Topic of the month May 2013: ESG Integration across Asset Classes - A Synopsis and Review

ESG Integration across Asset Classes - A Synopsis

Sustainable Investing at a Glance

Sustainable investing - understood as the incorporation of environmental, social, and governance (ESG) analysis into investment decision-making - is a growing discipline that offers opportunities for long-term value creation both for investors and society as a whole. The industry is a continually growing and changing field that encompasses institutional investors, asset managers and financial service providers.

In recent years, an increasing number of industry experts and academics across the globe have come to believe that key ESG developments - from climate change, to globalization, to the transforming societal expectations for corporations and finance - can have a significant role to play in long-term performance.

This belief is also reflected in the practice of 'mission-related investing' (MRI)-investing in financial products that seek to achieve social and/or environmental goals as well as yield market-rate financial returns. Foundation and university endowments, pension funds, socially responsible investors including church pension funds and socially responsible mutual funds, high-net-worth individuals, non-profits, and others target investments create long-term societal wealth while also achieving institutional financial objectives. ESG analysis and MRI share a concern with identifying and evaluating investments likely to support the long-term betterment of society.

For asset owners, integration of ESG factors into the investment process may help to address the ‘gap’ between the long‐term nature of their investments (30 years and longer for certain pension funds) and the short‐term behaviour of their managers. For asset managers, integration of ESG factors into the investment process aims to better assess long‐term risks or risks that have high impact but low frequency of occurrence.

Sustainable investing has made progress on many fronts: tools for accessing information about ESG issues are increasingly available, and publicly available data around corporate social responsibility (CSR) and sustainability practices is continually expanding; institutional investment strategies focusing on ESG-themed investments or integrating ESG factors into the investment decision-making process are common across many traditional and alternative asset classes; and, finally, research into the relationship between financial performance and ESG factors, both academic and applied, continues to improve in quantity and quality (see more details below). In addition, public communication standards with regards to sustainable investing-related activities and reporting have increased significantly.

The interest in ESG / sustainable investing has been driven by a variety of catalysts, including:

1.) The Role of the PRI

An increasing number of institutional investors are showing interest in ESG integration and are adopting sustainable investment strategies and policies. Since 2005, the number of signatories to the UN Principles for Responsible Investment (UN PRI) has grown steadily and reached 1,085 in July 2012, including 258 asset owners and 651 investment managers. Collectively they represent US$32 trillion of assets. According to the UN PRI, about 94 percent of signatories have adopted RI policies.

This result underscores growing acceptance of the principle that investors cannot, in the long run, achieve their goals by investing in corporations that externalize their costs onto society.

2.) The Role of Universal (Asset) Owners

Central to the philosophy of sustainable investing is a concept called ‘Universal Ownership’ . A Universal Owner is defined as a long‐term owner of a diversified investment portfolio that is spread across the entire market or markets. As a result, Universal Owners collectively own a share of the economy and are effectively tied into this share in the longer term. Universal Owners subscribe to the hypothesis that the long‐term financial interest of their investments depends on the ability of global markets to produce economic growth on a sustainable basis. As a result, they infer that their actions should involve managing their longer term risk through asset allocations and active ownership practices that are sensitive to longer term ESG factors.

A key argument supporting ESG investing from the perspective of a Universal Owner is the realization of portfolio externalities. Portfolio externalities are spill over production or consumption effects that cause other unrelated parties to incur costs for which no appropriate compensation is paid. Such un‐priced economic costs or benefits can often be internalized in investors’ investment portfolios, typically through cross‐holdings. While investors are directly compensated by the current returns of their investment portfolios, they also indirectly own the externalities generated by companies, which may offset the portfolio return in future. Most long‐term investors have the fiduciary responsibility to ensure multi-period sustainability of their investment portfolios.

