Topic of the month October 2015: VW Scandal and ESG

Scandal over diesel car emissions records to result in large-scale recalls, regulatory fines and management shuffle. On September 18th, German car manufacturer Volkswagen (VLKAY) came under fire for allegedly underreporting car emissions in the U.S. Internal investigations point to potential discrepancies in emissions for 11 million vehicles sold worldwide.

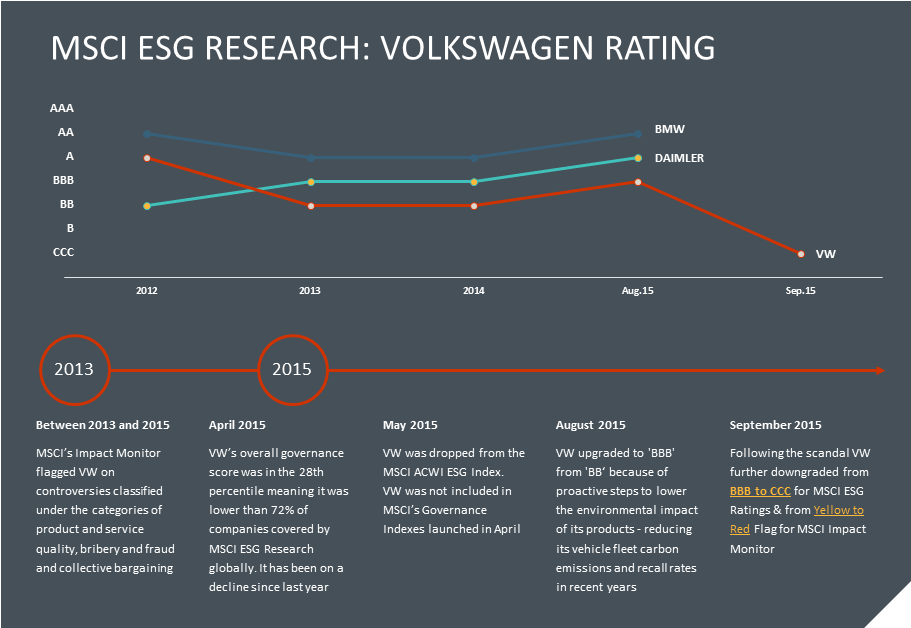

MSCI ESG Research View

On September 18th, German car manufacturer Volkswagen (VLKAY) came under fire for allegedly underreporting car emissions in the U.S. Internal investigations point to potential discrepancies in emissions for 11 million vehicles sold worldwide. On September 23rd, CEO Martin Winterkom stepped down. We are currently monitoring further developments and are reviewing the ESG Rating of Volkswagen.

Overall, we highlight the following developments in connection to the current controversy.

Corporate Governance

Winterkom’s resignation announcement noted that further personnel changes are anticipated. Two members of the Management Board have responsibilities in the passenger car divisions: CEO of the Volkswagen Passenger Cars brand Herbert Diess and CEO of Audi Rudolph Stadler. Much will depend on the views of key shareholders Porsche, Saxony and Qatar.

Based on the approach taken at previous scandals in Germany it is possible the vote to discharge the Management Board at next year’s AGM will be:

•Voted upon individually rather than the typical collective vote; and

•Certain individuals (possibly including Diess and Stadler) may not be proposed for discharge, or their discharge may be postponed pending the findings of the various investigations.

Given the level of shareholdings held by Porsche, Saxony and Qatar — 50.73%, 20% and 17%, respectively — their response will be crucial in the outcome.

Request for Special Audit

German shareholders may put forward a resolution at the AGM to request a special audit. This has previously happened at other companies where there have been allegations of wrongdoing, including at Deutsche Bank.

Ownership Structure of Volkswagen

The ownership and voting rights structure will have a significant bearing on the future developments at Volkswagen. The company has a dual class share structure (295,089,818 ordinary shares and 180,641,478 preferred shares), with voting rights granted only to the “ordinary” shares. In addition to ordinary shares, there are “preferred” shares that entitle the bearer to a €0.06 higher dividend than ordinary shares, but do not carry voting rights. This will likely limit institutional investors’ ability to effect change through voting.

Product Stewardship and Reputation

These developments may also pose the following risks:

• The controversy will likely affect future sales of diesel power vehicles in the U.S. and potentially other regions. In the U.S., market penetration of diesels is low and this case will presumably be a setback for diesel advancement for Volkswagen. After EPA’s announcement, Volkswagen halted sales of affected models.

• This controversy is associated with reputational risks, especially in the U.S. where Volkswagen has a low market share of less than 2%. Thus, these issues make it difficult to expand its position in the U.S., potentially putting its global growth strategy at risk.

• The controversy may also pose legal risks, including criminal investigations in the U.S. and investigations in other regions, such as the EU.

• In addition, there are possible class action suits, not just in the U.S., which may have significant negative financial impacts on the company.

Volkswagen’s violation of the U.S. Clean Air Act raises serious questions about the company’s product management practices. The company will carry recall costs related to 482,000 models, and as disclosures of the internal investigation suggest, up to 11 million vehicles may be affected.

As an auto manufacturer, 89% of Volkswagen's revenues come from higher ESG risk business segments because autos have tended to experience more recalls incidents than business segments of peers. BYD Company Ltd., for example, which shares Volkswagen’s GICS industry classification of Automobiles, has more diversified and lower risk product offerings such as Electronic Components. We also view larger sales as an indicator of the volume of operations. These present more opportunities for defects and recalls to occur, due to the complexity of processes and the breadth of oversight required. As a result, the likelihood of recall events occurring is higher for very large companies such as Volkswagen, compared to companies such as Renault which have lower production and sales volumes.

Due to Volkswagen’s high level of production compared to peers such as Daimler, Peugeot, or Renault, we would be looking for more robust systems and processes to offset that higher exposure. Our research found that:

•Volkswagen consistently had a higher warranties expense figure as a percentage of sales than the industry average over the 3-year period between 2011 and 2014 (average of 3.5% of sales vs. industry average of 1.2% for the 2011-2014 period), indicating a higher level of repairs costs.

• As of the most recent rating review in August 2015, Volkswagen also had modest policies and programs in place to manage product stewardship. For example, contrary to best practice, not all of its owned facilities were certified to widely accepted standards, such as ISO9001 or industry equivalent standards which we consider to be best practice. This contrasts with peer company Renault SA, which has implemented internal quality assurance systems across all its production sites, such as the Alliance Vehicle Evaluation System (AVES), Alliance New Product Quality Procedure (ANPQP), Alliance Supplier Evaluation System (ASES) and the definition of the parts per million (PPM) targets for parts manufactured outside the Group, all of which are all based on ISO/TS 16949 (considered best practice).

Conclusion

While the automotive industry is reeling from the catastrophic fallout of the VW scandal, it’s possible that over the long-term, this will have a bigger impact on the world of investing. Beyond the deceitful schemes aimed at defeating regulators, this scandal has exposed the fact that traditional valuation models such as discounted cash flow may not capture the full range of risks companies face today. The value of assessing companies with alternative data sets that put companies in a broader context can flag risks traditional analytical tools aren't designed to catch.

For more information, please contactesgclientservice@msci.com

Author: |

For more than 40 years, MSCI’s research-based indexes and analytics have helped the world’s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative research. Our line of products and services includes indexes, analytical models, data, real estate benchmarks and ESG research. MSCI serves 97 of the top 100 largest asset managers, based upon P&I data as of December 2014 and MSCI client data as of June 2015. For more information, visit us at www.msci.comor email esgclientservice@msci.com. |