Topic of the month December 2020: ESG: Being part of a paradigm shift

GAM Investments’ Amy Kam believes we are living through a paradigm shift when it comes to capital markets

and the enabling of ESG factors.

This article first appeared in The Asset.

The Great Smog of December 1952 was brought about by high-pressure weather systems and industrial pollution, mostly arising from the use of coal. It attacked the respiratory system of Londoners over a five-day period, making over 100,000 people ill and causing the death of over 12,000. The event precipitated a change in public attitude towards air quality and galvanised the government to enact new regulations to tackle the problem. Importantly, the UK had the political will, resources and technology to accomplish the task at hand. The world today is increasingly beset by similar events – searing heat waves, uncontrollable wildfires, prolonged droughts, destructive hurricanes and severe flooding, not to mention the current Covid-19 pandemic – all leaving misery in their path and all becoming part of a new normal.

Barriers

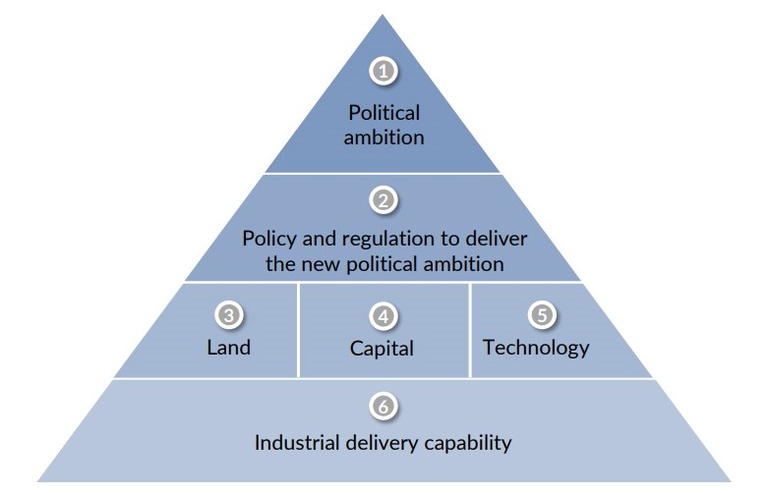

Efforts are being made to understand and combat this climate change trend. In a recent paper, UBS explored the six key enablers of energy transition1. Crucially, as with most things, it all starts at the top. The primary enabler is political ambition or a will to successfully combat climate change. As was the case in London in the 1950s, it must be accompanied by the correct policy and regulatory frameworks, the necessary resources (including capital and technology) and the capacity to do just that on an industrial and – in our case today – global scale.

Figure 1: The six enablers for future energy transition (net zero)

Source: Aurora Energy Research. Note: Consumer behaviour is not included in this framework of enablers for

net zero. For illustrative purposes only.

Most or all of these enablers are available to us today, but, as we all know, there are a lot of moving parts and obstacles to overcome in order to progress. Not least of these obstacles are the barriers put up and defended by those in some legacy industries (with much to lose in the short term), along with man-made climate change deniers. Perhaps those that lead must step up to the plate and the reduction of human-induced climate change should become a clear unifying global objective. Most countries, according to a National Geographic 2019 article, are not on track to hit their 2030 Paris agreement climate goals or are not prepared for the “untold human suffering” that this failure will cause. The more top-down or interventionist political systems may be a more fertile ground than other political systems for tackling the global issue of trying to limit the impact of climate change. If we believe that man-made climate change is an existential threat, then surely the main purpose of our governments should be to combat this. The conditions in the more liberalised economies, with arguably shorter-term thinking due to the frequency of elections and powerful lobbying groups, may lead to a propensity to dilute the efforts aimed at combatting climate change. We now need swift and bold action before it is too late.

It is also worth noting that in response to the pandemic, countries where trust in government and science, and in each other has been weakened, have performed most poorly in economic terms2. Interestingly, while many might see natural tensions between the public and private sectors of the economies, state and free-market systems, and east and west ideologies, a degree of convergence has come about. This is a positive development for the implementation of environmental, social and governance (ESG) goals. China is moving from greater state control to a more liberalised economy, while western economies look to regulation to protect the environment. The US is an important exception to this trend, although this may change given the results of the US election, which may eventually provide a clearer picture of when oil demand will peak (if it has not already done so) and where capex will go. My hope is that we are now in a stream of such irresistible change – brought about by Covid-19, which has fostered a rejuvenated focus on personal health and the health of our planet – and that we are living through a paradigm shift when it comes to capital markets and the enabling of ESG factors.

