Topic of the month Summer 2013 (July/August): Onshore Wind Energy - A Case Study

Onshore Wind Energy - A Case Study

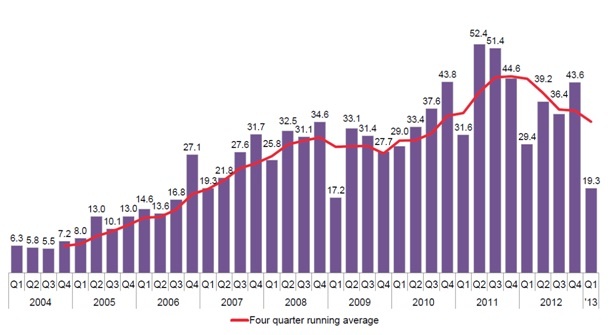

Investments in renewable energies have become a hot topic in recent years. Renewables are a fast growing market. In 2012 around 150 billion USD have been allocated to renewable energy assets worldwide according to Bloomberg New Energy Finance (Figure 1).

Investing in renewable power plants means investing in real assets and generates long-term stable cash flows. One main reason why renewable energy investments are a good complement in an investor’s portfolio is that the risk correlates less with the market portfolio but more with natural resources like wind potential or solar irradiation and energy prices. Currently, there are unfortunately numerous political and legal dependencies as long as a technology has not reached grid parity. However, further technological improvements and economies of scale in the renewables sector will soon enable grid parity in several regions in the world. This development will most probably be accelerated by increasing costs of conventional energies driven by more transparency about their real costs.

How to invest in this asset class and how can an investor profit from this interesting and fast growing market? The following article attempts to answer these questions on the basis of a case study.

Figure 1: Asset financing for new build clean energy assets, Q1 2004 – Q2 2013 ($BN).

Source: Bloomberg New Energy Finance. Global trends in clean energy investments, 15. April 2013.

Case Study – How to invest in an onshore wind farm with 10 x 2 MW Vestas V90 in Lower Saxony, Germany

In the following case study we introduce an imaginary but realistic project. It is an onshore wind farm with 10 x 2 MW Vestas V90 wind turbines located in Lower Saxony, Germany. We as specialised investment managers represent the prospective buyer and are acting for a renewable energy infrastructure fund, which is financed by pension funds. Moreover, we could as well represent a utility with renewable energy production targets or a civic participation fund, as they are very common in Germany.

The seller of the considered wind farm is a medium-sized project developer. Similar to the real estate market, project developers build an important link in the value chain between the initiator and the prospective operator of the power plant. In our case, the project developer has already fulfilled some important steps which mostly require a strong local presence. Amongst others, he has already secured the required piece of land, obtained all the permits for building and operating the wind farm and signed a procurement contract with the supplier of the wind turbines. He has integrated all these rights and contracts from scratch into a special purpose vehicle (SPV).

The latter is an important characteristic of renewable energy project financing. Project finance banks will fund the SPV directly – off-balance – with an essential amount of debt during construction. They rely only on future project cashflows for their financing without recourse to the investors of the SPV.

Typical criteria to consider for investments in wind energy: Technology, country and project stage

Among different types of investors, the process of investing in renewable energies stays more or less the same. The difference between the diverse types is mainly the investing strategy. Let us now investigate the situation for ourselves as an institutional investor.

First of all, we are looking for a well-established technology produced by a well-known manufacturer (technology risk). This requirement is fulfilled due to the fact that many onshore wind projects have been successfully implemented in recent years. Moreover, our turbine supplier is one of the biggest producers worldwide.

As second step we want to minimise the country specific risk and therefore look for a stable and reliable regulatory environment. As mentioned above, our project is located in Lower Saxony, Germany and should therefore satisfy this requirement. The only worries we have in regards to this point are current discussions about the continuity of the current EEG (German Renewable Energy Act). It is possible that after the elections in September 2013, the federal government might target stronger market integration for renewable energies and relinquishes the fixed compensation. Nevertheless, we think that these changes would only affect new projects and not existing operating power plants. Therefore the country risk can be seen as minimal assuming that the grid connection of the project will take place before the possible change in law.

Finally, there is the question about the project stage at the time of sale. Due to the fact that we want to minimise development and construction risks at this point, we need to further discuss this topic with the project developer. Our goal is to acquire the project as a ready-to-operate wind farm (turnkey). This step leads to lower risk, but obviously also to a lower return, because the project developer demands a higher compensation for his additional risk and bridge financing.

For this investment we expect a minimum return of 8.5% on our equity to be invested (equity IRR), which is based on our investment criteria as the investor in this fictive case.

Due Diligence – Master the financial, commercial, tax, technical and legal requirements

We now arrive at an agreement with the project developer and sign a non-binding offer (NBO) on the fundamental parameters of the project. Hence the project developer allows us insight into all the existing contracts and documents and guarantees us exclusivity on the project. Based on the detailed information we now have, we can start the due diligence process in order to evaluate the maximum price we would be willing to pay for the project.

