Topic of the month June 2014: Exploring the Mines of South Africa

Exploring the Mines of South Africa

Approaching its 20th week, the strike against the big three platinum producers (Lonmin, Anglo Platinum, and Impala Platinum) have cost the companies approximately 20% of their combined 2013 revenue (15% of combined 2011 revenue)1. While the current strike may be costly, the industry has a long history of conflict, strikes, and safety issues that reflect a business model that remains as reliant on labor-heavy extraction methods as it was decades ago. Even in the event that the companies will reach a wage agreement in the near term, without structural changes the industry-wide South African labor situation will remain unstable given continued poverty, private debt issues, and uncompensated physical risks of the mining workforces; which may prompt continued labor strikes and future state intervention, creating great uncertainty for investors.

I joined our South Africa-based ESG team to visit several mining operations, including in the West Wits gold field, Bushveld platinum belt near Rustenburg, Cullinan diamond mine, and coal fields in eMalahleni, meeting both mining company representatives and community members to more closely evaluate the issues in the South African mining operations.

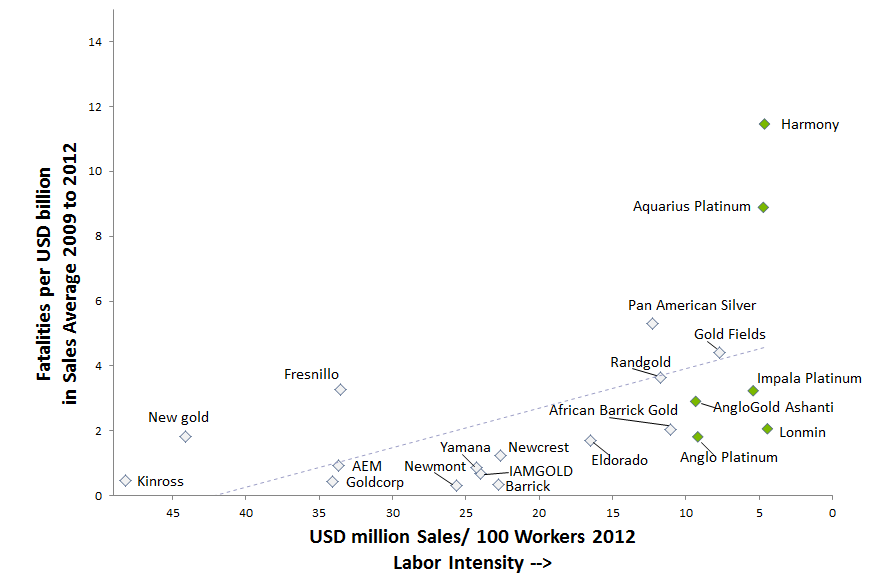

Many old South African gold mines in the West Rand of Johannesburg and platinum mines outside Rustenburg, where there have historically been labor issues, were designed during Apartheid years to utilize cheap migrant labor. Twenty years after the end of Apartheid, the basic labor model of the mines does not appear to have significantly changed. Most of the jobs in the industry remain low skilled manual labor in the absence of significant technological improvements in extraction methods; and the lowest paid jobs are often given to rock drill operators exposed to the most acute risks of rock falls. The circumstances have given rise to one of the highest rates of mining related fatalities in the world1, and the ongoing strikes reflect the gap between the physical risks taken by the mineworkers and the compensation paid for taking those risks, with most living in continued poverty.

Figure 1: High Fatality Rates at Most Labor Intensive Operators

Source: MSCI ESG Research

These risks are exacerbated by the growing depths of the generations-old mines in South Africa, many of which are reaching ultra-deep levels (below 2.5 kilometers) underground. Deep mining can destabilize rock, and the close proximity and size of many of the mines contributes to regular seismic events which may trigger mine collapses2,3. While I was in the country, a seismic event at the Harmony Gold Doornkop mine on the outskirts of Johannesburg led to nine fatalities of mine workers. This and similar incidents at the company contributed to a 12 to 15% drop in production in the first quarter of 2014 compared to the preceding quarter4.

