Topic of the month June 2015: Australia’s Fossil Fuel Projects - Dead in the water?

KEY FINDINGS IN THE REPORT:

• The number of environmental controversies for Australian companies has grown by 44% since 2011, fueled by sophisticated community and activist social media campaigns. Major targets include Whitehaven Coal, Santos and Orica.

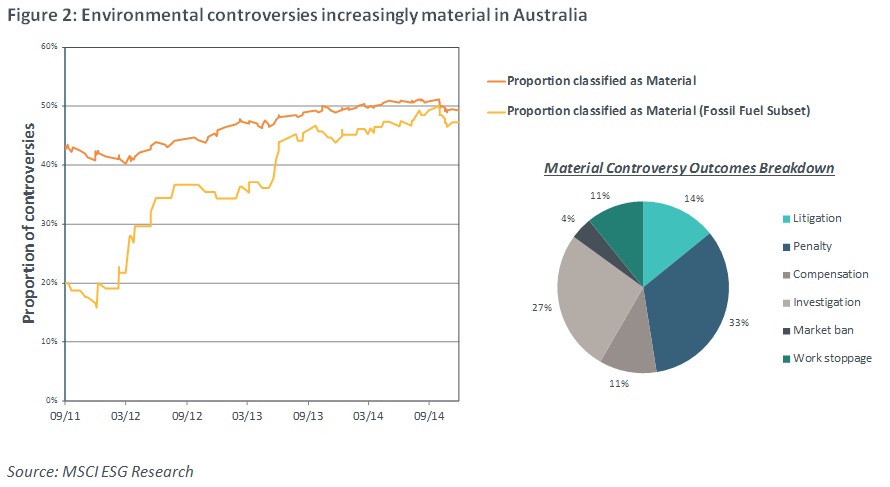

• Nearly 50% of environmental controversies in Australia targeting fossil fuel companies, up from just 20% in 2011, have resulted in some form of penalty, fine, redress, litigation, or direct cost. Australian companies with the most environmental controversies include Rio Tinto, BHP Billiton, Orica and Santos.

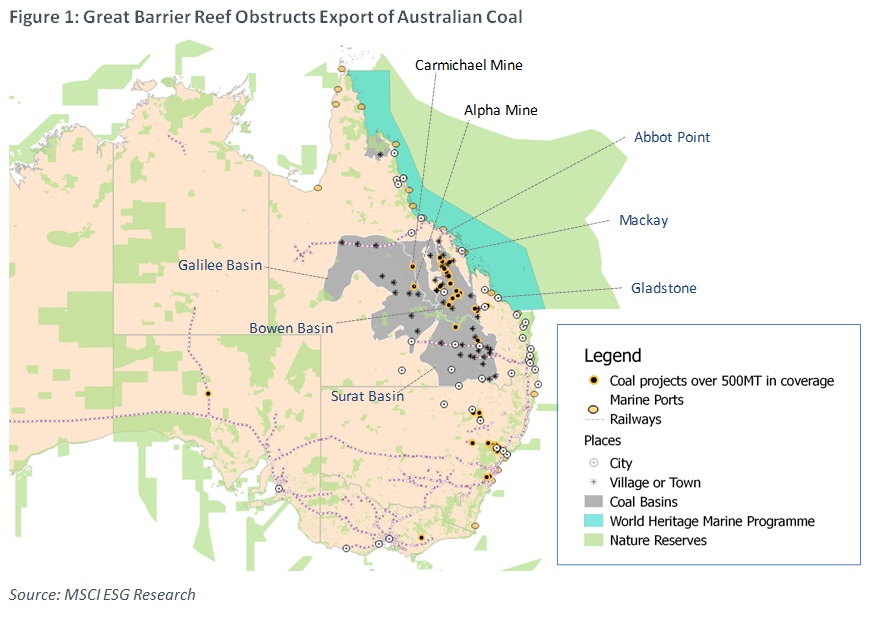

• Companies such as BHP Billiton, Rio Tinto and Whitehaven Coal, each of whom have coal operations in Australia that sell to China, may see demand slack given regulatory shifts in China despite significant capital outlays to develop pipelines and infrastructure to increase exports through the Great Barrier Reef.

• Public pressure on banks to limit funding with direct ties to infrastructure builds along the Great Barrier Reef are likely to affect both corporate cost of capital for borrowers and the big 4 banks – CBA, Westpac, ANZ and NAB– who we estimate to have as much as 10% of their total syndicated loan books allocated to borrowers with stranded asset risks in 2014 (up 64% since 2012).

