Topic of the month March 2013: ESG Reporting Requirements in Private Equity

ESG Reporting Requirements in Private Equity

Sustainable investment has always been at the very core of the private equity (PE) investment industry. As a medium to long term investor PE fund managers need to consider the long term development of a company within their portfolio, from acquisition to exit.

Is there a need for ESG reporting investment in Private Equity?

Though sustainable investment has always been a part of the PE investment philosophy, it used to be to a lesser degree the focus of investor reporting. Given the increasing awareness of ESG, CSR or any other name used in the industry, the reporting requirements for factors in relation to environmental, social and governance (ESG) aspects became more important, and most probably will gain in further importance.

One of the key drivers for the growing investor interest in ESG are the six Principles of Responsible Investment by the PRI, which alongside other industry-driven initiatives (such as the Global Reporting Initiative) is developing the first standardized reporting framework for ESG for the investment industry. It is crucial that these reporting standards are somehow comparable different funds and even asset classes. Moreover, it is necessary that this standard allows an efficient and direct reporting to all interested stakeholders, from investors to (non-)governmental institutions.

Currently, PE fund managers are facing an increasing demand by their investors to comply with specific reporting needs on ESG-related topics. However, there is not yet a widely accepted reporting standard for the PE industry which leads to an increase in bureaucratic work load for many PE fund managers. In many cases, the ESG-related information that’s required by investors is very similar, if not identical, so that just format or focus might differ slightly from one request to the other. This can lead to extensive additional effort and does not necessarily add any value to the PE fund manager’s day to day operations. Hence, it should be reduced as early as possible. A pro-active approach on reporting standards for PE should allow for a smooth transition into a comprehensive process, whereby providing best-in-class information to the investor does not result in an overwhelming information-gathering exercise.

What ESG information is crucial?

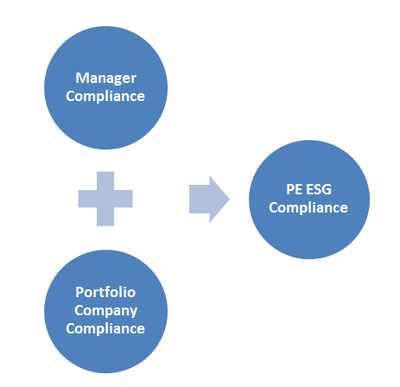

Typically, a PE fund manager is facing reporting on ESG-related issues from two ends:

Firstly, he/she has to ensure compliance and reporting on ESG issues at his/her own management entity. This can range from an obligation to implement an integrated investment-decision process that considers all aspects of ESG up to a commitment to fulfil international reporting standards such as the PRI. Secondly, the PE fund manager should analyse the portfolio company on different aspects of ESG depending on the respective industry. Especially in this case, reporting requirements can vary between different types of investors. Please note that most current standard frameworks such as the PRI Principles do not cover this topic entirely.

ESG standards should be set and measured on a sector by sector basis: An industrial company would likely be the focus of environmental ESG assessments, while a service provider might be evaluated with an ESG emphasis on social factors. Last but not least, the final ESG analysis criteria and weightings depend on the PE fund manager who sets the parameters on certain ESG factors whichever deems to be relevant for each portfolio company.

In the past, governance and environmental factors used to be the stronger focus of private equity investors, however, these days social aspects gain in importance. Responsible and long-term engagement with all company stakeholders seems to become more and more key to a firm’s successful development. Good relationships, engagement and communications with the workforce, the community and society at large can be a safeguard net for the company in times of trouble. Please note that the on going ‘war for talent’ might also force companies to rethink their organizational structures and process in order to become more flexible in their employment models and to attract the right candidates. These social ESG factors can determine the future growth of a company and are hence even more important for private equity-backed companies, especially, if the original investment model was based on the assumption of internal growth by expansion of the management team.

What steps do PE managers need to undertake when assessing ESG information?

In order to meet the increasing demand for ESG-related information, the PE fund manager should firstly determine all the ESG information required from its own operations and its portfolio companies. This should be done in a broad assessment covering all ESG risk factors required by current standards. However, the assessment should also consider potential ESG-related issues that might arise in the future.

For smaller and mid-sized PE fund managers with less than a billion under management this initial assessment exercise can be challenging, as probably not sufficient internal resources could be provided to meet the effort to complete this project in a realistic time frame.

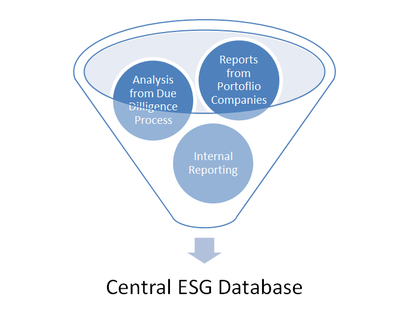

Eventually, the PE fund manager needs to establish a process that allows him/her to gather the required information within a pre-defined internal ESG assessment framework. This probably demands the use of a central ESG database and a data processing infrastructure in order to keep workflow low and to minimize the risk of errors. The system should be created with certain scalability in order to meet a growing demand for ESG-related information in the future.

Once established, this process should allow quick access to all required information for investor and internal reporting requirements. It’s crucial that the newly established ESG assessment process does not drain on the resources that would typically be used for taking investment decisions and that support fund operations on a day to day basis.

How should PE managers use ESG information?

Finally the manager should try to use ESG-related information and turn it into value. Effectively, the information should not be regarded as a simple exercise to ‘please’ investor mandates, instead it should be used to utilize the value potentials of sustainable investment. The initial analysis of a company’s compliance with ESG standards probably shows that there are certain strengths within a firm, but typically the analysis will also reveal weaknesses. Those need to be actively addressed and reduced in order to create additional value for the company.

Addressing company weaknesses does not just mean reducing the risk of being exposed to an ESG issue until exit and beyond, instead, it also means uncovering cost saving potentials and productivity increases. This could include initiatives such as switching off the lights in office buildings or creating an incentive scheme to attract more female workers with a special maternity program. ESG in the value chain for a private equity fund manager does not solely mean avoiding risk, but identifying factors that can give a competitive edge against the competition allowing a continuous growth and higher profitability.

Summary

Value generation through ESG integration into PE decision-making and investment processes should be the key driver for every manager – in order to achieve a best-in-class approach on ESG reporting going forward. Traditional cost saving potentials or efficiency measures should not be the only focus while creating value within a company. The way a PE fund managers is engaging with their assets in regard to ESG can hence become decisive for future success and ultimately positive returns.

The community of limited partners investing in private equity should also take a closer look on how their managers are addressing ESG-related issues and they should challenge the managers on their decisions – in order to achieve long-term positive returns for the current and next generation.

Last but not least, ESG reporting can be a first step into the right direction, but it is critical that ESG factor assessments must become part of the DNA of a PE fund manager. Only if the managers educate and involve their entire staff in this ‘extra-financial’ values assessment process, a permanent and lasting effect can be achieved. Simply keeping an ESG representative or officer will not lead to ESG compliant workflow. Only if all stakeholders are made aware of the importance of ESG issues, a true value effect can be established throughout the organization.

| Author: Joachim Merten, CFO, Quadriga Capital, Jersey j.merten@quadriga-capital.je |

-----------------------

Free Trial & Further Information

yourSRI does offer a free trial access to its database, no obligations and no fine print - please register here and join now.

In order to show the advantages and offerings of one of the leading databases in responsible investing worldwide, yourSRI is hosting a series of webinars. Click here to register

If you are interested in further information, please contact us.