Figure 2: Analysis of the forces for change for ESG in Asia

Source: GAM. For illustrative purposes only.

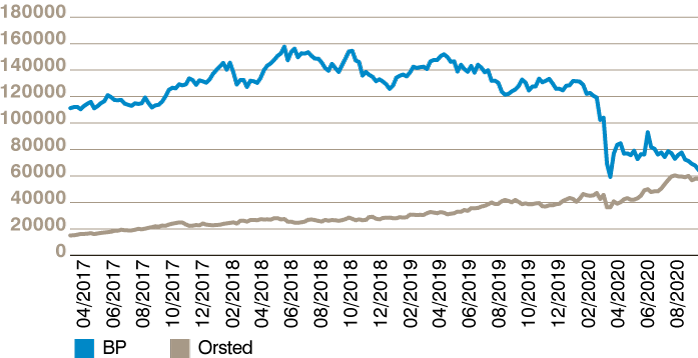

The Covid-19 pandemic further solidified my view on the relationship between human beings and climate change, and we have seen some remarkable phenomena, such as the massive convergence of market capitalisation between oil giant BP and a Danish renewable energy company (Orsted). Are we seeing the slow death of big oil? Has oil demand already peaked, or is it peaking sooner rather than later?

Chart 1: Orsted’s valuation versus BP (USD, millions)

Source: Bloomberg. Past performance is not an indicator of future performance and current or future trends. For illustrative purposes only.

Asia opportunity

As a sustainability-minded individual, I see immense market opportunity. Aside from the breath-taking pace of growth, the Asian hard-currency credit market offers attractive relative value, low correlation and diversification, sound corporate fundamentals, favourable demographics and low-volatility. Crucially, Asia provides ideal conditions for the take-off of the digital revolution, in which technology can change how energy is generated and how infrastructure can be built with much reduced reliance on capital and labour. We have already seen how North Asia has benefitted from its large share of the global consumer electronics supply chain and are now seeing how China’s political will has translated into dominance in the global solar power supply chain – alongside an ambitious plan to dominate the global electric vehicle supply and an aggressive target in green building.

Investing sustainably amid the pandemic

Many decisions come with difficult debates. One challenge is considering alignment to green bond taxonomy. Is it inclusive or exclusive? The Climate Bond Initiative has a clear taxonomy to exclude fossil fuels and, hence, certain transition projects (for example, from coal-to-gas ones) are excluded from their certification programme. The Green Bond Principles (GBP), on the other hand, set out by the International Capital Market Association is more lenient, with a clear map between its GBP and the United Nations’ 17 Sustainable Development Goals.

I believe in an inclusive approach. It is more important to have a model in which everyone and every country can play a part in achieving the common goal, rather than a divided universe where climate change deniers end up owning all the fossil fuel assets. Another challenge involved with managing an Asian fixed-income credit fund is the mapping of quasi-sovereign corporates that carry a significant social mandate for their respective governments. There is no blueprint for this, even though the climate change debate has been on-going for decades. This step into the unknown has its own demands, especially when operating with a small, lean team.

In our view, some external fund reviewers do not have the capacity, methodology and data to take green bonds into account when rating bond funds. This is despite the fact that the concept of “green bond”, invented more than a decade ago by the World Bank and the European Investment Bank, is considered the most prominent innovation of the last decade and has since channelled hundreds of billions of US dollars’ worth of capital into sustainable economic activity around the world.

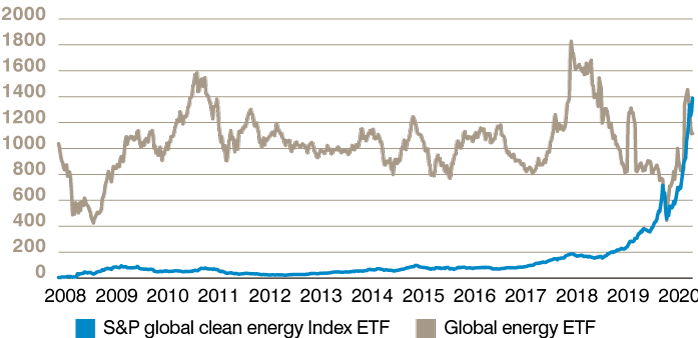

There are those that still debate the desirability and ethics of short-term returns versus ESG goals. However, Covid-19 is making this an increasingly less relevant question. If ESG factors were relevant for a five-year investment horizon, pre-Covid 19, these factors are now being brought forward. In other words, ESG considerations are increasingly more relevant and integrated in evaluating companies. One manifestation of this behavioural shift prompted by Covid-19 is the change in consumer preference towards clean energy ETFs – strong evidence that consumers are flexing their muscles, as the graph below illustrates.