EXECUTIVE SUMMARY

Risking impact to the Great Barrier Reef off Australia’s coast, the northeastern state of Queensland is seeing major development for new and expanded coal and gas projects, demanding a dramatic increase of port and rail capacity in chase of export opportunities to Asia. However, climate change and other environmental regulations and movements overshadow these investments, raising questions of their long term prospects and investment value.

In April 2014, I travelled to Gladstone with an investor delegation to speak with rail and extractive companies, environmental groups, the local council and chamber of commerce, around the consideration of ESG risks such as climate change and impacts on the nearby Great Barrier Reef. While on the trip it was apparent that environmental problems at the Gladstone harbor due to dredging activity by heavy industry remain unresolved from the perspective of local community, fishing and tourism industries, and environmental groups. Given tensions are still high, future projects are likely to face cumulative headwinds: stronger opposition from agitated local communities, national and international environmental groups and more environmentally scrutinized operations could result in increased risks of reputation damage and loss of license to operate for companies involved.

Coal, the most vulnerable business to climate-change regulations, represents the largest number of projects at feasibility stage in the state of Queensland - current pipeline consists of 50 new coal mining projects with a combined value of AUD 54 billion1 Mega-projects include Adani’s AUD 16.5 billion Carmichael Coal Mine, Clive Palmer’s AUD 8.8 billion Waratah Coal Project, and GVK/Hancock Coal’s AUD 8.2 billion Alpha Project. However, coal is also the most intensive energy source for carbon and other pollutants, which arguably puts it most at risk from environmental and climate initiatives around the world.

To understand the significance of the controversy and activism around the Great Barrier Reef in historical context, we examined our 8-year database of controversies for Australian companies. The proportion of these controversies relating to protests (including lockouts, rallies, arrests, delays, shutdowns and disturbances) followed an upward trend over time.

The pattern in Australia reflects a global one of increasingly vocal and active community resistance to extractive projects that threaten environmental resources or traditional land uses (see MSCI ESG Research report, Profiling Community Risk: Understanding the Risks of Community Opposition). It has been evident since mid-2014 that activists in the Gladstone Port region have been able to leverage international concern around the World Heritage listed Great Barrier Reef, with public commitments from several international banks to not fund the Abbot Point coal port 2. In addition, public opposition from Traditional Owners’ and rejection of the indigenous land use agreement was announced in April 20153 , and litigation in the Queensland courts from environmental groups was launched in April 2015 alleging the mine project presents “unacceptable risks” to tourism, ground water and the climate4 .

The results of the increased activism and attention to environmental preservation has also led to an increase in the proportion of potentially material impacts from these environmental controversies that have occurred in Australia – including penalties, litigation, revocation of licenses, and others as shown by the orange line in the Figure 25 . This is becoming especially significant for thesubset of Australian companies that are intrinsicallylinked to fossil fuels, as evident by the yellow line in Figure 2.

For the most part, companies operating in the region appear under-prepared for sophisticated community action such as coordinated protests; leveraging social media tools, as well as actions intended to impact the bottom line, which as pointed out above is on the rise.

As government approvals progress in 20156 , the development of these large-scale infrastructure projects appears increasingly inopportune given that global energy prices have collapsed over the past year. The combination of these factors highlights that companies and their investors must also stand ready to anticipate the following ESG trends:

•Increasing pressure from community and environmental groups

•Strengthening global environmental regulations may curtail long-term demand on fossil fuels

• Pressure on project lenders to wind back finance to potential 'stranded assets'

1 - As identified by the Australian Government Bureau of Resources and Energy Economics.

2 - http://rt.com/business/200031-banks-great-barrier-reef/; http://www.marketforces.org.au/abbot-point/

3 - https://www.communityrun.org/petitions/don-t-let-adani-build-their-huge-coal-mine-on-our-traditional-land?bucket&source=facebook-share-button&time=1427529735

4 - http://www.afr.com/business/mining/coal/adanis-thermal-coal-mine-will-be-stranded-court-told-20150331-1mbq85/

5 - Controversies were categorized as “material” if one or more outcomes from pie chart in Figure 3 were identified

6 - Adani and GVK approval to expand QLD port – SMH http://www.smh.com.au/business/mining-and-resources/adani-gvk-win-queensland-backing-to-expand-galilee-basin-coal-port-20150311-1415wd.html

Author: |