Topic of the month April 2017: The fourth dimension

The fourth dimension

More and more institutional investors are convinced about the importance of sustainability for the performance of a fund. In a current study conducted by TELOS in 2016, institutional investors mentioned, which are the most important aspects for their investments. The results sit up and take notice: 48 percent mentioned „sustainability“ as „important“ or „very important“; exactly the same percentage given for „performance“. The constant growing number of signatories of the Principles for Responsible Investments (PRI) shows the willingness of investors (asset owners), investment managers and service providers to integrate sustainability in their investment decisions. Almost 1700 signatories publicly committed themselves to promote sustainability in their investments.

Fact is, sustainable investment solutions are very popular for institutional investors.

Sustainable asset management

Based on this background, asset manager extend their product range on sustainable investment solutions. These investment solutions are only successful with an integrated and holistic approach for sustainability, which consists of four modules:

• Environmental management to preserve natural resources

• Social commitment such as support of long term social and charitable projects

• Sustainable staff management supporting the employees on expert skills, personal skills and healthcare

• Sustainable asset management services

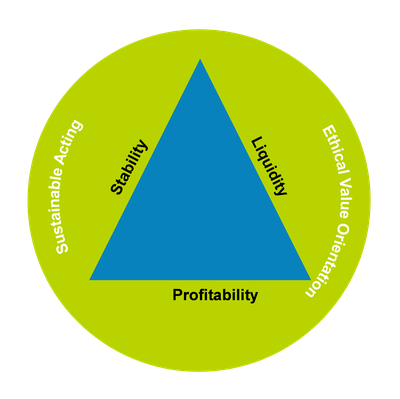

The challenge for “classic” fund management is to meet three competing objectives at the same time: stability, profitability and liquidity. Sustainable investments have to add a fourth dimension. The fourth dimension consists of environmental, social and governance aspects, which have to be integrated part of the processes for sustainable asset management- and administration-services.

Figure: Magic triangle + sustainability

How to integrate sustainability in fund solutions

What is the best possible way to integrate sustainability in fund solutions (mutual funds and AIF)? As a first step, each investor has to specify its own understanding of sustainability. Which aspects are most important and which sustainability goals have to be considered within the asset management process? Ecological, social or corporate governance aspects or a holistic approach? BayernInvest Kapitalverwaltungsgesellschaft mbH, a 100% subsidiary of BayernLB and competence centre for asset management and Master-KVG, recommends three different approaches for implementing sustainability in fund solutions:

1.) Without direct impacts on risk/return characteristics of the fund

In this case, the investor selects a sustainable benchmark, like STOXX Global ESG Leaders or STOXX Europe Christian Index to monitor the portfolio success. There are no direct impacts on the fund itself.

In this case, the investor selects a sustainable benchmark, like STOXX Global ESG Leaders or STOXX Europe Christian Index to monitor the portfolio success. There are no direct impacts on the fund itself.

2.) Limited impacts on risk/return characteristics of the fund

With this approach, sustainable research results are an integrated part of the investment process, e.g. carbon emissions or sustainable ratings. Furthermore proxy voting is exercised according to the understanding of sustainability. The intention is to improve sustainability while addressing critical ESG-topics to the invested companies. All in all there are limited impacts on the fund.

3.) Direct impacts on risk/return characteristics of the fund

In the strictest approach, exclusion criteria are defined as direct impacts on the fund. These include global standards like not investing in agricultural raw materials or in producers of banned weapons such as biological or chemical weapons, cluster munition and nuclear weapons.

Regional roots. Global responsibility

It is undisputed that the growth rates for sustainable and responsible investments are in the two-digit range Europewide. BayernInvest Kapitalverwaltungsgesellschaft mbH also focusses on a transparent and consistent approach for its products which includes investment processes. This commitment is demonstrated by the fact that BayernInvest signed the PRI (Principles for Responsible Investment) as one of the first German asset managers. All signatories commit themselves to comply with a guideline defining sustainable investment strategies. BayernInvest is therefore both – a company with regional roots and global responsibility. The company takes care of economic, social and environment-related development in the domestic region and wherever there are clients looking for support for their investments. BayernInvest is convinced that an orientation towards sustainable goals for all business processes in asset management and administration has and will have positive impacts on the success of the company.

Sustainable „DKB Zukunftsfonds“ convinces investors

Looking on a dedicated sustainable fund for institutional investors, the „DKB Zukunftsfonds“ is a convincing product with strict compliance to sustainable aspects and successful performance. The fund actively selects stocks – from Europe by focusing on EU – with integrated ESG business practices and promising evaluation criteria (value-approach).

Over a five year period from 2012 to 2016, the fund performance generated a performance of 11% p.a. In his peer group the „DKB Zukunftsfonds“ ranks top for sustainability. Analysts from Morningstar evaluated the fund in the category „Stock Europe flexible“ with three stars and FWW honoured the fund with five „FundStars“. In the year 2014 Absolut Research listed the fund among the „Top 10 percent“-performers in its peer group (category: Sustainability Europe, as at February 2017). Furthermore the fund ranks sixth among the Top 100 out of all funds licensed for distribution in Germany and has been classified as sustainable on yoursri.com. „DKB Zukunftsfonds“ outperformed the average ESG-Rating-Score of 65.4 percent by far with 75.9 percent. For further information please refer to https://yoursri.com/funds/65087112.

Author: |

About BayernInvest Kapitalverwaltungsgesellschaft mbH The Munich based BayernInvest Kapitalverwaltungsgesellschaft mbH is the competence centre for institutional asset management within the BayernLB group. As a full service provider, BayernInvest offers both asset management services as well as a central fund administration services (Master-KVG). Key competencies are a clear client oriented approach, characterised by excellent quality, flexibility and consideration of individual client needs. Total assets of BayernInvest are round about EUR 75 bn in mutual funds, segregated accounts and managed accounts. Therefore BayernInvest is one of the leading asset managers in Germany. For further information please refer to www.bayerninvest.de. |