Topic of the month December 2013: Exclusionary screening in sustainability funds

Exclusionary screening in sustainability funds

“Don’t invest in evil companies” is the most common answer you get, if you ask Joe around the corner about the essence of socially responsible investing. He might be right or he might be wrong, but the concept of excluding companies or issuers of financial instruments from a portfolio based on environmental, social or ethical criteria – also called exclusionary screening – is still one of the main pillars of sustainability fund management. Exclusionary screening can also be communicated with more ease to investors – more than any other concept of sustainability investing. Or did you ever try to explain the pros and cons of a best-in-class approach or the concept of an engagement process to an outsider in lieu of exclusionary screening?

The characteristics of the first investment products, which can be considered as sustainability funds today, were defined using exclusion criteria. With the launch of the Pioneer Mutual Fund in 1928, fund managers took the decision not to invest in companies that are inconsistent with the personal values of the investor. In those early days of socially responsible investing, exclusion criteria were mostly based on religious beliefs and recognition of elements that were deemed destructive or corrupt like alcohol, firearms and pornography. Over time, fund managers developed the set of criteria that took into account new developments. For example, the Vietnam War led to the exclusion of companies making profit through the production of war weapons. Further, the growing problems in South Africa in the 1980s led to the exclusion of companies with exposure to the Apartheid regime.

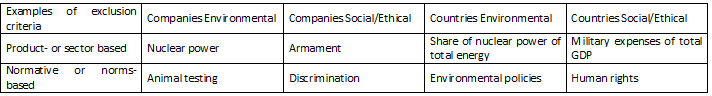

In general, the nature of exclusion criteria can be either product-based or sector-based on one hand, and normative or norms-based on the other hand. Moreover, the focus of these criteria is usually either on environmental or social/ethical issues. And finally, most exclusion criteria are either applied to companies or countries.

Source: Care Group AG

Where do we stand today? The large majority of funds apply exclusion criteria. Out of the 392 funds in the Screened Sustainability Fund Universe1 by Care Group, the large majority of 362 funds apply at least one exclusion criteria, and the average fund applies 14 of these criteria. However, there are significant regional discrepancies. Fund managers with a domicile2 in the United States are below average when it comes to the application of exclusion criteria. They apply an average number of 9 criteria. The same is true for fund managers with a domicile in France, which apply only 7 criteria on average. In Japan, exclusion criteria are hardly ever applied. On the other hand, exclusion criteria are much more favored in Australia (19) and Austria (21). The country with the highest number of exclusion criteria are the Netherlands with a striking number of 31 criteria applied by the average fund. Switzerland and Germany are only slightly above average.

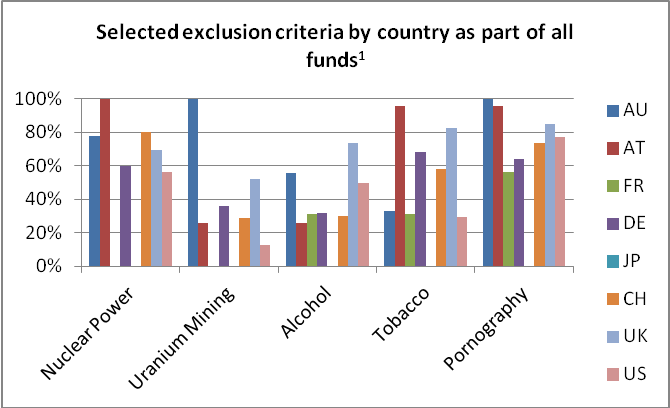

The most common exclusion criterion is considered by the 392 funds mentioned above is Cluster Bombs, which is applied by 329 funds. The next most common criteria all have a social nature as well: Landmines (applied by 328 funds), Non-conventional Weapons (applied by 309 funds), Tobacco (applied by 296 funds) and Armaments in general (applied by 272 funds). The most common exclusion criterion with an environmental focus is Nuclear Power, which is applied by 222 funds.

Interestingly, pure ethical funds do not work with significantly more exclusion criteria than other sustainability funds. Ethical funds are a kind of sustainability fund which focuses mainly on exclusionary screening, while other concepts like a positive or thematic screening are applied to a much lesser extent. One could therefore assume that the managers of ethical funds pay special attention to the compilation of the criteria set. But the average ethical fund applies 15 exclusion criteria, which is only one more than the average fund of the Screened Sustainability Fund Universe. The same is true for thematic funds. Investors might assume that thematic funds focus mainly on thematic screening and that they might neglect the application of exclusion criteria. This is not the case. The average thematic fund has also 14 exclusion criteria.

However, with the growing number of sustainability funds, fund managers increasingly adapt the set of exclusion criteria, partially also in order to distinguish their products from other funds. Some fund managers elaborate a very detailed and encompassing set of exclusion criteria. Among those are Oekoworld in Germany, Triodos in the Netherlands, Swisscanto in Switzerland and Domini in the United States. These fund managers go further to define exclusion criteria that are quite uncommon. Among those are Conflict Minerals, First Generation Bio-fuels and Oil Sand Processing. In the case of government bonds, countries may be excluded, if their military expenses exceed a certain level of the GDP or if the power generation through nuclear power plants exceeds a certain level of total power production.

Are funds with a large number of exclusion criteria the better sustainability funds? Certainly not! But an encompassing set of exclusion criteria can be seen as a proxy for the commitment of a sustainability fund manager to the concept of avoiding investments in issuers whose products or behavior is considered as not sustainable.

Source: Care Group AG

References:

- 1 The Screened Sustainability Fund Universe is a group of 392 sustainability funds, which are evaluated from a non-financial point of view on an annual basis by Care Group AG.

- 2 For this evaluation, the domicile of the fund manager has been taken into account and not the domicile of the fund. For example, Swisscanto LU Equity Fund Water Invest has been considered as a Swiss fund, although it has a domicile in Luxembourg.

| Author: Marco Mansfeld |

More information: www.caregroup.ch