3.) Availability of ESG Data and Information

ESG data and information has become more mainstream as well. Three main drivers have led to a greater availability of ESG information:

- Regulation: An increasing number of regulations that require companies to disclose their ESG performance have been adopted globally, including in emerging markets.

- ESG (research) networks: An increasing number of financial institutions are forming their own ESG and sustainability research departments supported by regional sustainable investment networks.

- Mainstream data providers: The market demand for ESG information has led to the entrance of well-funded financial information providers on the market and to the consolidation of smaller and more segregated data providers.

Today, MSCI ESG Research provides research, analysis and ratings for more than 5,000 global companies and MSCI ESG IVA Ratings are also mapped to over 260,000 fixed income securities.

ESG Factors and Portfolio Optimization

On balance, academic studies and industry analyses indicated that investors employing ESG factors did not impose a significant performance penalty, that investors achieved comparable risk-adjusted returns to non-ESG tilted strategies, and that investors may have enhanced their returns through the use of certain ESG strategies. For long-term investors such as Asset Owners, the evidence increasingly shows merit in sustainable investment approaches practiced within the context of fiduciary duty.

In the first quarter of 2013, MSCI ESG Research released a whitepaper and webinar on ‘Optimizing Environmental, Social, and Governance Factors in Portfolio Construction’. In the paper, we outlined that institutional investors wanting to integrate ESG factors in their investment strategies need the right tools to measure portfolio risk characteristics and performance. MSCI’s BarraOne and Barra Portfolio Manager can provide this utility with Intangible Value Assessment (IVA) ratings from MSCI ESG Research. We examined the use of IVA ratings with the Barra Global Equity Model (GEM3) to build optimized portfolios with improved ESG ratings, while keeping risk, performance, country, industry, and style characteristics similar to conventional benchmarks, such as the MSCI World Index. The risk model allowed us to separate systematic sources of active return - that is, common factor contributions - from asset specific return sources associated with IVA scores. While our study was designed primarily as an enhanced indexing exercise, and focussed on achieving benchmark returns comparable to the MSCI World Index, we identified three possible strategies during the observed period (February 2007 to December 2012) that raised ESG ratings with minimal effects on benchmark tracking error:

- ESG worst-in-class exclusion;

- ESG best-in-class overweighting;

- ESG momentum toward ratings improvements.

ESG Integration Strategies – Across Asset Classes

Recent research shows a trend toward developing models and tools for ESG integration across all asset classes, with a stronger penetration in the public equity space. Out of 5,175 ESG strategies analysed by the consulting group Mercer, around 57 percent were in listed equities, 20 percent were in fixed income, and the remaining 23 percent were spread across alternatives. While ESG integration is rising, not all ESG strategies, including ESG integration, screening, ESG-branded investment and governance / active ownership, achieve the same level of integration.

Active ownership is the most prevalent activity as the importance of proxy voting and monitoring corporate governance practices is typically considered to be a component of fiduciary duty within the mainstream financial community. Engagement activities have also been continually increasing due to the emergence of international collaborative initiatives.

A recent webinar series and online survey on ‘ESG Integration across Asset Classes’ conducted by MSCI ESG Research from April 1 to May 10, 2013, also showed that most survey participants (35%) focused on public equities. However, at the same time, there was a growing interest in other asset classes such as fixed income (20%), real estate (13%), private equity (13%) and other alternatives (13%) (see fig. 1).

Figure 1

Most participants (60%) characterized the current state of ESG investing as limited or fragmented (see fig. 2).

Figure 2

Key drivers for ESG adoption were identified as follows: the PRI (25%), asset owners (24%), NGOs (15%) and corporate institutions (11%) (see fig. 3).