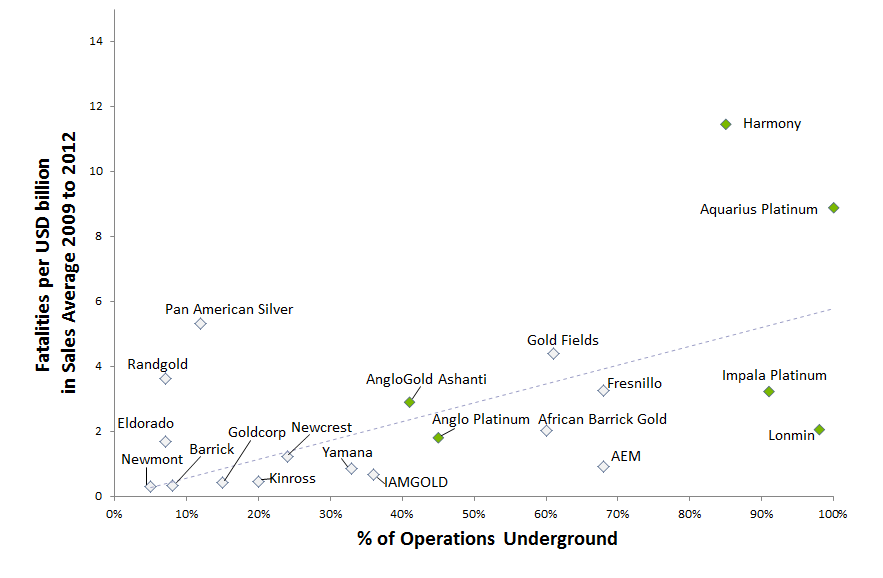

Across the mining sector, underground operations clearly correlate with fatality rates (figure 2). All mining presents hazards; but underground mines in particular have much higher safety risks than surface mines due to increased risks of roof collapse, fires, explosions, and poor air quality. Further, as the mines continue going deeper, temperatures and rock stress increase, making working conditions less hospitable (or costly to cool) and more dangerous.

Figure 2: Underground Operations Correlation to Fatality Rates

Source: MSCI ESG Research

Technological innovation may be needed to change this situation. One possible development that I saw firsthand was at an AngloGold Ashanti site visit.

2.7 Kilometer In-depth Analysis at the TauTona Anglogold Ashanti mine

I joined a team of investors and analysts on a tour of Anglogold Ashanti’s TauTona gold mine outside Johannesburg. With current operations at 3.9 kilometers underground, it is touted as the deepest mine in the world. Production began at TauTona in 1961, and it has since produced over 1,170 metric tons of gold (current market value of almost USD 49 billion) and contains a labyrinth of over 800 kilometers (500 miles) of tunnels. The company began employing a newly developed extraction method of reef boring (mechanical stoping as opposed to traditional drill and blast methods) and backfill support technology in 2014 with a goal of optimizing reef extraction, decreasing downstream processing, improving rock stability, and removing labor from the highest risk activities. In other words, the new technology, if proven, may improve both yield and safety.

The visit focused on a section of mine 2.7 kilometers underground that had been abandoned for 30 years due to safety risks that culminated in a high number of fatalities before closing. The new technology developed at Anglogold Ashanti has allowed extraction of the gold-bearing ore to begin again – following extraction of the ore, the company backfills the bore hole with a high density, quick drying material designed to mimic the compressive strength of the surrounding rock, potentially limiting collapses going forward. While the company stated that the new technology is likely three to five years away from full deployment and even further away from being utilized at scale, the safety and yield gains could be substantial.

Future of South African Mining

The lower cost and efficient production could also provide higher paid jobs and prospects of upward economic mobility that may quell labor unrest in the long-term; however, higher technological operations may also trigger a major loss of low skilled jobs, a move that may be opposed by unions and the government. The loss of jobs would be especially costly in a country with deep economic inequality, unemployment around 25% and endemic issues of personal debt5 . However, as the current platinum strike shows, continuing with business models reliant on cheap labor may not be sustainable. The current strike has cost the big three platinum producers over USD 1.9 billion in combined revenue losses, and as mining represents 6% of direct GDP for South Africa and accounts for 60% of exports6 , the current strike correlated with significant value drops of the rand in 2014. It also cost mineworkers as much as ZAR 9 billion (USD 860 million) in lost wages since the strike began in January 20147 . These factors are cited as major drivers of the contraction of the South African economy in the first quarter of 20148 . Further, the lost wages and impacts on the economy prompted Moody’s to increase its non-performing loan forecasts across South Africa by nearly 14%9. Up to 15% of mineworkers at Lonmin and Anglo Platinum lose a portion of their paycheck to garnishee orders, and few now are paying back their loans. This contributed to the 2014 first half loss of African Bank Investments10, which has provided about a third of loans to Anglo Platinum workers. The bank stated that about 71% of its first half loss was due to its customers unable to repay loans. As an illustration of the low wages and personal debt issues of platinum mineworkers, many continued living in shantytowns and signing up for predatory loans with interest rates reaching 80% APR11 even after platinum producers increased worker wages by 22% in 2012 following strikes.