Chart 2: Market cap evolution of the Global Energy ETF and S&P Global Clean Energy Index ETF

Source: Bloomberg. Data as of October 2020. Past performance is not an indicator of future performance and current or future trends.

Shifts like this allow critical mass to be reached and help resolve the chicken-or-egg dilemma, making ESG considerations more real and no longer just for disciples. Glancing out of my window, seeing today’s youth and future returning from school, I am drawn to reflect on my own life experiences. I spent my early formative years at the meeting point of rural and urban China. As a youngster, for most of the year I swam with my buddies in the clear local river. As China moved through industrialisation, the state of the river changed for the worse. Returning from university one vacation, I went to meet some old friends by the river. The next day, we all suffered from red, blotchy and itchy skin. Although this incident was more unpleasant than dangerous, it certainly made an impression.

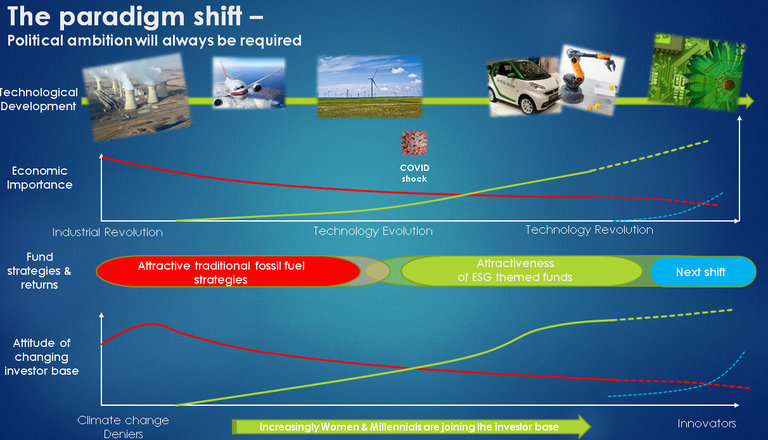

We are only stewards of where we live, borrowing it from our children. While it might be an uncomfortable trade-off, nothing, not even China’s rush to lift millions out of poverty, should irreversibly and devastatingly impact the environment on our watch. As stewards of the environment, now more than ever, we should seek to find ways of investing responsibly and sustainably. Another positive sign, cited in a recent study, is the changing demographics of the global investor base that is increasingly including more women and millennials, both of whom have been showing a greater interest in stewardship.

Figure 3: Paradigm shift – a fundamental change in approach or underlying assumptionsn

Source: GAM. For illustrative purposes only.

I am happy to report that the economic development in my hometown over the last 20 years has been phenomenal and, in this case, the river is now clean again. And, like London with the Great Smog before, we can learn from our mistakes. It is clear that we have reached the critical mass, there are enough people that recognise human-induced climate change exists. As a result, sustainable impact investing can improve returns and makes an increasingly measurable difference.

¹“The State of the Global Energy Transition 2020", Arie et all.

² Professor Joseph Stiglitz – “The Bottom Line” BBC Radio 4 – 10th October 2020.

Important legal information

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator for the current or future development. The companies listed were selected from the universe of companies covered by the portfolio managers to assist the reader in better understanding the themes presented. The companies included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice.

Author: Contact:

|

About GAM Investment Management (Switzerland) Ltd. PWe are an independent global asset management firm built by investors, for investors. We excel by focusing on truly active management of differentiated investment strategies. With our 35 + year heritage, we invest our clients’ capital using active strategies across discretionary, systematic and specialist solutions. As our industry evolves, we develop new products with global appeal and attractive returns to access new pools of client assets and to adapt to our clients’ changing needs. Collectively we manage CHF 120.4 billion1 in assets for institutions, financial advisers and private investors. Our investment professionals, who on average have more than 14 years of industry experience, manage CHF 33.9 billion in client assets. In addition to investment management, we also offer private labelling solutions, such as management company and other support services, to third parties – a business that has grown to CHF 86.5 billion¹ in assets over the past two decades. Operating in 14 countries, we are a truly global firm in scale and resources, yet small enough to remain nimble and flexible to meet clients’ needs. By focusing on superior investment returns, a differentiated product offering, global distribution strength and operating efficiency we seek to deliver sustainable growth for all stakeholders. ¹ As at 30 September 2020. |