Figure 3

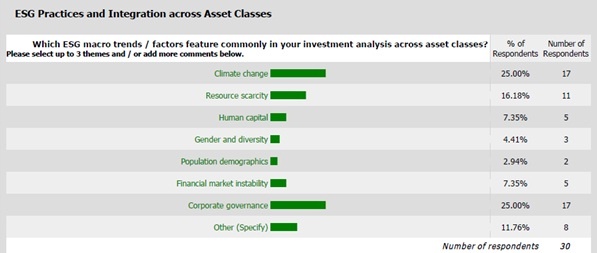

Participants mentioned a variety of key macro themes that feature in their investment analysis across asset classes, most commonly: 1st climate change (25%), 2nd corporate governance (25%) and 3rd resource scarcity (16%) (see fig. 4).

Figure 4

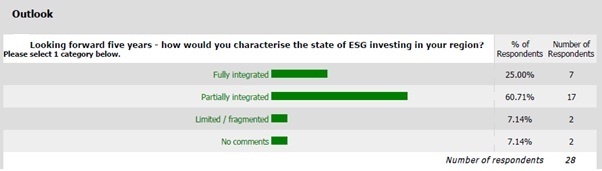

Last but not least, participants provided an outlook and perspective on ESG integration – most participants (60%) presumed that the current state of ESG investing (see fig. 2) will move from ‘limited / fragmented’ to ‘partially integrated’ (see fig. 5) in the next five years.

Figure 5

Conclusion

While financial markets globally have undergone substantial stress and change, an increasing number of institutional investors see ESG integration as a way to respond to the increasing client demand for sustainable investments.

However, without some general frameworks and how ESG products might serve the varied asset class needs, investors will remain restricted in assessing and implementing sustainable investing options, and systematic development of the field of ESG integration will remain slow.

More systematic use of portfolio‐level ESG risk measurement tools will help move ESG integration from a state that is too often aspirational to one that will have effective impact on portfolios.

References:

- ‘5 Years of PRI: Report on Progress’, PRI Report 2011

- ‘Do Investors Care about Sustainability? Seven Trends Provide Clues.’ By S. Lopresti and P. Lilak, PricewaterhouseCoopers LLP Report, 2012

- ‘ESG Integration across Asset Classes’, recorded on 11 April 2013

- ‘ESG Integration across Asset Classes’, conducted from 1 April – 10 May 2013, 31 participants took part in the online survey

- ‘Handbook on Responsible Investment Across Asset Classes’, Boston College, Centre for Responsible Investment, in collaboration with Eurosif and Social Investment Forum, 2008

- ‘Integrating ESG into the Investment Process’ by Remy Briand, Roger Urwin, Ching-Ping Chia, MSCI ESG Research Whitepaper 2011

- ‘Mercer’s ESG Ratings Update: 5,000 and Counting’, by J. Ambachtsheer and K. Burstein, Mercer.com Insight, February 13, 2012, Link: www.mercer.com/articles/ESG-ratings-update

- ‘Optimizing Environmental, Social, and Governance Factors in Portfolio Construction’, MSCI ESG Research Whitepaper by Douglas Cogan, Dan Sinnreich, Zoltan Nagy, February 2013

- ‘Optimizing Environmental, Social, and Governance Factors in Portfolio Construction’, MSCI ESG Research Webinar, hosted by Douglas Cogan, Dan Sinnreich, Zoltan Nagy, April 2013

- ‘Principles for Responsible Investment Signatories’, Principles for Responsible Investment: Official Home Report 2012

- ‘Portfolio Diversification and Environmental, Social, or Governance Criteria: Must Responsible Investments Really Be Poorly Diversified?’ by A Hoepner, University of St. Andrews, 2010

- ‘Responsible Investment’s second decade: Summary report of the state of ESG integration, policy and reporting’, Mercer / CaIPERS Whitepaper 2011

- ‘Sustainable Investing: Establishing Long-Term Value and Performance’, by M. Fulton, B. M. Kahn, and C. Sharples, DB Climate Change Advisors, Deutsche Bank Group, 2012

- ‘Sustainability: opportunity or opportunity cost?’, RCM Sustainability Whitepaper, July 2011