Despite the desperate conditions of many mineworkers, both financial analysts and companies in the industry are estimating that the financial impacts of the current wage demands are not implementable while maintaining profitability. Anglo American CEO, Mark Cutifani stated in Q2 2014 that operations not delivering at least a 20% return may be sold12 and publically announced consideration of selling the old Rustenberg mines. However, without implementing structural changes companies may have a difficult time selling their operations near intrinsic values. Moreover, even in a situation where the Association of Mineworkers and Construction Union (AMCU), the union leading the strikes, collapses under the plight of its members and operations get back to work, the fundamental issues that led to the labor unrest will remain without a major overhaul.

The importance of the jobs and mines may put the African National Congress (ANC) led government in a position to consider wrestling control of the mines; the government has already begun to step in to mediate between industry and labor. As it is the early days of state intervention, it remains unclear who will benefit. Nationalization risks seem far off since taxes from mines contribute a substantial amount of the government budget, but the current stalemate has added political fodder to calls by the youth league of the ANC to nationalize the mines.

On the upside, some South African mining companies have begun to transition to more modern processes, albeit on a difficult path. For instance, Gold Fields hired a team of 15 Australian experts at the beginning of the year to train employees and adopt mechanized processes at its ultra-deep South African South Deep mine. However, following several fatal accidents and a Section 54 “stop-work” order, inspections identified critical infrastructure in need of repair, forcing the company to suspend operations at its “most important value driver” for up to four months13.The transition in the platinum industry also comes with risks. The newest platinum mines being developed by Anglo American subsidiary Anglo Platinum and Impala Platinumin the northern and eastern limbs of the Bushveld complex afford greater mechanization of extraction and employ better educated and higher skilled people. However, these greenfield projects also face risks of stakeholder opposition due to their larger land footprint in areas with vulnerable ecosystems and traditional cultures that may trigger delays or cancelations of projects.

The future of mining will continue to face an uphill battle even if the wage dispute and strike ends given increasing competition for use of natural resources, particularly water and land, and skilled labor pools. Ultimately, the companies investing in technologies, communities, and their workforces to improve safety, increase efficiency, reduce land disturbances, increase employee skills, educate local workforces, and gain local support may be in the best position in the future.

References:

- 1MSCI ESG Research

- 2Hart, Michael. ”A Journey Into the World’s Deepest Gold Mine.” Wall Street Journal. December 2013

- 3Vella, Heidi. “Ultra-deep mining – overcoming challenges with industry collaboration.” Mining-technology.com, April 2014

- 4Harmony Gold. “Harmony’s production guidance for the March 2014 quarter.” March 2014

- 5 Slabbert, Antoinette. “Five million South Africans drowning in debt.” Moneyweb, November 2013

- 6Maylie, Devon; McGroarty, Patrick. “Strike Halts Platinum Mining in South Africa.” Wall Street Journal, January 2014

- 7Platinum Wage Negotiations. May 2014

- 8Grootes, Stephen. “Ngoako Ramathlodi: Straight into the platinum fire.” Daily Maverick, May 2014

- 9“South African banks face rising bad loans.” Moody’s, May 2014

- 10Bonorchis, Renee. “Why Record Loss Isn’t Freaking Out Market: South Africa Credit.” Bloomberg News, May 2014

- 11BonWild, Franz; Cohen, Mike; Bonorchis, Renee. “Mineworker Debt Mounts as South African Lending Booms.” Bloomberg News, January 2013

- 12Kayakiran, Firat. “Anglo American Sees 20% Returns After Rejigging Assets.” Bloomberg News, May 2014

- 13 “Gold Field shuts South Deep after deaths. ”Business Report, May 2014"

| Author: Sam Block Senior Analyst MSCI ESG Research |

For further Information on MSCI ESG Research please visit www.msci.com/esg or contact ESG Client Service esgclientservice@msci.com

Notice and Disclaimer

This document and all of the information contained in it, including without limitation all text, data, graphs, charts (collectively, the “Information”) is the property of MSCI Inc. or its subsidiaries (collectively, “MSCI”), or MSCI’s licensors, direct or indirect suppliers or any third party involved in making or compiling any Information (collectively, with MSCI, the “Information Providers”) and is provided for informational purposes only. The Information may not be modified, reverse-engineered, reproduced or redisseminated in whole or in part without prior written permission from MSCI.

The Information may not be used to create derivative works or to verify or correct other data or information. For example (but without limitation), the Information may not be used to create indexes, databases, risk models, analytics, software, or in connection with the issuing, offering, sponsoring, managing or marketing of any securities, portfolios, financial products or other investment vehicles utilizing or based on, linked to, tracking or otherwise derived from the Information or any other MSCI data, information, products or services.

The user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF THE INFORMATION PROVIDERS MAKES ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THE INFORMATION (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, EACH INFORMATION PROVIDER EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE) WITH RESPECT TO ANY OF THE INFORMATION.

Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if notified of the possibility of such damages. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited, including without limitation (as applicable), any liability for death or personal injury to the extent that such injury results from the negligence or willful default of itself, its servants, agents or sub-contractors.

Information containing any historical information, data or analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Past performance does not guarantee future results.

The Information should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. All Information is impersonal and not tailored to the needs of any person, entity or group of persons.

None of the Information constitutes an offer to sell (or a solicitation of an offer to buy), any security, financial product or other investment vehicle or any trading strategy.

It is not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any) based on that index. MSCI does not issue, sponsor, endorse, market, offer, review or otherwise express any opinion regarding any fund, ETF, derivative or other security, investment, financial product or trading strategy that is based on, linked to or seeks to provide an investment return related to the performance of any MSCI index (collectively, “Index Linked Investments”). MSCI makes no assurance that any Index Linked Investments will accurately track index performance or provide positive investment returns. MSCI Inc. is not an investment adviser or fiduciary and MSCI makes no representation regarding the advisability of investing in any Index Linked Investments.

Index returns do not represent the results of actual trading of investible assets/securities. MSCI maintains and calculates indices, but does not manage actual assets. Index returns do not reflect payment of any sales charges or fees an investor may pay to purchase the securities underlying the index or Index Linked Investments. The imposition of these fees and charges would cause the performance of an Index Linked Investment to be different than the MSCI index performance.

The Information may contain back tested data. Back-tested performance is not actual performance, but is hypothetical. There are frequently material differences between back tested performance results and actual results subsequently achieved by any investment strategy.

Constituents of MSCI equity indexes are listed companies, which are included in or excluded from the indexes according to the application of the relevant index methodologies. Accordingly, constituents in MSCI equity indexes may include MSCI Inc., clients of MSCI or suppliers to MSCI. Inclusion of a security within an MSCI index is not a recommendation by MSCI to buy, sell, or hold such security, nor is it considered to be investment advice.

Data and information produced by various affiliates of MSCI Inc., including MSCI ESG Research Inc. and Barra LLC, may be used in calculating certain MSCI equity indexes. More information can be found in the relevant standard equity index methodologies on www.msci.com.

MSCI receives compensation in connection with licensing its indices to third parties. MSCI Inc.’s revenue includes fees based on assets in investment products linked to MSCI equity indexes. Information can be found in MSCI’s company filings on the Investor Relations section of www.msci.com.

MSCI ESG Research Inc. is a Registered Investment Adviser under the Investment Advisers Act of 1940 and a subsidiary of MSCI Inc. Except with respect to any applicable products or services from MSCI ESG Research, neither MSCI nor any of its products or services recommends, endorses, approves or otherwise expresses any opinion regarding any issuer, securities, financial products or instruments or trading strategies and neither MSCI nor any of its products or services is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Issuers mentioned or included in any MSCI ESG Research materials may include MSCI Inc., clients of MSCI or suppliers to MSCI, and may also purchase research or other products or services from MSCI ESG Research. MSCI ESG Research materials, including materials utilized in any MSCI ESG Indexes or other products, have not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body.

Any use of or access to products, services or information of MSCI requires a license from MSCI. MSCI, Barra, RiskMetrics, IPD, FEA, InvestorForce, and other MSCI brands and product names are the trademarks, service marks, or registered trademarks of MSCI or its subsidiaries in the United States and other jurisdictions. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS)” is a service mark of MSCI and Standard & Poor’s. About MSCI ESG Research MSCI ESG Research products and services are designed to provide in-depth research, ratings and analysis of environmental, social and governance-related business practices to companies worldwide. Ratings and data from MSCI ESG Research are also used in the construction of the MSCI ESG Indexes. MSCI ESG Research Inc. is a Registered Investment Adviser under the Investment Advisers Act of 1940. About MSCI MSCI Inc. is a leading provider of investment decision support tools to investors globally, including asset managers, banks, hedge funds and pension funds. MSCI products and services include indexes, portfolio risk and performance analytics, and ESG data and research. The company’s flagship product offerings are: the MSCI indexes with approximately USD 8 trillion estimated to be benchmarked to them on a worldwide basis1; Barra multi-asset class factor models, portfolio risk and performance analytics; RiskMetrics multi-asset class market and credit risk analytics; IPD real estate information, indexes and analytics; MSCI ESG (environmental, social and governance) Research screening, analysis and ratings; and FEA valuation models and risk management software for the energy and commodities markets. MSCI is headquartered in New York, with research and commercial offices around the world. 1 As of September 30, 2013, as reported on January 31, 2014 by eVestment, Lipper and Bloomberg