Topic of the month July/August 2014: Sustainable Real Estate Investments through the Eyes of International Investors

Sustainable Real Estate Investments through the Eyes of International Investors

Trend towards Sustainable Investment Opportunities Continues

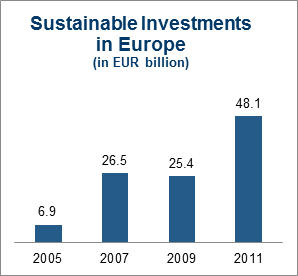

The demand for sustainable investments has been growing sharply amongst both private and institutional investors over the past decade. Sustainable investments in Europe totaled almost EUR 7 billion in 2005, while they amounted to more than EUR 48 billion in 2011.1 This development towards greater sustainability and corporate responsibility in investment decisions is frequently seen as a reaction to the mistakes and resulting turmoil of the financial crisis over recent years. Sustainable investments are the trend in the 21st century.

Source: Eurosif 2012

Increasing Importance of Sustainable Real Estate Investments

Sustainable investment opportunities are generally assessed with the help of environmental, social and governance criteria (ESG). These systematically influence investors' analysis and decision-making processes. The criteria are based on international guidelines including the OECD guidelines or the United Nations' "Global Compact" and "Principles for Responsible Investment" initiatives that provide a framework in terms of transparency, environmental protection, working conditions and sustainable corporate governance. Mostly institutional investors, committed to a sustainable investment strategy, are guided by these criteria in their investment decisions.

Sustainable real estate investments play an increasingly prominent role here. Their importance for globally sustainable development cannot be overstated. Buildings are responsible for around 35 percent of global primary energy consumption and for about one third of total greenhouse gas emissions 2. Thus, taking all economic aspects into account, the greatest potential for savings lies in the real estate area, which is of great significance at times of global climate protection goals and national energy strategies. In order to meet global climate protection goals, the volume of investment needed in the energy efficiency of buildings is estimated to be around USD 300 billion annually. In addition, it is expected that the investment potential will have a positive effect on the economy and employment. 3

If the growth potential of so-called green buildings is taken into account, the increasing interest of investors, tenants, users and other stakeholders becomes clear. This is because green buildings are not just about energy efficiency and CO2 reductions, but also about reducing water consumption and waste production, as well as improved conditions in terms of indoor climate, daylight, and space.

Increasing Transparency and Comparability of Real Estate Investments

For many investors, transparency is vital to ensure that different real estate investment opportunities can be compared against each other. Particularly as regards sustainability, there are big differences in the various regional real estate markets. The Jones Lang LaSalle Sustainability Transparency Index offers guidance in the selection of suitable markets. Countries with a high score in the index regularly demonstrate the highest transaction rates in real estate investments, which is attractive for investors.

For greater transparency and comparability of real estate as an asset class, numerous building labels and certification systems have spread worldwide. The international labels LEED 4 and Energy Star (US), BREEAM 5(UK), DGNB (Germany) and Minergie® in Switzerland are the most widely recognized labels. Building certifications, which originally emerged through national initiatives, are increasingly developing into international standards and are a prerequisite for many tenants (e.g. in the LEED Gold certified Prime Tower in Zurich) and investors. However, the focus of each of the building labels can vary considerably. While some labels give comprehensive consideration to economic, ecological and even social aspects in the certification process, others restrict themselves solely to energy-related aspects.

Credit Suisse Real Estate Asset Management adheres to the internationally established label standards in order to meet the needs of investors, tenants and other stakeholders. In 2009, with the "greenproperty" label, Credit Suisse launched its own quality seal for Switzerland as there was previously no comprehensive certification system in Switzerland. With 86 sustainability indicators, a holistic approach is adopted and the certification is periodically verified by independent surveyors. At present, properties with a total area of over 800,000 m2 are greenproperty-certified in the Credit Suisse portfolio or are in the process of being certified.

Internationally, however, the trend towards building certification has led to a confusing array of labels, which tends to perplex market players. There are frequently double and multiple certifications which makes it difficult to compare properties objectively and results in additional costs. Real estate experts expect that internationally unified standards will gain acceptance in the future, or rather that there will be a process of harmonization in the certification jungle. It is also expected that greater attention will be paid to measurable criteria both in operating buildings and managing their entire life cycle.

Stricter Requirements in Reporting Standards and Benchmarking

With rising demand for sustainable real estate investments, investors' requirements for comprehensive sustainability reporting are also increasing. In their investment decisions, investors increasingly pay attention to adherence to reporting standards, such as the Global Reporting Initiative (GRI) or recommendations from the European Public Real Estate Association (EPRA). These standards are based on harmonized performance indicators (so-called KPIs – Key Performance Indicators) so that it is possible to make systematically measurable statements about the quality and sustainability of buildings. The indicators measure important sustainability criteria of buildings, such as energy consumption, CO2 emissions, water consumption and waste production. For active portfolio management, these indicators are an important basis and necessary prerequisite for internal and external analyses. Thus, buildings are comparable internationally and are less dependent on national circumstances or different approaches to assessment.