- ‘The Stocks at Stake: Return and Risk in Socially Responsible Investment’, by Galema R, Plantinga A, Scholtens B, Journal of Banking and Finance, 2008

- ‘Trends in ESG Integration in Investments’, BSR Report August 2012

For further Information on MSCI ESG Research please visit www.msci.com/esg or contact ESG Client Service esgclientservice@msci.com.

| Author: Martina Macpherson, Vice President, MSCI ESG Research |

To hear more about ESG integration and the role of Asset Owners, please join us for the next MSCI ESG Research webinar debate on ‘ESG – Part of the Problem or Part of the Solution for Asset Owners’, May 28, 2012. For more information, please visit the MSCI ESG Research online events calendar.

Notice and Disclaimer:

This document and all of the information contained in it, including without limitation all text, data, graphs, charts (collectively, the “Information”) is the property of MSCI Inc. or its subsidiaries (collectively, “MSCI”), or MSCI’s licensors, direct or indirect suppliers or any third party involved in making or compiling any Information (collectively, with MSCI, the “Information Providers”) and is provided for informational purposes only. The Information may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI.

The Information may not be used to create derivative works or to verify or correct other data or information. For example (but without limitation), the Information may not be used to create indices, databases, risk models, analytics, software, or in connection with the issuing, offering, sponsoring, managing or marketing of any securities, portfolios, financial products or other investment vehicles utilizing or based on, linked to, tracking or otherwise derived from the Information or any other MSCI data, information, products or services.

The user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF THE INFORMATION PROVIDERS MAKES ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THE INFORMATION (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, EACH INFORMATION PROVIDER EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE) WITH RESPECT TO ANY OF THE INFORMATION. Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if notified of the possibility of such damages. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited, including without (as applicable), any liability for death or personal injury to the extent that such injury results from the negligence or willful default of itself, its servants, agents or sub-contractors. Information containing any historical information, data or analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Past performance does not guarantee future results. None of the Information constitutes an offer to sell (or a solicitation of an offer to buy), any security, financial product or other investment vehicle or any trading strategy.

You cannot invest in an index. MSCI does not issue, sponsor, endorse, market, offer, review or otherwise express any opinion regarding any investment or financial product that may be based on or linked to the performance of any MSCI index. MSCI’s indirect wholly-owned subsidiary Institutional Shareholder Services, Inc. (“ISS”) is a Registered Investment Adviser under the Investment Advisers Act of 1940. Except with respect to any applicable products or services from ISS (including applicable products or services from MSCI ESG Research, which are provided by ISS), neither MSCI nor any of its products or services recommends, endorses, approves or otherwise expresses any opinion regarding any issuer, securities, financial products or instruments or trading strategies and neither MSCI nor any of its products or services is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. The MSCI ESG Indices use ratings and other data, analysis and information from MSCI ESG Research. MSCI ESG Research is produced by ISS or its subsidiaries. Issuers mentioned or included in any MSCI ESG Research materials may be a client of MSCI, ISS, or another MSCI subsidiary, or the parent of, or affiliated with, a client of MSCI, ISS, or another MSCI subsidiary, including ISS Corporate Services, Inc., which provides tools and services to issuers. MSCI ESG Research materials, including materials utilized in any MSCI ESG Indices or other products, have not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body.

Any use of or access to products, services or information of MSCI requires a license from MSCI. MSCI, Barra, RiskMetrics, IPD, ISS, FEA, InvestorForce, and other MSCI brands and product names are the trademarks, service marks, or registered trademarks of MSCI or its subsidiaries in the United States and other jurisdictions. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS)” is a service mark of MSCI and Standard & Poor’s.

-----------------------

Free Trial & Further Information

yourSRI does offer a free trial access to its database, no obligations and no fine print - please register here and join now.

In order to show the advantages and offerings of one of the leading databases in responsible investing worldwide, yourSRI is hosting a series of webinars. Click here to register

If you are interested in further information, please contact us.