Topic of the month April 2020: Mirabaud Asset Management, responsible investing in active management.

Topic of the month April 2020: Mirabaud Asset Management, responsible investing in active management

by Responsible Investment Department, Mirabaud Asset Management (Suisse) SA

With total holdings of over $30 trillion of assets¹, Socially Responsible Investments (SRI) have seen unprecedented growth over recent years, bringing with it a vast array of definitions and interpretations.

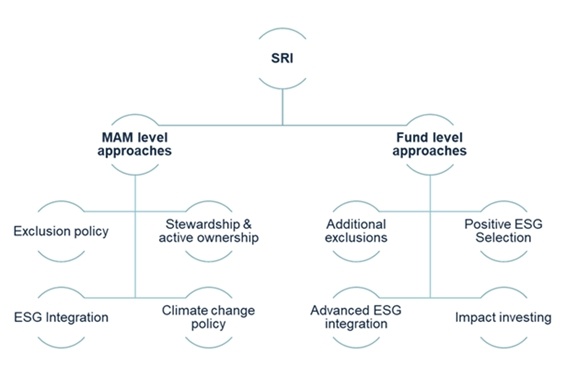

At Mirabaud Asset Management, our active management approach empowers us to take the lead and adopt a pragmatic stance to best manage our clients’ investments. Over our 200-year history, we have proven to be a sustainable business with a deep-rooted responsible philosophy and a vision to deliver long lasting value to our clients. This enables our active portfolio managers to identify and back sustainable businesses, whether it be through the robustness of their business models and cash flows or through their adoption of responsible business practices. This is of particular importance in today’s turbulent markets, where we stand by our fiduciary duty to manage clients’ assets responsibly, with the guidance of a robust SRI framework. Our active, conviction-based approach is reinforced with the integration of Environmental, Social and Governance (ESG) considerations into our investment processes. When it comes to Socially Responsible Investing, we do not apply a one-size fits all approach, but instead tailor our approach across our product offering and asset classes, given their unique investment approaches. Our strength of conviction implies we do the groundwork to confirm our views, stand by them and work together with our holding companies to drive positive change and better investment outcomes. There are two main ways we implement SRI at Mirabaud Asset Management:

First, through the development of firm-level SRI rules which are implemented across all our portfolios and asset classes. These firm-wide policies include:

- An exclusion policy, used in the context of negative screenings implemented prior to investment analysis. This sees the exclusion of all tobacco and controversial weapons issuers;

- An active ownership approach, which includes our proxy voting and engagement policies and really enables us to fulfil our role as shareholders and stewards of our clients’ assets;

- Our climate change policy, acknowledging climate change risks as a long-term threat and protecting our client’s investments accordingly;

- An ESG strategy, through which we aim to integrate ESG and risk considerations across all our investment activities.

We assess issuers from three different angles; responsibility, materiality and sustainability. Through the responsibility lens, we automatically exclude companies with severe controversies. Environmental, social or governance controversies go against our internal convictions and understanding of what a company’s responsibility to its stakeholders and the wider environment is. We also look at a company’s materiality. We seek to understand the extra-financial risks and opportunities that a company is exposed to, the potential financial impact and how these risks are being addressed. Finally, we assess a company’s sustainability. For this, we look at how its daily activities contribute to addressing global development challenges.

Having firm-wide SRI policies provides us with a strong first grounding in our responsible investment style. However, we also recognise that, although all our funds are built around the same high conviction and active style, each investment process is nevertheless unique. This leads us to our second point: We believe we can match a fund’s investment style with the right ESG implementation whilst also seeking to capture enhanced long-term risk-adjusted returns.

We combine analysis from third party data providers with our own discretion and in-house dedicated experts, selecting the most relevant and material factors to integrate into our fundamental approach.

Framework for our SRI approaches

For instance, our Global Equities funds are multi-thematic global portfolios that seek opportunities in long-term trends and sustainable growth. Some of the thematic trends have a focus on sustainability (e.g., health and wellbeing, ageing population). Whilst Mirabaud – Equities Global Focus targets companies in the earlier stages of growth and Mirabaud – Global Equity High Income targets more mature companies, both funds focus on growth-oriented, sustainable companies that have the ability to generate consistent cash flow. The positive ESG screening applied in both funds allows the investment team to identify the best performing companies with leading sustainability practices. The process is complemented with bottom-up research, which identifies best practices as well as material ESG opportunities and risks.

Mirabaud – Convertible Bonds Global also has an ESG strategy implemented both from a top-down and bottom-up perspective. As well as using an initial positive screening approach, the fund implements what we call advanced ESG integration. This implies that issuers’ ESG considerations are fully embedded into the fundamental analysis, as we believe they have the potential to mitigate risks or enhance long-term performance. The investment team applies proprietary ESG Scores to individual issuers based on their ESG performance on their most material issues. This in turn influences its eligibility and weight in the portfolio.

These ESG approaches are complemented with an in-depth understanding of portfolio companies and their ESG risks and challenges. In active management, there is flexibility to engage directly and continuously with companies, to gain an information edge and drive change on the most material financial and non-financial risks that are critical to their growth.

Ultimately, what our robust, fully integrated SRI framework enables us to do is have a clear voice on key sustainability issues and identify market leaders. Our fund managers actively allocate capital to companies with strong underlying fundamentals and sustainable business models, with the vision to deliver the best outcomes to our clients.

IMPORTANT INFORMATION

This document contains information or may incorporate by reference data concerning certain collective investment schemes ("funds") which are only available for distribution in the countries where they have been registered. This document is for the exclusive use of the individual to whom it has been given and may not be either copied or transferred to third parties. In addition, this document is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions or limitations.

The contents of this document are provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe for, retain or dispose of fund units, shares, investment products or strategies. Before investing in any fund or pursuing any strategy mentioned in this document, potential investors should consult the latest versions of the relevant legal documents such as, in relation to the funds, the Prospectus and, where applicable, the Key Investor Information Document (KIID) which describe in greater detail the specific risks. Moreover, potential investors are recommended to seek professional financial, legal and tax advice prior to making an investment decision. The sources of the information contained in this document are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed, and some figures may only be estimates. There is no guarantee that objectives and targets will be met by the portfolio manager.

This communication may only be circulated to Eligible Counterparties and Professional Investors and should not be circulated to Retail Investors for whom it is not suitable. All investment involves risks. Past performance is not indicative or a guarantee of future returns. Fund values can fall as well as rise, and investors may lose the amount of their original investment. Returns may decrease or increase as a result of currency fluctuations. This document is issued by the following entities: in the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority under firm reference number 122140.; in Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva, as Swiss representative. Swiss paying agent: Mirabaud & Cie SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS., 13, avenue Hoche, 75008 Paris. In Spain: Mirabaud Asset Management (España) S.G.I.I.C., S.A.U., Calle Fortuny, 6 - 2ª Planta, 28010 Madrid. The Prospectus, the Articles of Association, the Key Investor Information Document (KIID) as well as the annual and semi-annual reports (as the case may be), of the funds may be obtained free of charge from the above-mentioned entities.

.

|

About Mirabaud Asset Management Mirabaud Asset Management is part of a family of modern asset management boutiques that evolve with the times, taking into account the growing needs and expectations of its institutional clients as well as the regulatory environment. Offering an active management style based on conviction and a targeted range of investment solutions, Mirabaud has positioned itself as a leading player in this business sector in Switzerland and worldwide. |