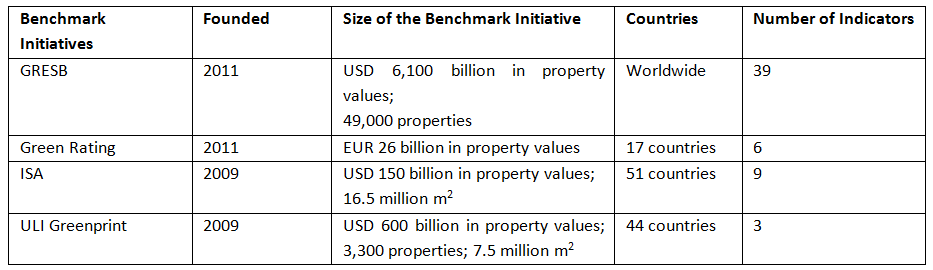

The increasing systematization and use of indicators form the basis of benchmark initiatives that assess the performance of real estate investment companies and funds.. In this respect, benchmark initiatives (cf. table) make a significant contribution to increasing market transparency. Thus, benchmark initiatives are not only useful for many investors, but are also an important instrument for real estate investment companies. In recent years, increasing numbers of real estate investment companies and funds have taken part in benchmark initiatives in order to check their sustainability performance and competitiveness. One of the biggest benchmark initiatives is the Global Real Estate Sustainability Benchmark (GRESB). Globally, more than 500 of the biggest real estate investment companies, with over 49,000 properties and 6.1 trillion in assets, participate in the GRESB's benchmark initiative. Credit Suisse Real Estate Asset Management has been a member of the GRESB since 2013. With its sustainable real estate fund, Credit Suisse is one of the leaders in the GRESB peer group and achieves above average results. 6 In addition to comparison opportunities, steps can be defined to optimize the entire portfolio.

Sustainability as an Integral Part of Active Portfolio Management

Instead of focusing exclusively on sustainable investment solutions, many institutional investors expect sustainability to be an integral part of active portfolio management and not only to be reflected in a list of different certified buildings. This may also explain why an actual market for sustainable real estate investments has not been established. Apart from sustainability indicators, the focus remains on returns, a successful track record and an experienced management team. Nevertheless, real estate managers must increasingly and with greater transparency show investors how they integrate sustainability indicators into their investment strategies and processes. In this regard, a contribution to sustainable development can be ensured.

Issuers of sustainable investment solutions are facing increasing demand. However, in the case of sustainable real estate investments the offering is still quite limited. This is despite the fact that, in recent years, many international companies have been paying attention to high ecological standards in property rentals.

Annex, additional information:

Source: Credit Suisse, 2014

Copyright by Harry Gugger Studio; Building labels continue to be an important part of a sustainable real estate strategy: A real estate fund of Credit Suisse was granted building permission for the planned, 31-story office block "The Exchange" in Vancouver. The renovation of the old stock exchange is the first project in Canada to involve the conversion of a listed building with LEED Platinum certification. Once it is completed, it will meet the highest standards for sustainable building design defined by the Canada Green Building Council. The building's energy requirements will be half those of a traditional office building of comparable size, and the running costs for tenants will be lower. Vancouver's first stock exchange was built in 1928-29 and the conversion of this listed building was designed by a team of architects led by the Swiss Harry Gugger. The building's facade and entrance hall will be preserved and the original trading floor will be rebuilt using archived plans. Further information about the project can be found at: www.theexchangebuilding.ca

The Decarbonization of Switzerland's Real Estate Sector - The goal of the study is to determine what action banks can take regarding investments in reducing CO2. Significant influence can be exercised over decarbonization via real estate investments. This report analyzes the CO2 reduction potential in the real estate sector using the specific example of Credit Suisse's Real Estate Asset Management. See Case Study by Credit Suisse in Cooperation with WWF. See Case Study by Credit Suisse in Cooperation with WWF.

Footnote and References:

- 1 Eurosif 2012

- 2International Energy Agency (2013), Transition to Sustainable Buildings: Strategies and Opportunities to 2050, OECD/IEA, Paris

- 3European Commission (2014), Energy Economic Developments in Europe

- 4Leadership in Energy and Environmental Design

- 5BRE Environmental Assessment Method

- 6 Historical performance indications and financial market scenarios are not reliable indicators of current or future performance. Source: GRESB, 2013

|

Notice and Disclaimer

This material has been prepared for information purposes only and is subject to change. It should not be interpreted as investment advice or any recommendation to buy or sell a particular security. The value of investments, and the income from them, may go down as well as up. You may not recover what you invest. Past performance is not a reliable indicator of future results.

These materials do not constitute any form of marketing material, an offer to sell or a solicitation of an offer to buy securities. Any funds or other investment vehicles managed by Credit Suisse Real Estate Asset Management are not offered to U.S. persons nor does Credit Suisse Real Estate Asset Management offer its investment advisory services generally to U.S. persons.