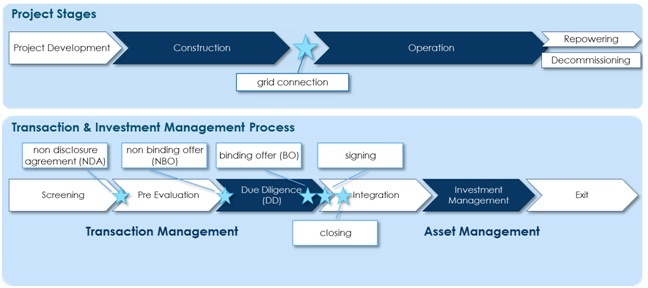

Figure 2: Project Stages versus Transaction & Investment Management Process.

In our fictitious case grid connection, signing and closing are falling together (turnkey project).

Source: sustainable finance team GmbH (2013).

From wind to electricity – Investigating the potential of our project

One important question at the beginning of the due diligence process is to evaluate the wind potential. The project’s profitability depends to a high degree on the long-term wind regime at the specific site in combination with the configuration of the wind park. Since we are not technical experts, the project developer gives us insight into two different wind reports, which have been compiled by order of the seller.

In addition to that, we request a third one from an independent institution who is free from any conflict of interest. The results of the three reports are close to each other and show an average potential of 42,000 MWh per year for our project. With respect to the installed capacity of 20 MW, this potential equates 2,100 full load hours. In order to have a security margin in our calculations, we subtract different security cuts and continue our calculations with a net electricity production of 37,000 MWh/a. Among others these security cuts include reduced availability due to maintenance as well as grid losses and other long-term uncertainties. These steps are sufficient for the technical due diligence of a turnkey project. If it were an older wind farm, we would have had to inspect technical aspects of the entire plant like gearing box, blades and other components.

In our calculation, we consider different project durations between 20 and 30 years in order to understand the influence of different durations. The limited project duration is one of the main differences between project finance and corporate finance theory.

Feed-in-tariff and electricity prices – manage political project risks

The expected feed-in-tariff is directly derived from the EEG §29 (note that renewable energy laws change often, in our case we use the latest version of EEG 2012). If our project starts operations before the 31st of December 2013, we receive 92.70 EUR/MWh for the first 20 years including an additional bonus for system services (SDL). For the time after the EEG expires, we need to estimate the market electricity price. The importance of this driver is mainly dependent on the country in which the project is located. If there is a quota tariff system in the respective country, the wholesale price gets more important.

Furthermore, recent market research shows a price effect called merit order: due to high correlation between wind farms production around Europe, the market price tends towards zero or can even be negative during days with plentiful supply of wind. This is caused by the free resource availability of renewable energy plants and should be considered when estimating future electricity spot prices.

OPEX – estimating all expenditures for operations over the plant’s full lifetime

The next important step in the due diligence process is to investigate the different operating expenditures and to check, whether all contracts are complete and all necessary deliveries by external service companies are included for the plant’s full lifetime. For sake of simplicity we only consider four different expenditures in our case: land lease, maintenance and repair, plant management and insurance. We suppose total operating expenditures of about 20 EUR/MWh in the beginning and a significant increase after expiration of the full maintenance contract.

Furthermore taxes and depreciation have to be included in the analysis, because they can have a significant impact on the return of the project. As mentioned above in regards to feed-in-tariffs, we have country specific differences in this section, too. Additional difficulties derive from different deal forms, legal form of the SPV and dependencies in the investor’s fund structure.

Financing – Debt and Equity

It is important to analyse the effect of the capital structure on the return and the development of the effective pay-out to our investors exactly. Usually banks insist on covenants in the loan contract, which restrict dividend payments. A typical ratio that is used by banks is the debt service coverage ratio (DSCR), which puts free cashflow (cashflows available for capital services) in relation to debt service. Too high debt level can therefore lead to a shift of dividend payments into the future which can have a major negative impact on the pay-out return of the project. On the other hand, it does not make sense to fully finance the project with equity if the interest rate of debt is lower than the return of the project (positive leverage effect).

In most countries in Europe governmental backed loan programmes for renewable energy asset financings are available. Our fictitious case qualifies for the German KfW renewable energy programme. We suppose a gearing of 75% with an interest rate of 3.00%, linear redemption, and a maturity of 17 years. Our bank demands that our project meets at least a DSCR of 1.30. Due to the non-recourse debt arrangement, the bank asks to block cash on an account. This so called debt service reserve accounts (DSRA) usually has to cover 50% of next annual debt service.

How much are we willing to pay for the onshore wind farm?

After studying all given contracts and negotiating with different parties we now have enough information for the valuation of the project. Given the data, we assumed in our case, we get the minimum return of 8.5% for an asset price of about 31 Million Euros (CAPEX). Therefore that will be the maximum price we are willing to pay for the considered onshore wind farm (total fair value). Subtracting the net debt derived from above results in the equity amount that needs to be paid for the acquisition of our imaginary SPV. This deal form is called a share deal.

