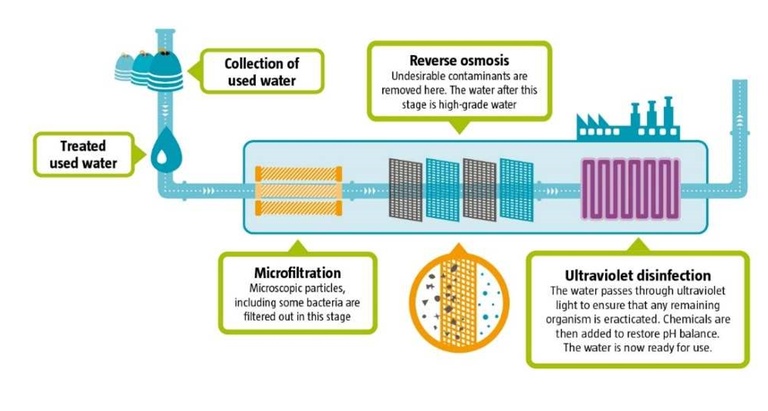

As water becomes scarcer, water treatment technologies and reuse methods offer the best and cheapest solutions for meeting demand. As a result, the markets for desalination, water recycling and reverse osmosis, micro and ultrafiltration technologies are expected to achieve annual growth rates in excess of 10 percent over the next couple of years. Countries in water-stressed regions are already proving that a little financing, ingenuity and long-term thinking can go a long way. Singapore, for example, has invested heavily in such technologies as rainwater capture, wastewater treatment and innovative water purification methods (see Graphic/infobox 1), while the Gulf States rely heavily on desalination,

complemented by other methods such as cloud seeding to produce rain. These forerunners can serve as role models for other water-stressed areas.

Water’s rippling effect across SDGs

Water plays an essential role in addressing global inequalities and challenges which the global community is tackling with the UN’s Sustainable Development Goals (SDGs). Beyond SDG 6 “Clean Water and Sanitation”, water management has a direct impact on more than half of the 17 SDGs (see Graphic/infobox 2). For example, water treatment technologies can help reduce the number of deaths and illnesses from water pollution and contamination, which is one of the specific targets of SDG 3 “Health and Well-being”. Farmers’ use of micro-drip irrigation to improve crop yields directly supports SDG 2, which aims to reduce hunger through sustainable food production.

Water investments also have positive social benefits. For example, women and children in Africa and Asia often spend up to six hours a day collecting water. Investments in better access to water for these population groups thus contribute to SDG 4 “Quality Education” and SDG 5 “Gender Equality” by freeing up children’s time to attend school and women’s time to pursue other activities that give them financial independence.

By investing in innovative water companies, investors can effectively contribute to the SDGs while tapping the long-term growth opportunities offered by the water theme. Necessity is fueling water innovation and investments across the globe, and particularly in emerging markets, creating a wealth of compelling investment opportunities for investors seeking both financial returns and a positive social and environmental impact.

Graphic/infobox 1

Singapore - a leader in waste water management techniques

Singapore is a powerhouse in water management. It is one of the most water stressed countries on the planet, but has invested heavily in water management technologies and techniques including natural rainwater capture, waste water treatment, and purification methods like microfiltration, reverse osmosis, and ultraviolet disinfection.

Source: UN Wastewater Report 2017

Graphic/infobox 2

The SDG 6, Clean water and sanitation, has a direct impact on more than half of the 17 SDGs

Water management is addressed by SDG 6: Clean water and sanitation, but water’s essential role in supporting healthy populations, ecosystems, economic development and global growth is more far-reaching. In fact, water management has a direct impact on more than half of the 17 SDGs. Investing in water companies, not only helps safeguard clean water supplies, it’s also an effective way to optimize SDG contributions, reduce inequalities, and improve the lives of billions across multiple economic and health dimensions.

1 United Nations Environment Program, Policy Options for Decoupling Economic Growth from Water Use and Water Pollution, March 2016, https://www.unenvironment.org/news-and-stories/press-release/half-world-face-severe-water-stress-2030-unless-water-use-decoupled

2 Fidelity International Research Brief, Water: Structural demand growth creates investing opportunities, https://www.fidelityinternational.com/middle-east/news-insight/21-century-themes/water.page

3 United Nations World Water Development Report 2017, Wastewater: The Untapped Resource

4 China’s 13th Five Year Plan: What Role Will Wastewater Play?, Water World, http://www.waterworld.com/articles/wwi/print/volume-32/issue-7/technology-case-studies/china-s-13th-five-year-plan-what-role-will-wastewater-play.html

5 Big Companies invest billions to secure water supplies, Financial Times, November 6, 2017

6 BBC, Future Now Project, Is the World Running Out of Fresh Water?, April 12, 2017

7 Harvard Business Review, September 9, 2015, Coca-Cola met its water goals early. Were they too easy?, https://hbr.org/2015/09/coca-cola-met-its-water-goals-earlywere-they-too-easy

Important legal information: The details given on these pages do not constitute an offer. They are given for information purposes only. No liability is assumed for the correctness and accuracy of the details given. References to specific secu-rities are presented to illustrate our investment philosophy and are not be considered investment recommendations. The securities identified and described may or may not be purchased, sold, or recommended for advisory clients. It should not be assumed that an investment in these securities was or will be profitable. © 2018 RobecoSAM AG

|

About RobecoSAM Founded in 1995, RobecoSAM is an investment specialist focused exclusively on Sustainability Investing. It offers asset management, indices, impact analysis and investment, sustainability assessments, and benchmarking services. Together with S&P Dow Jones Indices, RobecoSAM publishes the globally recognized Dow Jones Sustainability Indices (DJSI) as well as the S&P ESG Factor Weighted Index Series, the first index family to treat ESG as a standalone performance factor using the RobecoSAM Smart ESG methodology. As of June 30, 2018, RobecoSAM had client assets under management, advice and/or license of approximately USD 21.5 billion. For more information visit: www.robecosam.com/en/professionals/strategies-services/funds |