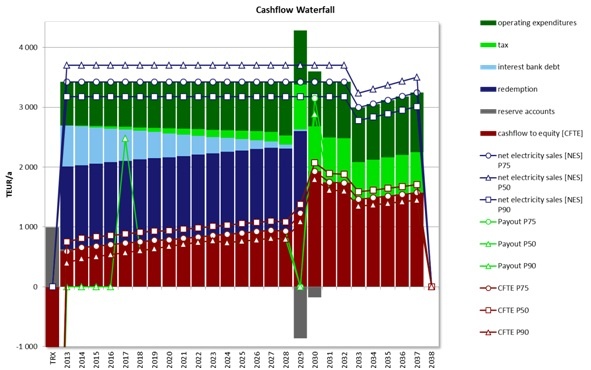

Furthermore, the financial model gives us detailed information about the prospective financial development of the whole project. The following graphs (Figure 3 and 4) give a little overview of the outputs and on how the project develops over time.

Cashflow Waterfall – Where does the money go?

The graph below gives an interesting insight into where the revenues go. We introduced a statistical band width of our revenues, depending on the long term uncertainty of wind assessment. Our reference case (the top line which flushes with the bars), represents the p75 value, meaning that 25% of all potential outcomes are worse than this. The upper band p50 shows the median and p90 a very conservative lower band. After consideration of operating expenditures (OPEX), taxes and debt service (interest and redemption) including reserve accounts, cashflow to equity (CFTE) remains. This is our reference value for calculating the equity IRR.

Figure 3: Cashflow waterfall for our case.

Source: sustainable finance team’s financial model SSFFM.

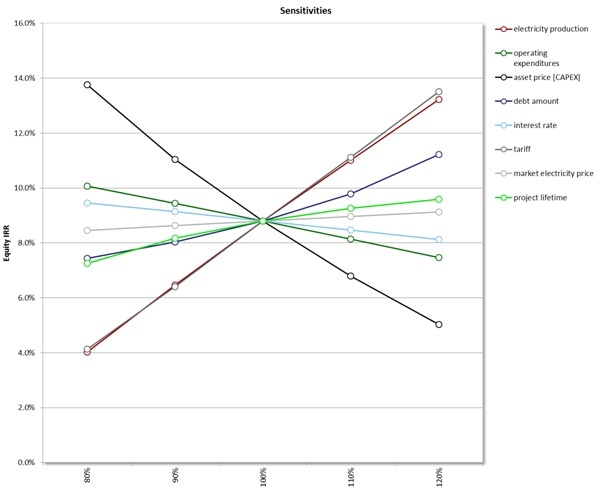

We are also interested in sensitivities. The following graph shows how a change of various input variables affect our equity IRR. As mentioned above, energy production (depending on the wind regime) and feed-in-tariffs (depending on politics) have the highest impact on returns. Furthermore, the CAPEX (fair value at which the asset will be acquired) is also highly sensitive. The latter represents the most important issue in the transaction process of renewable energy projects. By acquisition you will definitely lock-in the largest cash outflow (CAPEX) and given that, most of your future revenues without any possibility to change or influence them in the future. A new strategy or innovation cannot have any effect as it is the case in corporate finance. Therefore, an in-depth due diligence, adequate financial modelling, on-going risk mitigation during negotiation of the share purchase agreement (SPA) and professional external advise are highly crucial when dealing with renewable energy assets.

Figure 4: Sensitivity analysis for our case.

Source: sustainable finance team’s financial model SSFFM.

Conclusion

In this article we have presented the process of evaluating a renewable energy project in a simplified way. With the help of a case study of an imaginary project in Germany, we have gone through some of the most important steps in the evaluation of a renewable energy project. Buying a renewable energy project is challenging, but in no case impossible. However it is recommendable to consult specialists for the supervision of the process, as there are always important project specifics in each case not mentioned in this short article that should be considered in order to ensure a successful and profitable transaction.

Renewables are a very interesting asset class for pension funds, due to the long-term investment horizon, alternative risk profile and stable cashflows over time. In the last couple of years the renewables investment market has reached a high degree of professionalism. A broad variety of specialised renewable funds and advisory companies specialised on financial, commercial, legal and tax issues have established to meet the growing needs of investors. The time has come to invest in this sustainable and socially responsible market that will lay the foundation of our future energy infrastructure.

| Author: Matthias Stettler, M.A. HSG, Managing Partner at sustainable finance team GmbH, Basel |

| Author: Tobias Bitterli, B.A. University of Basel, Investment Analyst at sustainable finance team GmbH, Basel |

Sustainable finance team is specialised on investment management of renewable energy assets. To date the team has gained experience in investments and asset management of photovoltaic and on- and offshore wind power plants in Europe totalling an asset volume of 500 Million Euros. This in-depth knowledge is concentrated in their financial model SSFFM which can be licenced by interested third parties. For further information please visit us at www.sft-basel.ch or contact us at info@sft-basel.ch.

-----------------------

Free Trial & Further Information

yourSRI does offer a free trial access to its database, no obligations and no fine print - please register here and join now.

In order to show the advantages and offerings of one of the leading databases in responsible investing worldwide, yourSRI is hosting a series of webinars. Click here to register

If you are interested in further information, please contact us.